The FHA Streamline Refinance is a lenient mortgage program. Official FHA guidelines allow borrowers to ignore most traditional mortgage verifications associated with a refinance, including those for income, credit and employment.

And now, with FHA mortgage rates ultra-low near 3 percent, refinancing homeowners can ignore something else — FHA mortgage insurance premiums (MIP).

Verify your FHA streamline refinance eligibilityFHA Streamline Refinance : Low Rates, Fast Closings

The FHA Streamline Refinance is a special mortgage product, reserved for homeowners whose existing mortgages are FHA-insured.

The “streamline” moniker alludes to the relative ease with which an FHA Streamline Refinance is underwritten.

According to the official FHA loans guidelines, the FHA Streamline Refinance requires no income verification, no employment verification, and no credit history. And no matter whether you live in a single-family residence or a condo, there’s no need to get an appraisal, either.

As part of the FHA Streamline Refinance program, the FHA waives the appraisal process in full, assigning the home’s current value to its initial purchase price instead.

For homeowners whose homes have lost value, this is good news. Because the FHA Streamline Refinance specifically waives the need for an appraisal, it allows homeowners to refinance with unlimited loan-to-value (LTV). Much like the program from Fannie Mae and Freddie Mac, no matter how far underwater your home, the FHA will refinance you via its streamline program without extra cost or penalty.

To gain approval, then, all that the FHA does check is that you’ve made at least 6 payments on your current mortgage; that those payments have been made on-time; and that your mortgage has a “purpose”.

Even better is that FHA mortgage rates are mostly below 4 percent.

Verify your FHA streamline refinance eligibilityNew FHA MIP Cancelation Policy

As part of the FHA Streamline Refinance, FHA homeowners are required to “restart” their respective home loans. This includes paying the FHA’s upfront mortgage insurance premium which is due at closing, and the FHA’s annual mortgage insurance premium (MIP) which is paid monthly, pro-rata.

FHA homeowners have witnessed rising MIP since 2008 as FHA’s reserve fund dwindled — the result of a high number of loan defaults. The FHA has raised its mortgage insurance schedule 6 times in 6 years.

Here is how FHA MIP schedules have changed since 2008 for borrowers making 3.5% downpayments on a purchase, and for refinances with less than 5% equity :

- January 2008 : 0.50% annual MIP plus 1.50% upfront MIP added to loan balance

- October 2008 : 0.55% annual MIP plus 1.75% upfront MIP added to loan balance

- April 2010 : 0.55% annual MIP plus 2.25% upfront MIP added to loan balance

- October 2010 : 0.90% annual MIP plus 1.00% upfront MIP added to loan balance

- April 2011 : 1.15% annual MIP plus 1.00% upfront MIP added to loan balance

- April 2012 : 1.25% annual MIP plus 1.75% upfront MIP added to loan balance

- April 2013 : 1.35% annual MIP plus 1.75% upfront MIP added to loan balance

But, it’s not just rising MIP that should worry you. Beginning June 3, 2013, many FHA homeowners will lose their ability to “cancel MIP” on their new — purchase or refinance. .

There’s benefit in acting quickly, then. FHA Case Numbers assigned prior to June 3, 2013 will be exempt from the ruling.

Verify your FHA streamline refinance eligibilityGet Rid Of MIP Faster Via An FHA Streamline Refinance

Under current FHA rules, FHA-insured homeowners using a standard, 30-year fixed rate mortgage, monthly mortgage insurance payments are required until two specific conditions are met :

- The loan balance is 78% of the purchase price, or less

- At least 60 monthly MIP payments must have been made to the FHA

Unfortunately, FHA loans don’t reach that 78% mark as fast as you would think. With a starting mortgage of 5 percent, for example, it takes nearly 9 years to reach 78% LTV; a mortgage at 5.50 percent takes nearly 12 years.

However, at today’s ultra-low mortgage rates, the cancel point is more favorable by years.

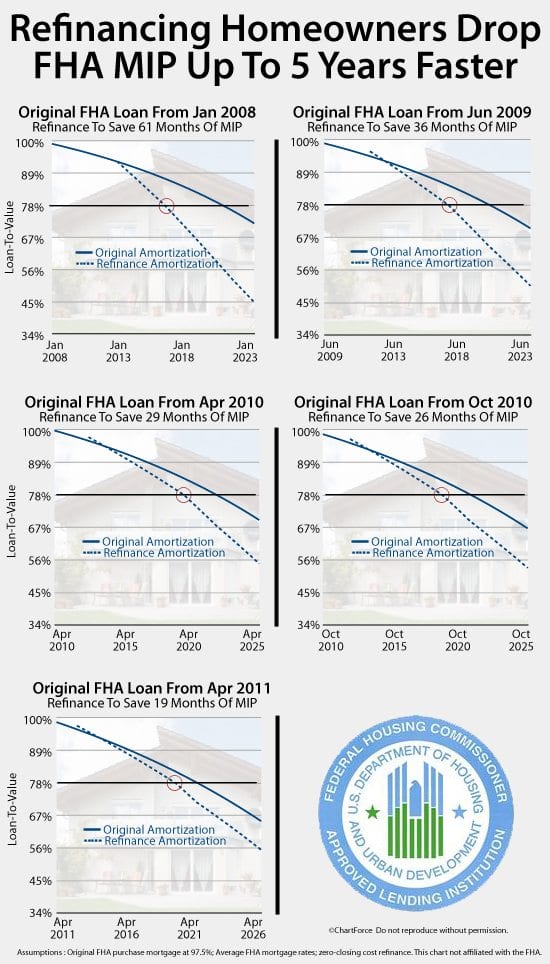

Homeowners today are paying much larger shares of principal to their mortgage each month so paydowns happen faster. Low rates have changed the math of FHA Streamline Refinance such that nearly all refinancing homeowners can reach their respective MIP drop-off points faster with a refinance than without one.

Even accounting for today’s 1.75% upfront payment, the savings are still there :

- An FHA loan from January 2008, if refinanced today, will drop MIP 61 months faster

- An FHA loan from June 2009, if refinanced today, will drop MIP 36 months faster

- An FHA loan from April 2010, if refinanced today, will drop MIP 29 months faster

- An FHA loan from October 2010, if refinanced today, will drop MIP 26 months faster

- An FHA loan from April 2011, if refinanced today, will drop MIP 19 months faster

Our two key assumptions, of course, is that the homeowner made an FHA minimum 3.5% downpayment at the time of purchase, and that the homeowner is applying his/her monthly savings back to the new principal balance monthly.

The math works because mortgage rates are low. And it’s amazing. Nearly everyone can refinance via the FHA Streamline Refinance and save money long-term. This wasn’t possible until mortgage rates fell into the 3s.

Verify your FHA streamline refinance eligibilitySee Today’s FHA Mortgage Rates

Despite rising mortgage insurance rates, the FHA will still close more than 500,000 mortgages this year. The FHA Streamline Refinance is more attractive than ever. And, with FHA MIP cancelation policies changing June 3, 2013, the time to act is now.

Get started with a live rate quote. Get rid of your FHA MIP quicker.

Time to make a move? Let us find the right mortgage for you