Mortgage rate forecast for next week (Mar. 9-13)

After falling into the 5%'s for the first time since September 2022, mortgage rates took a slight step up this week.

The average 30-year fixed rate mortgage (FRM) inched up to 6% on Mar. 5 from 5.98% on Feb. 26, according to Freddie Mac. The last time the average 30-year FRM went above 7% was Jan. 16, 2025.

“Rates are down nearly a full percentage point from this time in 2024, spurring activity from buyers, sellers and owners. As a result, refinance activity is up, and purchase applications are ahead of last year’s pace,” said Sam Khater, chief economist at Freddie Mac.

| Average 30-year fixed rate | 1-week ago | 4-weeks ago | 3-months ago | 1-year ago |

| 6.00% | 5.98% | 6.11% | 6.19% | 6.63% |

The latest borrowing activity

Though lagging, the most recent weekly mortgage application report from the Mortgage Bankers Association showed a seasonally adjusted 11% increase for the seven days ending Feb. 27. The refinance index jumped 14.3% week-over-week while surging 109% from a year ago. The purchase index rose 6.1% weekly and stands 14.3% higher year-over-year.

“Refinance applications increased for the fourth straight week to the strongest pace since 2022, with conventional refinances up 20 percent. The increase in the average loan size for refinances indicates that more borrowers with larger loan sizes are seeking to lower their monthly payments. Purchase applications also moved higher, with the week’s pace almost 10 percent ahead of last year’s pace, as lower rates and growing levels of housing inventory continue to support homebuyer interest,” said Joel Kan, deputy chief economist at the MBA.

Find your lowest mortgage rate. Start hereIn this article (Skip to...)

- Will rates go down in March?

- 90-day forecast

- Expert rate predictions

- Mortgage rate trends

- Rates by loan type

- Mortgage strategies for March

- Mortgage rates FAQ

Will mortgage rates go down in March?

“Overall, March looks more steady than volatile and that stability is a win for buyers heading into the spring market.“

-Ralph DiBugnara, president at Home Qualified

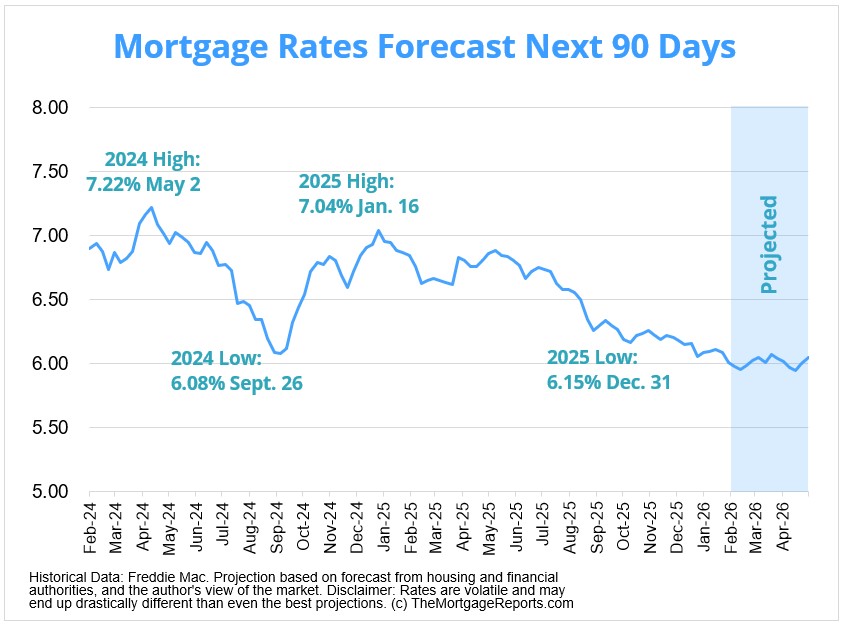

Mortgage rates fluctuated significantly in 2023, with the average 30-year fixed rate going as low as 6.09% and as high as 7.79%, according to Freddie Mac. That range narrowed from 6.08% to 7.22% in 2024, and further in 2025 between 6.15% and 7.04%.

Find your lowest mortgage rate. Start hereWe may have already seen the peak of this rate cycle. But if inflation rises, mortgage rates could uptrend. Many factors drive interest rates, which makes them subject to volatility and could change direction any given week.

Experts weighed in on whether 30-year mortgage rates will climb, fall, or level off in March.

Expert mortgage rate predictions for March

Dan Cooper, EVP of capital markets/servicing at Cornerstone Home Lending

Prediction: Rates will rise

“Throughout the month of February, we saw interest rates decline amid easing inflation data, concerns surrounding a potential AI-induced recession and a lower-than-expected market impact from increased tariffs. While we expected this trend to continue, the recent conflict in the Middle East has driven a sharp increase in oil prices that could trigger a resurgence in inflation if disruptions persist. As a result, interest rates have begun to move higher, a trend that will likely continue in the near term. We anticipate the U.S. 10-Year Treasury trending towards the 4.2% level — up from approximately 4.05% currently — should the conflict continue to drag on and pressure energy markets.”

Ralph DiBugnara, president at Home Qualified

Prediction: Rates will moderate

“As we head into March, I expect mortgage rates to stay in the low-to-mid 6% range for 30-year fixed and around 5.625% for 15-year fixed. There has been a slight inflation reduction over the last few months and expect that to slowly continue. The 10-year Treasury has also eased some, which is helping rates stabilize.

“But we won’t see rates come down drastically or even in a straight line down, there may be some ups and downs over the next few months. This is mostly because the Fed is still in wait-and-see mode and not making any large decisions to drop the rates. Overall, March looks more steady than volatile and that stability is a win for buyers heading into the spring market.”

Charles Goodwin, head of bridge and DSCR lending at Kiavi

Prediction: Rates will moderate

“As we head into March, we were expecting mortgage rates to remain relatively stable, with the 10-year Treasury still driving most of the action. But over the weekend, the Supreme Court ruled that many of the former tariffs would need to be reversed, and the administration responded quickly with a more universal tariff approach. Markets reacted, and we’ve seen the 10-year Treasury drop slightly on that news. As of today, mortgage rates have dipped into the high 5% range.

“Labor and inflation numbers still matter, but policy is becoming a bigger part of the conversation. We’ve already seen steps aimed at improving affordability on the demand side, including added liquidity in the mortgage-backed securities market, and that’s helped keep some downward pressure on rates. If rates can hold at these levels, that should translate into a slightly more active spring housing market. If the data stays in line, I’d expect rates to hover around the 6% range, with any real volatility coming from macro surprises or policy shifts rather than the Fed calendar itself.”

Marc Halpern, CEO at Foundation Mortgage

Prediction: Rates will moderate

“In his recent State of the Union address, the President reiterated his position that a decrease in mortgage rates, which have dropped around 1% in the last year, will be key to improving housing affordability. Nonetheless, mortgage rates continue to move lower very slowly, with a 30-year mortgage hovering around 6%, and recent minutes from the Federal Open Market Committee, which sets benchmark interest rates, indicate that without a further reduction in inflation, mortgage rates are unlikely to shift lower than another percentage point this year, and that’s a generous prediction.”

Rebekah Scott, director of investment real estate at Atlas Real Estate

Prediction: Rates will decline

“The most important thing consumers should understand is that we’re experiencing a rare window of opportunity. Rates just dipped below 6% for the first time since 2022, and while nothing is guaranteed, this appears more sustainable than the brief dip we saw in January. Tariff uncertainty and economic softness are pushing investors toward bonds, which is pulling rates down. Whether this holds depends on factors no one can predict with certainty.

“More broadly, we’re entering what some economists are calling the “Great Reset” in housing. This isn’t a crash or a correction; it’s a normalization. Inventory is up roughly 20% from a year ago, incomes are finally outpacing home price growth, and the intense seller’s market is moderating. If you’ve been waiting for conditions to improve, they have. Not dramatically, but meaningfully.”

Sam Williamson, senior economist at First American

Prediction: Rates will moderate

“Mortgage rates are expected to hold in the low‑6% range in March as the spring home-buying season gets underway. The near‑term mortgage rate outlook will hinge on upcoming inflation and employment data for February, which will help shape expectations ahead of next month’s Federal Open Market Committee meeting. If February delivers another strong jobs report and underlying inflation remains contained, mortgage rates are likely to remain near current levels as steady Fed rate expectations keep longer‑term bond yields anchored. However, softer inflation or hiring could put modest downward pressure on mortgage rates by pulling expectations for Fed cuts forward.

“Zooming out, the mortgage rate environment is notably improved from last year. With mortgage rates near three-year lows and nearly a full percentage point below a year ago, lower borrowing costs have expanded buyers’ purchasing power. That boost could help support firmer early-season demand as buyers find more homes within their budget.”

Mortgage interest rates forecast next 90 days

As inflation ran rampant in 2022, the Federal Reserve took action to bring it down and that led to the average 30-year fixed-rate mortgage spiking in 2023.

When inflation gradually cooled in 2024, the Fed made three rate cuts (September, November, and December). Amid the uncertainty and chaos of 2025, the Federal Reserve Open Market Committee held the federal funds rate range steady at its first five meetings, before continued instability and weakened job markets justified three cuts to end the year. The central bank then held rates at its first 2026 meeting, resuming its wait-and-see approach during a time of murky economic outlooks.

Find your lowest mortgage rate. Start hereOf course, rates could rise or fall on any given week due to many factors or if another global event causes widespread uncertainty in the economy.

Mortgage rate predictions for 2026

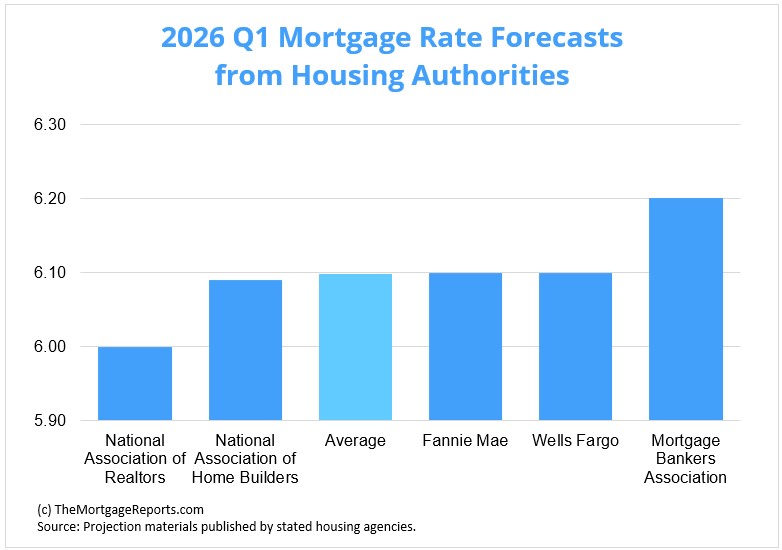

The 30-year fixed-rate mortgage averaged 6% as of Mar. 5, according to Freddie Mac. Four of the five major housing authorities we looked at predict 2026’s opening quarter average to finish above that.

National Association of Realtors sits at the low end of the group, projecting the average 30-year fixed interest rate to settle at 6%. Meanwhile, the Mortgage Bankers Association had the highest Q1 forecast of 6.2%.

| Housing Authority | 30-Year Mortgage Rate Forecast (Q1 2026) |

| National Association of Realtors | 6.00% |

| National Association of Home Builders | 6.09% |

| Fannie Mae | 6.10% |

| Wells Fargo | 6.10% |

| Mortgage Bankers Association | 6.20% |

| Average Prediction | 6.098% |

Current mortgage interest rate trends

Mortgage rates inched up after three straight weeks of declines.

The average 30-year fixed rate rose to 6% on Mar. 5 from 5.98% on Feb. 26. Meanwhile, the average 15-year fixed mortgage rate dipped to 5.43% from 5.44%.

| Month | Average 30-Year Fixed Rate |

| February 2025 | 6.84% |

| March 2025 | 6.65% |

| April 2025 | 6.73% |

| May 2025 | 6.82% |

| June 2025 | 6.82% |

| July 2025 | 6.72% |

| August 2025 | 6.59% |

| September 2025 | 6.35% |

| October 2025 | 6.25% |

| November 2025 | 6.24% |

| December 2025 | 6.19% |

| January 2026 | 6.10% |

| February 2026 | 6.05% |

| March 2026 | 6.00% |

Source: Freddie Mac

After hitting record-low territory in 2020 and 2021, mortgage rates climbed to a 23-year high in 2023 before descending over 2024 and 2025. Many experts and industry authorities believe they will follow a downward trajectory in 2026. Whatever happens, interest rates are still below historical averages.

Dating back to April 1971, the fixed 30-year interest rate averaged around 7.8%, according to Freddie Mac. So if you haven’t locked a rate yet, don’t lose too much sleep over it. You can still get a good deal, historically speaking — especially if you’re a borrower with strong credit.

Just make sure you shop around to find the best lender and lowest rate for your unique situation.

Mortgage rate trends by loan type

Many mortgage shoppers don’t realize there are different types of rates in today’s mortgage market. But this knowledge can help home buyers and refinancing households find the best value for their situation.

Find your lowest mortgage rate. Start hereWhich mortgage loan is best?

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high-priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits, which max out at $ in most parts of the U.S.

On the other hand, if you’re a veteran or service member, a VA loan is almost always the right choice. VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance (PMI). But you need an eligible service history to qualify.

Conforming loans and FHA loans (those backed by the Federal Housing Administration) are great low-down-payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620. FHA loans are even more lenient about credit; home buyers can often qualify with a score of 580 or higher, and a less-than-perfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates — similar to VA — and reduced mortgage insurance costs. The catch? You need to live in a ‘rural’ area and have moderate or low income to be USDA-eligible.

Mortgage rate strategies for March 2026

Mortgage rates displayed their famous volatility throughout 2024 before 2025’s gradual downtrend. The Federal Reserve ended 2025 with three-straight rate cuts and projected the potential for more in 2026, providing optimism for modestly descending rates over the course of the year.

Find your lowest mortgage rate. Start hereHowever, the Trump Administration’s wealth and power consolidation, alongside unstable inflation caused the Fed to pause in January. As always, the committee said it would adjust its policies as necessary — which could mean additional cuts, none at all or even possible raises.

Here are just a few strategies to keep in mind if you’re mortgage shopping in the coming months.

Be ready to move quickly

Indecision can lead to failure or missed opportunities. That holds true in home buying as well.

Although the housing market is becoming more balanced than the recent past, it still favors sellers. Prospective borrowers should take the lessons learned from the last few years and apply them now even though conditions are less extreme.

“Taking too long to decide to make an offer can lead to paying more for the home at best and at worst to losing out on it entirely. Buyers should get pre-approved (not pre-qualified) for their mortgage, so that the seller has some certainty about the deal closing. And be ready to close quickly — a long escrow period will put you at a disadvantage.

“And it’s definitely not a bad idea to work with a real estate agent who has access to “coming soon” properties, which can give a buyer a little bit of a head start competing for the limited number of homes available,” said Rick Sharga.

If mortgage rates continue on a downward trajectory, more and more buyers will likely enter the market after being priced out on the sidelines. Being decisive (and prepared) should only play to your advantage.

Shopping around isn’t only for the holidays

Since interest rates can vary drastically from day to day and from lender to lender, failing to shop around likely leads to money lost.

Lenders charge different rates for different levels of credit scores. And while there are ways to negotiate a lower mortgage rate, the easiest is to get multiple quotes from multiple lenders and leverage them against each other.

“For potential home buyers, it’s important to get quotes from multiple lenders for a mortgage, as rates can vary dramatically, especially during such a volatile period,” said Odeta Kushi.

As the mortgage market slows due to lessened demand, lenders will be more eager for business. While missing out on the rock-bottom rates of 2020 and 2021 may sting, there’s always a way to use the market to your advantage.

How to shop for interest rates

Rate shopping doesn’t just mean looking at the lowest rates advertised online because those aren’t available to everyone. Typically, those are offered to borrowers with great credit who can put a down payment of 20% or more.

The rate lenders actually offer depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment (if buying a home)

- Your home equity (if refinancing)

- Your loan-to-value ratio (LTV)

- Your debt-to-income ratio (DTI)

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a ‘real’ rate quote based on your financial situation.

You should get three to five of these quotes at a minimum, then compare them to find the best offer. Look for the lowest rate, but also pay attention to your annual percentage rate (APR), estimated closing costs, and ‘discount points’ — extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Compare mortgage and refinance rates. Start here

Mortgage interest rate FAQ

Current mortgage rates are averaging 6% for a 30-year fixed-rate loan and 5.43% for a 15-year fixed-rate loan, according to Freddie Mac’s latest weekly rate survey. Your individual rate could be higher or lower than the average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Mortgage rates could decrease next week (Mar. 9-13, 2025) if the mortgage market takes a cautious approach to a possible recession. However, rates could rise if lenders account for the Federal Reserve taking measures to counteract inflation or if a global event brings economic uncertainty.

If inflation continues to dissipate and the economy cools or goes into a recession, it's likely mortgage rates will decrease in 2026. Although, it's important to remember that interest rates are notoriously volatile and are driven by many factors, so they can rise during any given week.

Mortgage rates may rise in 2026. High inflation, strong demand in the housing market, and policy changes by the Federal Reserve in 2022 and 2023 all pushed rates higher. However, if the U.S. does indeed enter a recession, mortgage rates could come down.

Freddie Mac is now citing average 30-year rates in the 6% range. If you can find a rate in the 5s or 6s, you’re in a very good position. Remember that rates vary a lot by borrower. Those with perfect credit and large down payments may get below-average interest rates, while poor-credit borrowers and those with non-QM loans could see much higher rates. You’ll need to get pre-approved for a mortgage to know your exact rate.

For the most part, industry experts do not expect the housing market to crash in 2026. Yes, home prices are over-inflated. But many of the risk factors that led to the 2008 crash are not present in today’s market. Low inventory and massive buyer demand should keep the market propped up. Plus, mortgage lending practices are much safer than they used to be. That means there’s not a subprime mortgage crisis waiting in the wings.

At the time of this writing, the lowest 30-year mortgage rate ever was 2.65%. That’s according to Freddie Mac’s Primary Mortgage Market Survey, the most widely used benchmark for current mortgage interest rates.

Locking your rate is a personal decision. You should do what’s right for your situation rather than trying to time the market. If you’re buying a home, the right time to lock a rate is after you’ve secured a purchase agreement and shopped for your best mortgage deal. If you’re refinancing, you should make sure you compare offers from at least three to five lenders before locking a rate. That said, rates are rising. So the sooner you can lock in today’s market, the better.

That depends on your situation. It’s a good time to refinance if your current mortgage rate is above market rates and you could lower your monthly mortgage payment. It might also be good to refinance if you can switch from an adjustable-rate mortgage to a low fixed-rate mortgage; refinance to get rid of FHA mortgage insurance; or switch to a short-term 10- or 15-year mortgage to pay off your loan early.

It’s often worth refinancing for 1 percentage point, as this can yield significant savings on your mortgage payments and total interest payments. Just make sure your refinance savings justify your closing costs. You can use a mortgage calculator or speak with a loan officer to crunch the numbers.

Start by choosing a list of three to five mortgage lenders that you’re interested in. Look for lenders with low advertised rates, great customer service scores, and recommendations from friends, family, or a real estate agent. Then get pre-approved by those lenders to see what rates and fees they can offer you. Compare your offers (Loan Estimates) to find the best overall deal for the loan type you want.

What are today’s mortgage rates?

Mortgage rates are rising, but borrowers can almost always find a better deal by shopping around. Connect with a mortgage lender to find out exactly what rate you qualify for.

Time to make a move? Let us find the right mortgage for you1Today's mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

- https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- http://www.freddiemac.com/research/datasets/refinance-stats/index.page