In this article:

- What is a bi-weekly mortgage program?

- How much extra do you pay with a bi-weekly mortgage program?

- How much time and money can you save?

The bi-weekly mortgage program is one way to pay less interest and pay your home loan faster, without refinancing your mortgage.

Verify your new rateWhat is a bi-weekly mortgage?

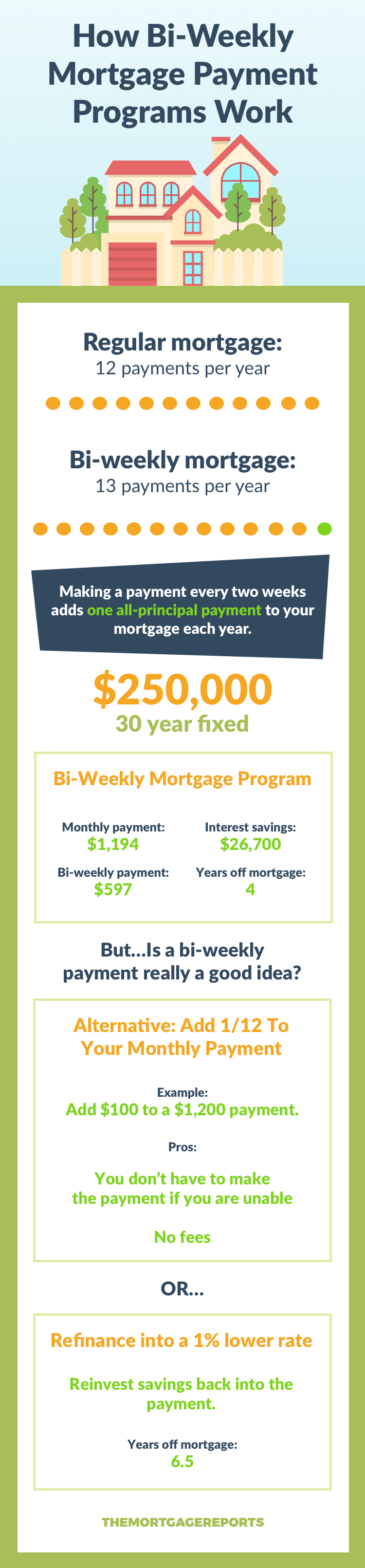

A biweekly mortgage is “regular” mortgage. The only difference is that you structure your payments so that, instead of making one payment at the beginning of each month, you make half of one payment every two weeks.

Because there are 52 weeks in a year, you make 26 of these half-payments, which is like making an extra monthly payment each year. And it’s relatively painless.

Does a bi-weekly mortgage work as advertised?

Biweekly mortgage repayment schemes to allow you to own your home faster. It, like other methods of accelerating your mortgage repayment, do in fact pay your balance down more quickly and save you interest costs.

Whether the bi-weekly mortgage is the most effective strategy depends on if the loan servicer charges more to process your payments this way, and if there is a mortgage refinance available that could do a better job of saving you time and money.

Understanding your options is the first way to make sure you’re making a good choice. Read more about bi-weekly mortgages below.

How the “regular” mortgage repayment costs you money

The typical mortgage asks for one payment per month, which equals 12 payments per year. So you’d pay 360 payments over a 30-year period to zero out your mortgage balance.

Each mortgage payment has an interest portion and a principal portion. The interest part goes to your lender to cover the monthly interest on your remaining balance. The principal part goes toward actually reducing that balance.

As you pay down your balance, the interest cost diminishes. That leaves more of your payment for reducing your balance. It’s like a snowball — your balance is lower, so your interest is lower, and every month, your balance goes down faster.

This repayment schedule is the reason why during the first five years or so, your loan’s balance goes down only a little. But later, it drops dramatically. The technical term for this repayment schedule is amortization (ah-mor-ti-ZHAY-shun).

Verify your new rateThe bi-weekly mortgage plan: 13 payments a year

A bi-weekly mortgage payment program is meant to short-circuit your loan’s amortization schedule.

Instead of taking 12 payments per year, the bi-weekly payment plan asks for one payment every two weeks, which adds up to 13 payments per year.

When you make a standard payment, it first covers the interest you owe for the previous month’s borrowing, based on your remaining balance in mortgage interest rate. Anything over that amount must be directed toward reducing your remaining principal balance.

The bi-weekly scheme actually provides a 13th monthly payment each year, and that extra must be aplied to lowering your balance.

At today’s mortgage rates, bi-weekly payments shorten your loan term by four years.

Verify your new rateDIY bi-weekly mortgage (you don’t need to pay bank charges)

Bi-weekly payments plans work; there’s no doubt about that. It’s basic math. However, there are several reasons why homeowners may want to avoid enrolling in a bi-weekly mortgage payment plan.

The first — and most obvious — reason to avoid bi-weekly mortgage payment programs is that homeowners choosing to self-manage their bi-weekly payments get better results than via a bank-managed bi-weekly payment program.

Here’s how to self-manage: Rather than sending payments to the bank every other week, achieve the same result by making your regular mortgage payment once monthly, then adding 1/12 of your regular mortgage payment to your check. (You may have to send two separate checks, with one marked “apply to principal” to make sure they apply it properly).

For every $1,200 in your mortgage payment, in other words, add $100 to your monthly payment.

By sending $1,300 to your lender monthly, you’ll “overpay” your mortgage by $1,200 annually, which is a 13th payment.

Assuming a $300,000 mortgage at 4.000%, look at how the math works :

- Bank-managed bi-weekly mortgage payments pays off in 26 years, 0 months

- Self-managed bi-weekly mortgage payments pays off in 25 years, 11 months

This math works because banks don’t apply that 13th payment until the year is complete. By contrast, your self-managed system applies 12 times per year.

If your bank is charging for its bi-weekly mortgage payment program, just say “no”.

Bi-weekly mortgage? There may be a better way

While it’s proven that the bi-weekly repayment scheme can save you money, there may be better options. If you don’t expect to keep your home for many more years, refinancing to a hybrid ARM with a much lower interest rate (5/1 ARM rates often run about 1 percent lower than 30-year fixed rates), while making the same higher payment, could take a bigger bite out of your mortgage faster.

Alternatively, if you’ve been paying your mortgage for a longer time period (say, ten years), you may be able to refinance into a 15-year mortgage (15-year mortgage rates typically are .5 percent lower than 30-year mortgage rates) and save both time and interest in a big way.

What are today’s mortgage rates?

There is no reason that you can’t combine the savings of a refinance with the accelerated repayment of a bi-weekly repayment plan. Check out today’s rates and see what your options are.

Time to make a move? Let us find the right mortgage for you