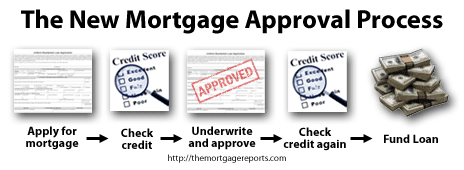

When does “cleared to close” not mean “cleared to close”? When Fannie Mae’s involved, that’s when.

Verify your mortgage eligibilityFannie Mae’s “Loan Quality Initiative”

Fannie Mae doesn’t make loans. Rather, it buys loans from banks and securitizes them into mortgage-backed securities. As such, Fannie Mae wants to make sure that every loan it buys to meet its basic underwriting standards. That way, it can stand behind the quality of its securities.

And, when we talk about loan approvals, this is actually what’s happening; your loan is being underwritten based on Fannie Mae’s guidelines. Loans approved for closing are — presumably — in line with Fannie Mae’s minimum standards.

We say “presumably” because when foreclosures began to increase last decade, Fannie Mae started an audit of its loans and found large numbers of mortgage that had failed to meet its standards. Some loans, it found, were grossly underwritten, comprising its securities and its bottom-line.

To limit “bad loans”, Fannie Mae created its Loan Quality Initiative.

The Loan Quality Initiative is broad in scope, comprising 9 pages. For banks, it creates “extra steps” in underwriting. It’s validation of things like social security numbers and borrower occupancy. They’re small tasks, but time-consuming, and there’s a lot of them.

As a mortgage applicant, you don’t have to worry about what the bank is doing. You have one task only — don’t mess up your credit.

Verify your mortgage eligibilityJust Before Funding, Your Credit Will Be Repulled

The Loan Quality Initiative requires lenders to re-verify credit credit profiles just prior to closing and to look for changes. In other words, although your credit was pulled at the start of underwriting, Fannie Mae wants your bank to pull it again — just in case something changed.

This ensures that loans are priced properly, and are funded on the borrower’s risk at closing as opposed to at application; because a lot can change while a loan is in-process. Especially when the loan is for a purchase closing in 60 days or more.

Banks will repull your credit prior to closing. Some of the things they’re looking for include :

- Did you apply for new credit cards while your loan was in-process?

- Did you run up existing cards while your loan was in-process?

- Did you finance an automobile while your loan was in-process?

- Did you make some other major purchase while your loan was in-process?

- Did you add non-disclosed debts while your loan was in-process?

Each of the above is a red flag to underwriting. If your “final” credit report doesn’t match your original credit report, your mortgage may be subject to a complete re-underwrite and, in a worst case scenario, a loan application denial.

The 3 Credit Hotspots For Loans In-Process

The Loan Quality Initiative is pretty straight-forward and common sense-like. As a mortgage applicant, it’s easy to avoid its claws. There are 3 things for which an underwriter looks in your credit file.

Here are those 3 items how the bank will react.

What the bank will do: Recalculate debt-to-income ratios using your “new” minimum payment due figures. If the DTI exceeds Fannie Mae’s maximum threshold, the loan will be denied.

What you should do about it: Don’t run up credit cards prior to closing — even for layaway items. Consider paying more than the minimum due, just in case.

What the bank will do: Use your new credit score to assess loan-level pricing adjustments or outright denials for when scores fall below Fannie Mae’s minimum credit score requirement.

What you should do about it: Follow the basic rules of keeping your credit score high — pay your bills, don’t let things go into collection, and don’t look for new credit unless necessary. Click here to get your credit scores.

What the bank will do: Look at the Credit Inquiry section of your credit report to look for “non-disclosed liabilities”. If items are found, the bank will ask for supporting documentation on the inquiry, and will use the information to re-underwrite your mortgage.

What you should do about it: Don’t go looking for new credit until after your loan is funded. Period. Now re-read that first sentence, please, to help it sink it.

And remember — this is all happening after your loan has reached “final approval” status. You should protect your credit all the way through funding. Don’t buy new furniture on credit the day before you move in; or buy a car for that new garage.

Verify your mortgage eligibilityLoan Approvals Tough, But Not Impossible

Fannie Mae began its Loan Quality Initiative to improve its loan pool’s overall performance. Better loan quality helps to keep conforming mortgage rates down and reduces the taxpayer burden of bad loans. That’s two big wins.

Unfortunately, the Loan Quality Initiative can also result in additional mortgage turndowns and broken closings.

Therefore, be extra careful with your credit between your application date and closing. If you must buy something big, consider paying cash or waiting it out. major purchases on your credit card can be grounds to revoke an approval.

Even if your loan is cleared-to-close.

Verify your mortgage eligibilityApply For A Mortgage With Great, Low Rates

Fannie Mae’s Loan Quality Initiative applies to Fannie Mae loans only. It does not apply to FHA mortgages, USDA loans, VA loans or jumbo loans. However, it’s still good smarts to keep your credit clean while your loan is in-process.

To get started with a purchase closing or a refinance, get started with a mortgage rate.

Time to make a move? Let us find the right mortgage for you