Using a cash gift for your down payment

Are you receiving a cash gift to help with the down payment on your new home? Many other home buyers are, too.

Down payment gifts can make it much easier to purchase a home, and mortgage lenders are generally happy to accept them.

Lenders allow cash gifts for down payments on a huge array of loan programs including FHA loans, VA loans, USDA loans, conventional loans, and even jumbo loans.

However, if you’re getting a cash gift for down payment, you’ll want to be sure you document the gift properly. Should you receive your gift improperly, your lender is likely to reject your home loan application.

Verify your mortgage eligibilityIn this article (Skip to…)

- How cash gifts work

- Step-by-step process

- Who can gift a down payment?

- How much can be gifted?

- Tax implications

- Should I use a down payment gift?

- Am I eligible?

How cash down payment gifts work

It’s common for today’s buyers to receive cash down payment gifts. First-time homebuyers are most likely to receive a cash gift, but repeat- and move-up buyers may receive them, too.

Down payment gifts are not difficult to give and receive. The key is providing the right paperwork and following established guidelines.

Down payment gift rules are:

- The gift must be documented with a formal gift letter (see below)

- A paper trail must be shown for the gifted monies as they move from the gift giver’s account to the home buyer’s account

- The gift may not be a ‘loan in disguise.’ The gift giver (donor) cannot require repayment of the gift money in any way

There’s a 3-step process when accepting a cash down payment gift. No matter what type of loan you use — conventional, FHA, VA, or other — the 3-step process is the same.

Here’s what you need to do at each step to make sure your mortgage down payment gift will be approved by your lender.

Step 1: Write the down payment gift letter

The ‘gift letter’ is key to getting your mortgage approved when using a cash gift for your down payment.

Luckily, writing a gift letter is simple. Its main purpose is to state the amount of the gift and who it’s coming from. And, the letter certifies that the money does not need to be repaid — which is a must for down payment gifts.

Your mortgage gift letter should include the following information :

- The dollar amount of the gift

- The date the gift funds were transferred

- The address of the property being purchased

- The donor’s relationship to the home buyer

- The donor’s name, address, and phone number

- The donor’s account information (where the money is coming from)

- A note that the gift is actually a gift and not a loan and will not be repaid

The gift letter should be only as long as needed and should not contain “extra” information. Have all parties sign and date the letter.

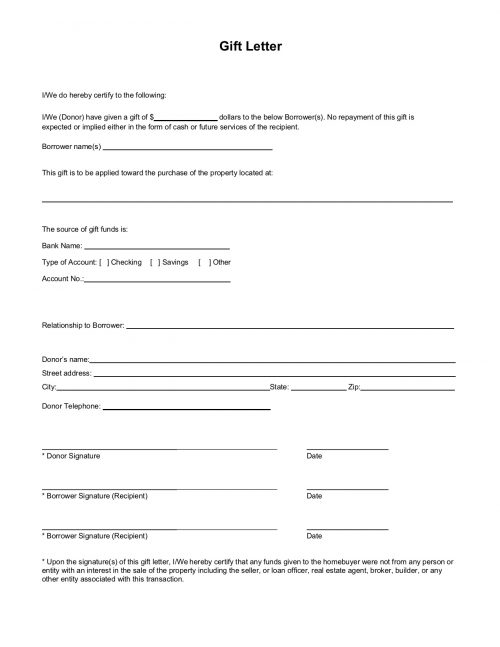

Mortgage gift letter template

Click the image below to download a mortgage gift letter template you can print and use to document your own down payment gift. Or, click here for a PDF you can fill out online.

Click the image to download a PDF mortgage gift letter template

Step 2: Document the source of the gift funds

With your mortgage down payment gift letter written, you’ll want to make sure you don’t violate the rules of ‘taking a gift.’ In order to do that, make sure to keep an extra-strong paper trail for the money being gifted.

If you are the person who is gifting funds to the buyer, for example, and you sell your personal stock holding as part of the down payment gift process, you will want to make sure that you document the sale of your stock as well as the transfer of funds from your brokerage account into the account from which you’re making the gift.

Do not make the transfer without a proper paper trail.

Next, you’ll want to write a check to the home buyer for the exact dollar amount specified in the gift letter you’ve written. Photocopy the check. Keep one copy for your records and give one copy to the buyer — the lender will want to see it as part of the process.

The giver may also have the option to wire funds rather than writing a paper check. However, a check is preferable.

It’s simpler for a lender to document and track a personal check than it is to track a wire; and this will make things go more smoothly at closing.

Step 3: Document receipt of the down payment gift

Now that the gifter has handed, in the form of a check, a down payment gift to the buyer, the following steps are required.

First, with the gift check in hand, the buyer should physically walk into their bank to make the deposit in-person. Do not deposit the check online using an iPhone or Android app or at an ATM machine.

In addition, into whichever bank account you deposit your gift money, make sure it’s the same bank account from which all of your money at closing will be drawn.

You do not want to bring money to closing from multiple savings accounts. This, too, can complicate your paperwork for the lender at a time when your goal is to keep things simple.

When you get to your branch, do the following :

- Deposit the gift funds into a bank account

- End your transaction

- Collect a receipt (deposit slip) and a bank statement showing the deposit

Under no circumstances whatsoever should you “co-mingle” your gift deposit with other monies, nor with other gifts.

The amount specified on your teller receipt should match exactly the dollar amount on the certified down payment gift letter.

If the amount is off by even a small amount, the lender could reject your letter and the funds that came with it.

Note that if you are receiving multiple cash gifts for down payment, you should follow this process for each gift independently. Again, do not co-mingle your gifts. Be guided by your gift letter.

Verify your home buying eligibility

Who can gift money for a mortgage down payment?

Generally, any family member can gift money for a down payment. That includes parents, grandparents, siblings, children, fiancés, or domestic partners. Those related by marriage, adoption, or legal guardianship can also gift a down payment.

Conforming loans — those backed by Fannie Mae and Freddie Mac — only allow down payment gifts from someone related to the borrower in one of the ways listed above.

However, government-backed loans have looser requirements for cash gifts.

If you’re using an FHA, VA, or USDA loan, your cash gift could also come from a close friend, employer, charitable organization, government agency, labor union, or someone else with a non-familial relationship.

One important note: Mortgage down payment gifts cannot come from anyone with an interest in the transaction.

That includes a seller, real estate agent, Realtor, home builder, broker, or anyone else with a stake in the transaction.

Your mortgage gift letter must state the relationship of the person gifting the funds, and certify that the giver is not an ‘interested party’ in the sale.

How much money can be gifted for a down payment?

There’s no dollar limit to the amount of funds someone can gift you for your down payment.

However, depending on your mortgage loan program and the type of home you’re buying, you may have to pay at least part of the down payment out of pocket. This is known as a ‘minimum borrower contribution.’

Conventional loan

Freddie Mac allows you to cover the entire down payment and closing costs using gift money, as long as you’re buying a primary residence (meaning you’ll live in the home full-time).

You can use gifted money for the full down payment on a second home as well, so long as the cash gift equates to a 20% down payment or bigger. If the down payment on your second home is less than 20%, at least 5% must come from your own funds.

Fannie Mae is a little stricter in this regard. Fannie requires a 5% borrower contribution for 2-4-unit primary residences as well as second homes.

Neither Fannie nor Freddie allows gift money for the purchase of an investment property.

FHA, VA, and USDA loans

FHA loans require a minimum 3.5% down payment, and the entire amount can come from gift funds. You can use gifted money toward your closing costs, too.

The VA loan and USDA loan programs do not require any down payment. That means there’s no minimum borrower contribution.

However, some home buyers choose to make a down payment with USDA or VA anyway, and you’re free to use a cash gift to do so.

FHA, VA, and USDA do not allow the purchase of second homes or investment properties.

Verify your home buying eligibility

Is a gift for a down payment taxable?

There may be tax implications when giving or receiving a cash down payment gift.

The home buyer (person receiving the gift) typically shouldn’t have to pay taxes on the funds. The giver, however, may still have to pay taxes on the money they gifted. This is a discussion you should have with your accountant — we do not give tax advice.

Everybody’s tax situation is different and personal circumstances are rarely addressed in full by websites or web resources. Speak to your tax professional prior to making or receiving a cash gift for down payment.

And, remember that your lender will not report cash gifts to the IRS; it’s not the lender’s responsibility to report such things. Your lender will use your gift letter(s) for underwriting only, in an attempt to approve your loan.

Should I use a down payment gift?

Many home buyers use a down payment gift because they want to make a 20% down payment.

With a 20% down payment, home buyers can often qualify for the lowest interest rates offered by their ban. And with 20% down, there is no accompanying private mortgage insurance (PMI).

Furthermore, with 20% down, the borrower has a smaller loan amount, and thus, more affordable monthly mortgage payments. They’ll also pay off their home sooner and save on total interest over the life of the loan.

However, not everyone receiving a cash gift wants to make a 20% down payment. And you’re by no means required to put 20% down.

Low-down-payment loans also allow cash gifts for the down payment.

Some prefer to make small down payments instead.

Low-down-payment loans also allow cash gifts for down payment.

For example, the FHA mortgage, which requires a 3.5% down payment allows cash gifts. So do the Conventional 97 mortgage and the HomeReady mortgage from Fannie Mae, both of which require just 3% down.

Many low-down-payment mortgages do not require a ‘borrower contribution.’ That means no part of the down payment or closing costs needs to come out of your own funds.

You could cover all your upfront fees using gift money or other creative strategies, like down payment assistance and lender credits.

Am I eligible to use a down payment gift?

Pretty much all major types of mortgage loans allow down payment gifts.

And, if you’re buying a primary residence (meaning you’ll live in the house full time), you might be able to use gifted funds for your entire down payment. In other words, you might not have to pay anything out of pocket.

Make sure the gifted down payment funds are properly documented via a mortgage gift letter. Otherwise, the lender won’t accept them. And make sure there’s a paper trail in place to show where the money came from.

As long as have all the correct paperwork, down payment gifts are no problem — and they can be a huge help getting you into your first home.

Time to make a move? Let us find the right mortgage for you