Savings is not fun

Nobody talks about emergency savings. It’s a subject that’s about as sexy as the mumps. If you ever wanted to end a blind date early, just bring up the importance of emergency savings. You’ll be home by 8 PM.

Yet the reality is that you cannot have financial stability without cash in the bank. It will always happen that you will need actual folding money for an emergency auto repair, medical cost, or some surprise expense that comes out of nowhere. And that has become especially obvious in the wake of the longest-running government shutdown in US history.

Verify your new rateHow long could you survive if you missed a paycheck?

Most obvious way to see the need for emergency savings is to look at the government layoffs. Some 800,000 people were furloughed. To make matters worse, more than half – about 420,000 individuals – were required to keep working even though paychecks had been suspended.

You might expect that federal employees would have the ability to weather a financial storm. After all, government jobs include health coverage, vacations, and retirement accounts. Such benefits – plus salaries that grow with inflation allowances – sound like the ideal prescription for maintaining a middle-class lifestyle.

The reality turns out to be very different. An array of news reports suggests that many government workers have little or no savings, that they live from paycheck to paycheck. The warning for everyone is that if you don’t have emergency cash you can be in trouble — if not today, then at some point down the road and probably when you least expect it.

How much do you need?

What do you need in the way of liquid reserves? Everyone has a different number, and the usual suggestions range from two to eight months worth of living expenses. However, according to the Bureau of Labor Statistics, the average period of unemployment between jobs was roughly 22 weeks in December 2018. That means having cash equal to monthly expenditures for six months is a good goal.

Mortgage lenders, who depend on borrowers being able to make their payments if they experience a cash flow glitch, have their own formulas. They require “reserves,” which are funds available to make mortgage payments for a certain number of months.

However, everyone has ongoing expenses in addition to their mortgage payments. And since the shutdown, Fannie Mae and Freddie Mac, who back most mortgages in the US, have increased their reserve requirements for everyone. Not just those who work for the government.

Related: Should you buy a home or continue to rent (video)?

Emergency savings and mortgages

When you borrow money from a mortgage lender, one of the assets they like to see is ready cash. If you have reserves in the bank equal to required mortgage payments for two or three months, lenders will be very happy. You’ll need more if you’re a property investor with rentals and / or many financed properties.

According to Fannie Mae, acceptable reserves can include such assets as cash, stocks, bonds, mutual funds, certificates of deposit, money market funds, trust accounts, retirement savings account as well as the cash value of a vested life insurance policies.

How much do you need? That depends on the type of financing you want. The requirements range from zero to a lot more. For example:

- The FHA has no reserve requirement for a prime residence or duplex, three-months for properties with three to four units

- The VA has no reserve requirement for a prime residence but requires a six-month cash reserve for multi-unit properties

- Fannie Mae does not require reserves for a prime residence but asks for 2 percent of the unpaid mortgage balance

- Freddie Mac requires no reserves for a prime residence but six months for properties with two to four units

Some mortgage programs require given reserve set-asides, but even when there is no reserve requirement, lenders still want to see reserves. Why? Reserves reduce less lender risk. Less risk can mean an easier time getting approved, and maybe even a lower mortgage rate.

For details and specifics, be sure to speak with loan officers and the specific program for which you want to apply.

What do when you have no emergency savings

Of course, a nice bank account is your best source of funds should you experience an interruption in income. But if you’re hitting hard times now and don’t have one, that’s not very comforting information.

What do people do when they have no emergency savings? There are options out there; the problem is that none of them are very good.

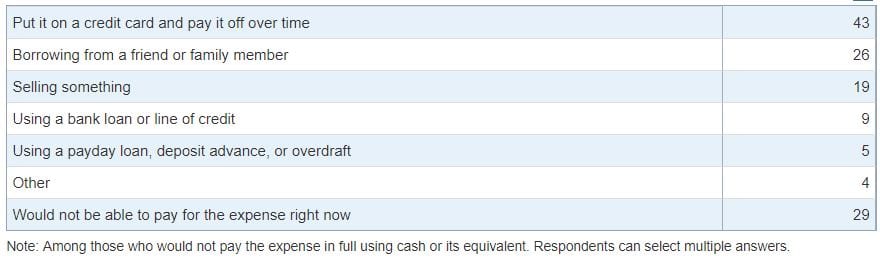

This graph from the Federal Reserve shows how the 41 percent of Americans who don’t have $400 to cover an emergency would handle an unexpected expense:

Borrowing from family members

You might be able to borrow from mom and dad or your rich cousin Daphne. Relatives may well advance money — perhaps a gift or a loan with little or no interest. Moreover, relatives are unlikely to report such borrowing to a credit bureau, and therefore one negative impact of additional borrowing can be avoided.

However, family relationships are complex. Borrowing money from a relative can result in a damaged ego, reduced status, and years-long disputes and arguments. There is also the possibility the relative will say no. As much as relatives may love you, they may love you more if you don’t ask for cash.

Sell some stuff

One way to get cash you won’t have to repay is by selling something you don’t need. You can have a garage sale if you want to get rid of a lot of stuff and live in a neighborhood that supports that sort of thing.

Or, you can make a fast buck the modern way. The Letgo app is probably the fastest way to upload your item and unload it to a local buyer. And there are many similar apps you can use on your mobile device to sell your things while living your life. Other options include eBay and Craigslist.

Tap credit cards

You may find that the credit cards in your pocket allow you to instantly borrow thousands of dollars. This sounds great, until you look at the fees and charges, as well as the damage to your credit score. It can take years to pay off credit card debt, especially if you only make the minimum monthly payments.

In most cases, the fees and interest rates for cash advances on credit cards are higher than those to charge purchases. You can minimize the damage by putting groceries, gas and other purchases directly on the card, rather than taking a cash advance for the same spending.

If you don’t currently have emergency savings or credit, consider applying for a card now. Don’t use it, or charge only small amounts and pay the balance each month. That will improve your credit score and also provide a source of emergency cash if you need one.

Hit up your retirement account

Hopefully, you have retirement funds. You might be able to dip into this money you have set aside, but be aware that withdrawals may be taxable. In many cases, there are also penalties. And tax-deferred deposits become taxable income when you withdraw them. If you’re in a 25 percent bracket and also get hit with a 10 percent penalty, it could cost you about $1,500 to withdraw $1,000.

If your 401(k) plan allows it, you’re better off borrowing against it. The rate are reasonable, you’re borrowing from yourself, and there is no penalty. But if you leave or lose your job before repaying in full, you’ll be hit with penalties and taxes.

You may be able to exploit something known as the 60-day rule. Once every 12 months, you may be able to rollover funds from one retirement account to another without paying a tax or penalty.

“When you roll over a retirement plan distribution,” says the IRS, “you generally don’t pay tax on it until you withdraw it from the new plan. By rolling over, you’re saving for your future and your money continues to grow tax-deferred.”

In effect, you may be able to get a short-term, tax-free loan. However, there is risk. Rollovers can be complex and if the money is not repaid within 60 days you can face an assortment of expensive taxes and penalties. Do not consider a retirement fund roll-over without proper professional advice.

Payday lending — last, last, last resort

You can borrow from your nearby, friendly payday lender. Payday loan (aka cash advance or “no credit check” personal loan) lenders are so friendly because they are about to make a lot of money from you.

A 2013 study by the Consumer Financial Protection Bureau found that the typical payday loan was for about $392. And the interest rate? A modest 339 percent! The loans are very short-term and come with fees to roll them over. And according to the Center for Responsible Lending, only 1 percent of borrowers pay the loans back in two weeks. On average, these loans get rolled over eight to 13 times, racking up fees every time.

Obviously, it’s cheaper and smarter to have $400 in the bank. Not only will this amount allow you to avoid many payday lenders, it means you will have funds on hand which will allow you to pay bills on time and avoid late fees. This is not only a way to save money, it can also help your credit standing.

How to save

At first, bulking up savings may seem difficult. In practice, it’s not that hard. As a way to start try this: With each monthly payment look at the penalty for a late fee. Pay the bill in full and on time and then deposit the late fee you didn’t pay in savings. You might be surprised at how quickly the money will add up.

Or pick one thing that you routinely spend on that you can cut. If you eat lunch out three days a week, cut to two and deposit that money weekly into savings. Shop your auto and home insurance, and deposit what you save. In no time, you’ll have a couple months of reserves, and some better spending habits.

Or have that garage sale and use the proceeds to boost your savings quickly.

Home equity for emergencies

Home equity is a kind of savings. You pay your mortgage every month, your balance goes down, and your homeownership interest increases. In addition, your property value may also rise over time, giving you some extra wealth.

However, home equity is not like cash in the bank. You can’t just take it out when you want it. And if you lose your job, you’ll have a very hard time extracting home equity, because mortgage lenders don’t like to make loans to broke, unemployed people.

One way around this, if you’re concerned about emergency savings, is to establish a home equity line of credit (HELOC) before you need the money, while your credit rating is good and you have a job. leave this account alone, and it will be there for you when you need it. And be very conservative in your use of the funds, because you will have to make monthly payments, even while unemployed, and you will have to repay the balance or risk losing your home to foreclosure.

Time to make a move? Let us find the right mortgage for you