What Is Inflation?

Inflation is an economic term. It describes purchasing power decreasing over time.

More commonly, changes in inflation are referred to as changes in The Cost of Living; the everyday items we buy get more expensive and our heating and gas bills go up, for example.

It’s not that the goods got more expensive, necessarily, however. It’s that the money we’re using to buy said goods is worth less. That what inflation is. It’s when the money we spend doesn’t “go as far”.

Inflation also does a number on mortgage rates.

Verify your home loan eligibility. Start here

Inflation Leads To Higher Mortgage Rates

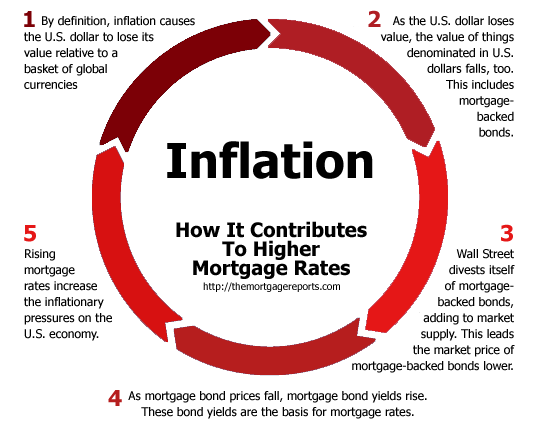

Inflation is a self-reinforcing cycle. The longer it lasts, the more insidious its effects, and rising mortgage rates are an unfortunate consequence.

Because inflation devalues the U.S. dollar, it devalues everything denominated in U.S. dollars. This includes mortgage-backed bonds, of course, so when inflation is present, demand for MBS starts to fall. Investors don’t want to own an assets that’s likely to lose its value over time, after all.

Falling demand causes prices to fall, too. It’s basic economics. Then, as prices fall, the corresponding yields rise. This translates into higher rates for everyday Americans for all mortgage types — conforming, FHA, jumbo, VA, and USDA.

Right now, inflation fears are low. Energy costs have dropped, the Fed has not “printed money” in more than a year, and the economy is growing slowly, and steadily. Prices are steady and mortgage rates are lower than they’ve ever been in history.

Home buyers and rate shoppers are looking a gift horse in the mouth. It’s a great time to lock a mortgage rate.

Verify your home loan eligibility. Start hereLock A Pre-Inflation Mortgage Rate While You Can

The U.S. economy is heating up. Look past the weak data of the past 3 weeks and focus on the broader picture. Job growth is returning, home prices are rising, and the construction remains in an up-cycle. However, with Wall Street speculating about the Fed’s next intervention — possibly as soon as next month — the low mortgage rates could be gone.

If you’re shopping for a mortgage, it’s a great time to lock one in. Sure, rates may go lower. But what if they don’t?

Time to make a move? Let us find the right mortgage for you