Your roadmap to saving for a house

Can we really tell you how to save for a house without changing your lifestyle? Well, yes, to some extent. Clearly, saving any big sum involves commitment and sacrifices.

But you shouldn’t necessarily have to become a hermit living on a subsistence diet. We’re suggesting ways in which you can continue to enjoy the things you love while quickly building worthwhile savings.

Verify your home buying eligibility. Start here1. Set a realistic house-saving goal

If you’re reading this close to when it was published (as 2022 turned into 2023), you’re likely feeling shell-shocked. Because 2021 and 2022 delivered a double whammy to those wanting to buy a home.

The good news is that, with luck, those bad times may be over. Because many experts are expecting both home price rises and mortgage rates to moderate in 2023.

Rocketing home prices

The first blow to those looking to buy a house was sharply rising home prices. As this graph from the St. Louis Fed shows, median home prices nationwide soared during those two years. Indeed, they climbed to $454,900 in the third quarter of 2022 from $369,800 at the start of 2021.

Median Sales Price of Houses Sold for the United States [MSPUS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MSPUS, December 17, 2022.

In other words, first-time homebuyers might have started out in January 2021 wanting a home for $370,000, only to find the same place costing $455,000 20 months later. That’s what you call moving the goalposts.

Soaring mortgage rates

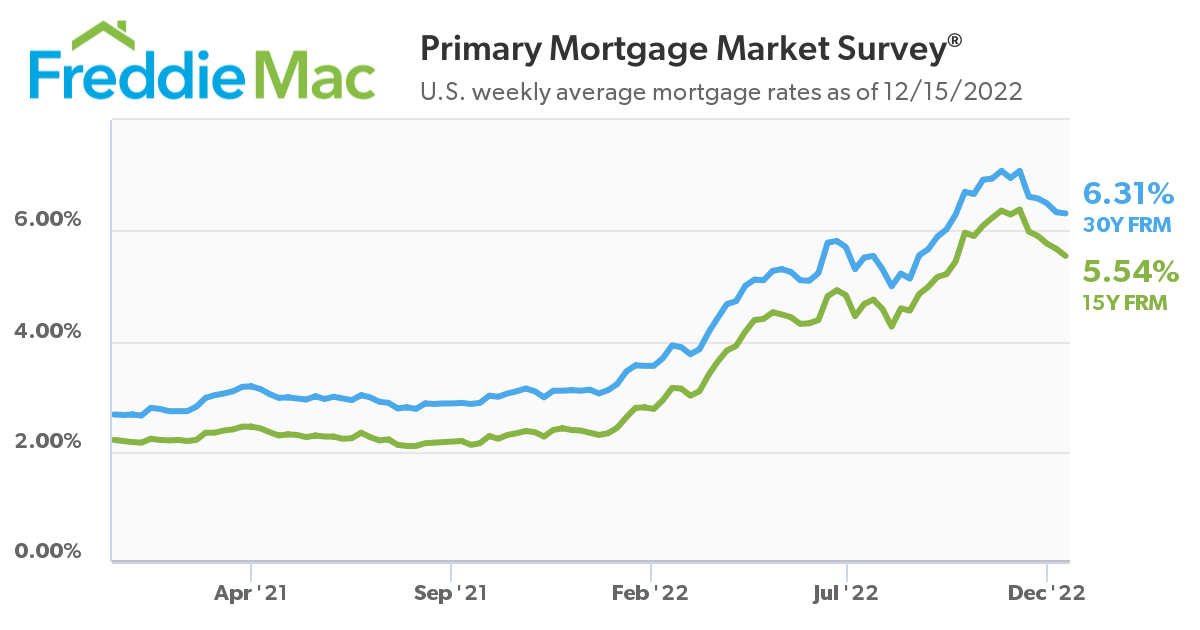

Things were at least as bad for mortgage rates. On Jan. 6, 2021, the average rate for a 30-year, fixed-rate mortgage (FRM) hit its all-time low of 2.65%, according to Freddie Mac. On Nov. 9, 2022, they hit their recent peak of 7.08%. That was way more than twice as high: 167% higher. Luckily, they began to dip toward the end of that year, but only down to 6.31% on Dec. 15.

Better times ahead for homebuyers?

The late Harvard economist John Kenneth Galbraith wrote: “The only function of economic forecasting is to make astrology look respectable.” And he was right.

For those exploring how to buy a house, things were looking better at the end of 2022 than they had for a long time. Home prices were leveling out and many expected modest or moderate falls in 2023.

Meanwhile, mortgage rates had fallen back to 6.3% from nearly 7.1% in a little over a month. There may be ups and downs to come, but many think they’ll be lower at the end of 2023 than they were at its start.

So, there’s reason to hope that the double whammy of 2021-22 will turn into a double boost in 2023.

Setting your home price budget and home savings target

If the experts are proved right, you can find homes you like the look of now and have some hope you’ll still be able to afford similar ones in a couple of years’ time. Indeed, in some places, you may find home prices falling, though how big a drop you’ll see (if any) will vary from area to area.

And, if mortgage rates do continue to head lower, you should be able to afford a better home. Lower mortgage rates mean lower monthly payments, so the home price you can afford will rise.

Still, for now, it’s probably safer to assume that home prices won’t fall far by the time you’re ready to buy. So if you are devising a plan for how to save for a house, set your budget based on the current prices of the sorts of homes you want.

You then need to decide on the sort of mortgage that suits you best. Most first-time homebuyers need a down payment of 3% (conventional loan) or 3.5% (FHA loan) of the home’s purchase price. But two types of mortgage require zero down payments: VA loans (for military personnel and veterans) and USDA loans (for those buying in rural locations).

This is also a good time to discover whether you might be eligible for down payment assistance. Read on for more information about these programs, some of which can help with closing costs, too.

In addition to any down payment, you’ll also need to save closing costs, which can be 2%-5% of the purchase price. For more details, read Upfront costs of buying a home: What you need to save for.

Check your home loan options. Start here2. How to save for a house: Determine your timeline

So, now you have a pretty good idea of how much you need to save. Your next big step in determining how to save for a house is to decide how long you’re going to give yourself to reach your savings target.

At this stage, some go all in. They might move into mom and dad’s basement, give up every luxury, avoid socializing, take staycations, and eat food from their markets’ near-expiration-date shelves. In other words, they cut out everything that isn’t necessary to live and work.

And there are real advantages to this. The pain may be acute but it’s only temporary. And that level of sacrifice can make you feel very virtuous.

Save for a house while maintaining your lifestyle

However, this approach doesn’t suit everyone. And perhaps most wannabe homebuyers take a more measured approach.

If you’re one of them and are serious about becoming a homeowner, you could begin by taking a close look at your household expenditures. Maintain your lifestyle by continuing with the things you really value but eliminate the stuff that makes you say “Meh!” Read How to set and stick to a budget for ways of optimizing your savings.

Now you have an idea of your potential for savings. So, set a monthly target. Then look at your goals through the other end of the telescope: How much do you need to save in total and how long are you going to allow yourself to accumulate that much?

Suppose you decide you need $10,000 in homebuying costs and want to reach that target in 2½ years (30 months). You’d need to save $333 a month ($10,000 ÷ 30 months = $333.33).

How does that compare with the savings target mentioned in the earlier paragraph? If you’re short, you have to decide whether to cut your outgoings more or extend the savings period. If you expect to meet the target early, you could consider buying your home sooner or adding more indulgences to your outgoings.

Once you begin saving, track your progress. In our example, do you have $1,000 after three months and $4,000 after a year? If not, why not? Do you need to set a more realistic target or should you make yourself save more?

There are several suggestions coming up for boosting your savings with one-time windfalls. But it’s probably best not to count your chickens at this stage.

3. Automate your savings

Another helpful method when developing a plan for how to save for a house is to automate your savings. You know how much you need to set aside each month. So, make it easy for yourself by setting up automated transfers from your checking account to a savings account. In our example, that would be $333.33 each month.

Nobody’s going to blame you if you have to raid your savings account for serious emergencies. Maybe your car breaks down and you have to get it fixed immediately for your commute. Or perhaps you lose or break your smartphone. Or maybe you suddenly have to fly off to visit a sick parent.

But try not to touch your savings other than in such exceptional circumstances. Doing so can quickly become habit-forming.

4. How to save for a house: Audit your subscriptions

In the summer of 2022, CNBC reported:

Close to a third of consumers underestimate how much they spend on subscriptions by $100 to $199 each month, a new study shows.

Meanwhile, 42% of consumers say they’d forgotten they were paying subs for services they no longer use. Often, the monthly sums involved are small: $2.99 here, $6.99 there, and maybe $15.99 for something else.

But those can add up. In our example, finding just $34 a month in unused or sub-value subscriptions could represent 10% of your savings target. And if you’re paying for a gym you never visit, it could be a much bigger chunk.

When determining how to save for a house, set aside an afternoon to run through your bank and card statements. And cancel every subscription that you don’t really need.

5. Save bonuses and tax refunds

Do you get an annual bonus? Can you get paid overtime? Do you look forward to your fat tax refund check each year? Great! These can be the least painful ways when you’re exploring how to save for a house.

Just transfer them in full straight into your savings account. You might be able to buy your home earlier than planned. Or you could perhaps afford a bigger and better house or apartment.

6. Save your raise

When your boss gives you a raise, don’t see it as a way to indulge yourself with extra treats or better status symbols. Instead, increase your automated transfer into your savings account by the same amount.

Oh, OK. Maybe keep back just a bit as a reward for yourself.

7. Pay down credit cards and loans

Oh, this one’s a tough ask! Can you really save and pay down debt at the same time?

When it comes to identifying how to save for a house, do your best, especially with credit card balances. When a card balance is greater than 10% of that card’s credit limit, you risk harming your credit score. And that score is going to play a big part in determining the mortgage rate you’re going to have to pay.

Also, mortgage lenders will look closely at your existing debt burden when considering your loan application. Read up on debt-to-income ratios to discover just how crucial these can be.

8. How to save for a house: Look into assistance options

We mentioned earlier down payment assistance programs, some of which help with closing costs, too. There are thousands of these from sea to shining sea. And at least one — often several — will cover the area where you wish to buy.

Each program gets to set its own rules and eligibility criteria. And many are designed for those with low or moderate incomes. But others are more inclusive.

Read Down payment assistance programs in every state for 2023 to discover how to find ones that might help you. If you’re in line for assistance, you might need to save a lot less than otherwise and could move into your own home sooner than you currently think possible.

Don’t forget that financial help might be available closer to home. Many parents and grandparents are eager to see their adult children on the housing ladder as soon as possible. Might yours be able to make a cash gift toward your down payment? Find out early so you can adjust your savings targets.

9. Choose the right type of savings account

Interest rates may have risen sharply in 2022. But, sadly, very little of that benefit had fed through into yields on savings by Dec. 15 that year.

According to the Federal Deposit Insurance Corporation (FDIC), average yields nationwide that day were just 0.3% p.a. Well, you’re not going to get rich on that. However, every cent counts when you’re saving for a house.

It’s definitely worth comparison shopping for your savings account. At the end of 2022, we found accounts on the web delivering yields of ten-times that average rate or better: 3% and even 3.6% p.a. You’re still not going to make a fortune but every little helps.

You may get better yields by choosing money market accounts (MMAs) or certificates of deposit (CDs). However, these tend to restrict your access to your money. So, you may have to pay a big chunk of the interest you’ve earned if you redeem your CD early. And many banks cap the number of withdrawals you can make from an MMA each year.

Of course, you may view such restrictions as good things. You won’t be making withdrawals other than in the most exceptional circumstances.

Verify your home buying eligibility. Start hereHow to save for a house: FAQ

How much money should you save for a house?

As much as you can. The bigger your down payment, the better the home you can afford. And, the higher the proportion of your home’s price you put down, the lower your mortgage rate’s likely to be.

How long does it take to save for a house?

How long’s a piece of string? It depends on your house price, your income, expenses and how good a saver you are. You might also cut the time by getting cash help from a down payment assistance program or family member.

How much do you need to save for a down payment?

As a minimum, expect to need a 3% or 3.5% down payment. But some mortgages (VA and USDA loans) require zero down payment.

How much do you need to save for closing costs?

These typically range from 2-5% of your home loan amount. Read more about assistance with closing costs and how to drive yours down.

What’s the fastest way to save for a house?

How to save for a house the fastest way? Give up everything that makes life worth living and obsess about your savings.

However, most people aren’t willing to make such extreme sacrifices. And they’re willing to take a bit longer to become homeowners if it means they can maintain a decent lifestyle.

Time to make a move? Let us find the right mortgage for you