NOTE : FHA mortgage guidelines are subject to change. The information below may be outdated.

The FHA will raise its mortgage insurance premiums April 9, 2012. All FHA mortgage applicants — first-time buyers, repeat buyers, and users of the FHA Streamline Refinance program — will be subject to the new fees.

Verify your FHA loan eligibilityFHA Mortgages : How They Work

They’re called “FHA mortgages” but the Federal Housing Administration (FHA) doesn’t really make mortgages. Rather, it insures them for lenders that do.

The better name for FHA mortgages would be “FHA-insured mortgages” because it more accurately reflects the relationship between the FHA and the banks that underwrite such loans.

It follows, then, that the FHA charges for its insurance — just like an auto-insurer or life insurer would. And also like an auto insurer or life insurer, the higher the risk of the applicant, the higher the premium of the policy.

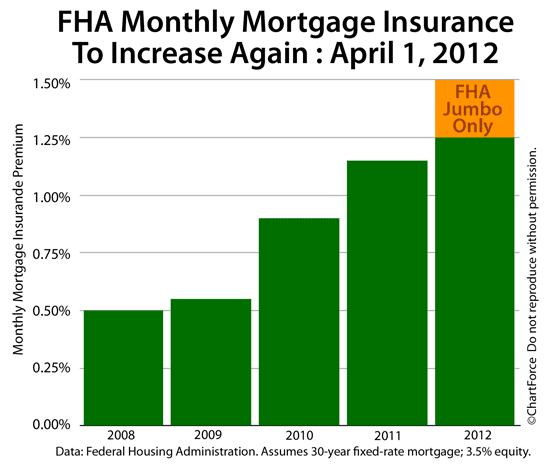

Unfortunately for FHA mortgage applicants, the FHA has deemed its mortgage insurance premiums too low to cover projected losses. Beginning April 1, 2012, for the fourth time in 3 years, the FHA will raise its mortgage insurance premiums. The change applies to new loans registered on, or after, April 9, 2012.

FHA mortgage insurance premiums for loan registered prior to April 9, 2012, and for loans already closed, are exempt from the changes.

Get “grandfathered in” to the old FHA rates by locking your mortgage rate today.

Verify your FHA loan eligibilityNew FHA Mortgage Insurance Premium Schedules

The new FHA mortgage insurance premium schedule raises FHA loan costs significantly. FHA-backed households from Seattle, Washington to Miami, Florida will pay more each month for their FHA mortgages — 30-year fixed, 15-year fixed, or otherwise.

FHA mortgage insurance is paid in two parts.

The first part is the “Upfront Mortgage Insurance Premium”. Sometimes abbreviated as UFMIP, upfront mortgage insurance premiums will rise from 1.000 percent of your FHA loan size to 1.750 percent of your FHA loan size.

For example, if you live in Alexandria, Virginia and you borrow up to the FHA’s local loan limit of $729,750, your upfront mortgage insurance premium will rise 75% from $7,295 to $12,771. This amount is added to your loan size. FHA upfront MIP is not paid via cash. You’ll pay interest on this amount for the life of your loan.

The changes in the FHA’s annual mortgage insurance premiums are less extreme, rising only 10 basis points.

The new schedule, for loans with case numbers assigned on or after April 9, 2012 :

- 15-year loan terms with loan-to-value over 90% : 0.60 percent annual MIP

- 15-year loan terms with loan-t0-value under 90% : 0.35 percent annual MIP

- 30-year loan terms with loan-to-value over 95% : 1.25 percent annual MIP

- 30-year loan terms with loan-to-value under 95% : 1.20 percent annual MIP

Furthermore, beginning June 11, 2012, all FHA mortgages made for $625,500 or more will be subject to an additional 0.25 percent annual mortgage insurance fee.

A Los Angeles, California homeowner, therefore, using the FHA’s full $729,750 local loan limit for a low-downpayment, 30-year fixed rate mortgage will pay annual mortgage insurance premium of 1.50% to the FHA, or $912 per month.

Loans made prior to April 9, 2012 will use the old FHA mortgage insurance schedule :

- 15-year loan terms with loan-to-value over 90% : 0.50 percent annual MIP

- 15-year loan terms with loan-t0-value under 90% : 0.25 percent annual MIP

- 30-year loan terms with loan-to-value over 95% : 1.15 percent annual MIP

- 30-year loan terms with loan-to-value under 95% : 1.10 percent annual MIP

There is no “jumbo FHA mortgage premium” for loans made prior to April 9, 2012.

Verify your FHA loan eligibilitySpecial Cases : FHA Streamline Refinance MIPs

As part of the FHA’s announcement, there was also reference to the FHA’s benchmark refinance program, the FHA Streamline Refinance.

The FHA suggested that a subset of households using the streamline refi program will get access to lower mortgage insurance premiums after refinancing — not higher.

No official announcement has been made, but it’s believed that mortgage insurance premiums — both upfront and annual — will be dramatically lowered for FHA Streamline Refinances used to replace an existing FHA mortgages originated prior to June 1, 2009. New FHA Streamline Refinances that replace loans originally originated after June 1, 2009 will still pay the new, standard FHA mortgage insurance rates listed above.

The June 1, 2009 deadline should sound familiar — it’s the same deadline for Fannie Mae and Freddie Mac’s HARP 2.0 program.

The FHA is expected to confirm new FHA Streamline Refinance mortgage insurance premiums within a few weeks.

Verify your FHA loan eligibilityLock Your FHA Rate Before The Price Hike

The FHA will make a formal announcement on its new FHA premiums in the coming days. Some of the exact numbers at top may change slightly. However, the FHA has confirmed the April 9, 2012 rollout date.

If you’re planning to use the FHA for your next home mortgage, get your loan application started today. If you wait, you’ll be subject to the FHA’s new premiums.

Time to make a move? Let us find the right mortgage for you