Today’s mortgage and refinance rates

Average mortgage rates merely inched higher yesterday. But that snapshot is very far from the full story. At the start of this week, the average rate for a 30-year, fixed-rate mortgage (FRM) for a highly qualified borrower was 6.54%, according to Mortgage News Daily’s archives. it’s now 6.8%. At the start of this month, that same rate was 6.04%. Wow! February’s been terrible for mortgage rates.

And, right now, I don’t see any grounds for expecting things to get better. There are a few important economic publications that could push mortgage rates a little lower this week. But I doubt they’ll fall far, if at all. And, with markets in their current gloomy mood, I suspect that a rise is more likely than a fall over the next seven days.

Bond markets will be closed for Presidents Day next Monday. That means mortgage rates should barely move, and we’ll take a day off. See you on Tuesday.

Find and lock a low rateCurrent mortgage and refinance rates

| Program | Mortgage Rate | APR* | Change |

|---|---|---|---|

| Conventional 30-year fixed | |||

| Conventional 30-year fixed | 6.789% | 6.817% | Unchanged |

| Conventional 15-year fixed | |||

| Conventional 15-year fixed | 6.178% | 6.216% | +0.01% |

| Conventional 20-year fixed | |||

| Conventional 20-year fixed | 6.724% | 6.777% | -0.02% |

| Conventional 10-year fixed | |||

| Conventional 10-year fixed | 6.407% | 6.508% | -0.02% |

| 30-year fixed FHA | |||

| 30-year fixed FHA | 6.462% | 7.242% | -0.02% |

| 15-year fixed FHA | |||

| 15-year fixed FHA | 6.288% | 6.818% | +0.01% |

| 30-year fixed VA | |||

| 30-year fixed VA | 6.247% | 6.48% | -0.04% |

| 15-year fixed VA | |||

| 15-year fixed VA | 6.25% | 6.61% | Unchanged |

| 5/1 ARM Conventional | |||

| 5/1 ARM Conventional | 7.25% | 7.338% | Unchanged |

| 5/1 ARM FHA | |||

| 5/1 ARM FHA | 7.25% | 7.591% | +0.01% |

| 5/1 ARM VA | |||

| 5/1 ARM VA | 7.25% | 7.591% | +0.01% |

| Rates are provided by our partner network, and may not reflect the market. Your rate might be different. Click here for a personalized rate quote. See our rate assumptions here. | |||

Should you lock a mortgage rate today?

During the week, I changed my personal rate lock recommendations (below). Before then, there was a decent chance that mortgage rates might fall a bit. But that’s much less likely now than it was.

Of course, they’ll still fall on some days and perhaps for longer periods. But I doubt that those falls will outweigh the rises surrounding them for at least several weeks — and maybe several months.

Anyway, my new personal rate lock recommendations are:

- LOCK if closing in 7 days

- LOCK if closing in 15 days

- LOCK if closing in 30 days

- LOCK if closing in 45 days

- LOCK if closing in 60 days

However, with so much uncertainty at the moment, your instincts could easily turn out to be as good as mine — or better. So let your gut and your own tolerance for risk help guide you.

What’s moving current mortgage rates

There are currently two main barriers to low mortgage rates. And both are currently conspiring to keep these rates high and are push them higher. These are those two:

1. High inflation

The first is persistently high inflation. True, the rate at which prices are rising has dropped in recent months. And the annual inflation rate continues to fall.

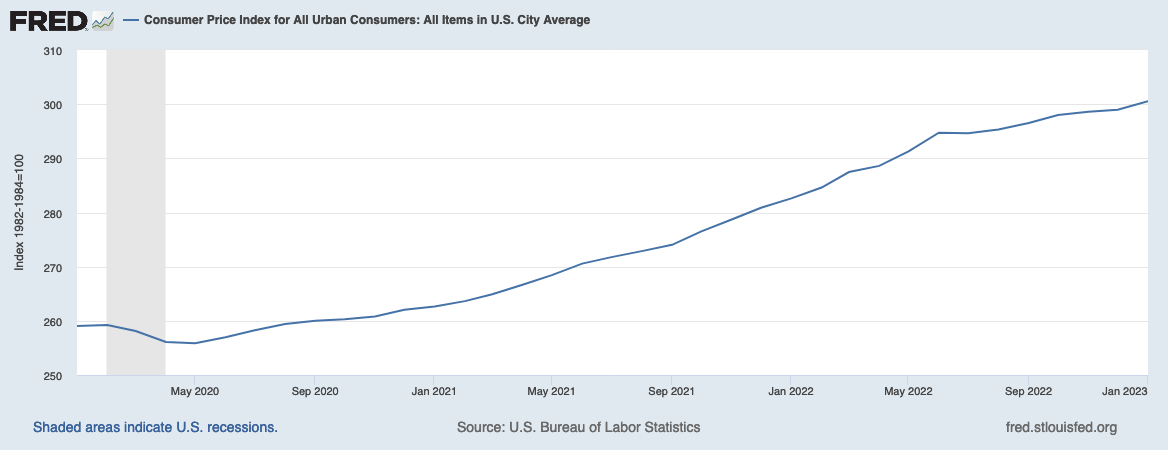

But, when you look at monthly figures, the numbers are less cheery. This graph from the Federal Reserve Bank of St. Louis shows how the consumer price index (CPI) has moved since the start of 2020, just before COVID hit hard. It’s an index showing how prices have changed since 1982-84 when the baseline was 100.

Mortgage rates are largely determined by yields on a specialist bond called a mortgage-backed security. When bondholders see high inflation, they’ll pay less for a bond because their profit will be eaten up by higher prices. And lower bond prices invariably result in higher yields, translating into higher mortgage rates.

There are no “usuallys” or “oftens” in how bond prices and yields work. It’s a mathematical certainty.

2. A thriving economy

It’s a truism that mortgage rates tend to rise when the economy’s doing well and to fall when it’s doing badly. You can see why if you think about the MBS market.

When the economy’s booming, investors can make fortunes on stock markets. Smart ones keep some in bonds because they’re safer.

But investment risks are low during good economic times. So stocks usually do well while bond prices fall. And, as we just discovered, low MBS prices equal higher yields and mortgage rates.

Depending on your news sources, you may be under the impression that the U.S. economy is currently struggling. But it simply isn’t.

Just in the last 15 days, we’ve seen astonishingly good employment data and excellent retail sales numbers. It may be a stretch to say the U.S. economy is booming at the moment but it’s certainly healthy.

Might things change?

The late Harvard economist John Kenneth Galbraith once observed:

THE only function of economic forecasting is to make astrology look respectable.

And only a fool would guarantee that the economy, inflation and mortgage rates will continue to follow the course they’re on now. There are simply too many events that could come out of left field and spoil any prediction.

For example, COVID-19 could mutate into a deadlier and more infectious strain. Or some other similarly harmful disease could emerge. Perhaps the U.S. and NATO could end up in a shooting war with China or Russia. Or there could be some earth-shattering natural disaster that upends the global economy.

Those currently look unlikely, but lesser events could still throw the country into recession or send the economy soaring. But, chances are, the current economic trends will persist during the coming weeks and months. And, if that’s the case, mortgage rates look less likely to fall than rise.

Economic reports next week

Three economic publications stand the highest chance of moving mortgage rates over the next seven days. And they all appear in the last half of the week.

First are the minutes of the last Federal Open Market Committee (FOMC) meeting, which are released on Wednesday. This is the Federal Reserve’s monetary policy body and investors always pore over the minutes to try to glean more insights into the Fed’s thinking on future interest rates.

The second event is the publication on Thursday of revised gross domestic product (GDP) figures for the last quarter of 2022. Those should only trouble us if they bring a big surprise.

And the third event is Friday’s personal consumption expenditures (PCE) report. Its price index typically takes second place to the CPI. But it is the Fed’s favored gauge of inflation. So, it needs to be taken seriously.

Important reports and events are shown in bold in the following list. And I doubt any others will move mortgage rates far unless they reveal shockingly good or bad data.

- Monday — Markets closed for Presidents Day

- Tuesday — February purchasing manager indexes (PMIs) for the services and manufacturing sectors from S&P. Plus existing home sales in January

- Wednesday — FOMC minutes for Feb. 1 meeting (Released at 2 p.m. (ET))

- Thursday — Revised GDP figures for Q4/22. Plus initial jobless claims for the week ending Feb. 18

- Friday — January PCE price index. Plus January’s new home sales. And the February consumer sentiment index

Pay attention on the last three days of next week.

Time to make a move? Let us find the right mortgage for you

Mortgage interest rates forecast for next week

Only a week ago, I was still hoping that a good CPI report could push mortgage rates lower. But those worse-than-expected figures shattered my and markets’ optimism.

We may be due some modest falls in mortgage rates as investors ponder whether those have risen too high over the last couple of weeks. But such decreases may well not materialize.

And, given the mood in markets, I reckon that mortgage rates are more likely to rise than fall over the next seven days. Unless, of course, next week’s economic data turn out to be way more rate-friendly than I’m expecting.

How your mortgage interest rate is determined

Mortgage and refinance rates are generally determined by prices in a secondary market (similar to the stock or bond markets) where mortgage-backed securities are traded.

And that’s highly dependent on the economy. So mortgage rates tend to be high when things are going well and low when the economy’s in trouble. But inflation rates can undermine those tendencies.

Your part

But you play a big part in determining your own mortgage rate in five ways. And you can affect it significantly by:

- Shopping around for your best mortgage rate — They vary widely from lender to lender

- Boosting your credit score — Even a small bump can make a big difference to your rate and payments

- Saving the biggest down payment you can — Lenders like you to have real skin in this game

- Keeping your other borrowing modest — The lower your other monthly commitments, the bigger the mortgage you can afford

- Choosing your mortgage carefully — Are you better off with a conventional, conforming, FHA, VA, USDA, jumbo or another loan?

Time spent getting these ducks in a row can see you winning lower rates.

Remember, they’re not just a mortgage rate

Be sure to count all your forthcoming homeownership costs when you’re working out how big a mortgage you can afford. So, focus on your “PITI.” That’s your Principal (pays down the amount you borrowed), Interest (the price of borrowing), (property) Taxes, and (homeowners) Insurance. Our mortgage calculator can help with these.

Depending on your type of mortgage and the size of your down payment, you may have to pay mortgage insurance, too. And that can easily run into three figures every month.

But there are other potential costs. So, you’ll have to pay homeowners association dues if you choose to live somewhere with an HOA. And, wherever you live, you should expect repairs and maintenance costs. There’s no landlord to call when things go wrong!

Finally, you’ll find it hard to forget closing costs. You can see those reflected in the annual percentage rate (APR) that lenders will quote you. Because that effectively spreads them out over your loan’s term, making that rate higher than your straight mortgage rate.

But you may be able to get help with those closing costs and your down payment, especially if you’re a first-time buyer. Read:

Down payment assistance programs in every state for 2023

Mortgage rate methodology

The Mortgage Reports receives rates based on selected criteria from multiple lending partners each day. We arrive at an average rate and APR for each loan type to display in our chart. Because we average an array of rates, it gives you a better idea of what you might find in the marketplace. Furthermore, we average rates for the same loan types. For example, FHA fixed with FHA fixed. The result is a good snapshot of daily rates and how they change over time.