How should you choose a mortgage?

Ten years ago, it was tough to get a mortgage. Lenders were stingy and guidelines were tight. Few loans were approved and the housing market suffered.

Today, the mortgage market looks different.

Home values have (finally) surpassed last decade’s peak prices, and mortgage lenders are more willing to make loans than during any period this decade.

More than 70% of purchase loans are getting approved right now, according to Ellie Mae, whose mortgage software helps to process more than 3.5 million loan applications annually.

This is the largest approval percentage since such data has been tracked.

But, there’s more to it for today’s buyers than just “Will my mortgage get approved?”. There are more mortgage choices available than during any part of this decade, too.

A proliferation of have helped spur homeownership among long-time renters; and the return of the is making it easier for existing homeowners to “move up” to something bigger.

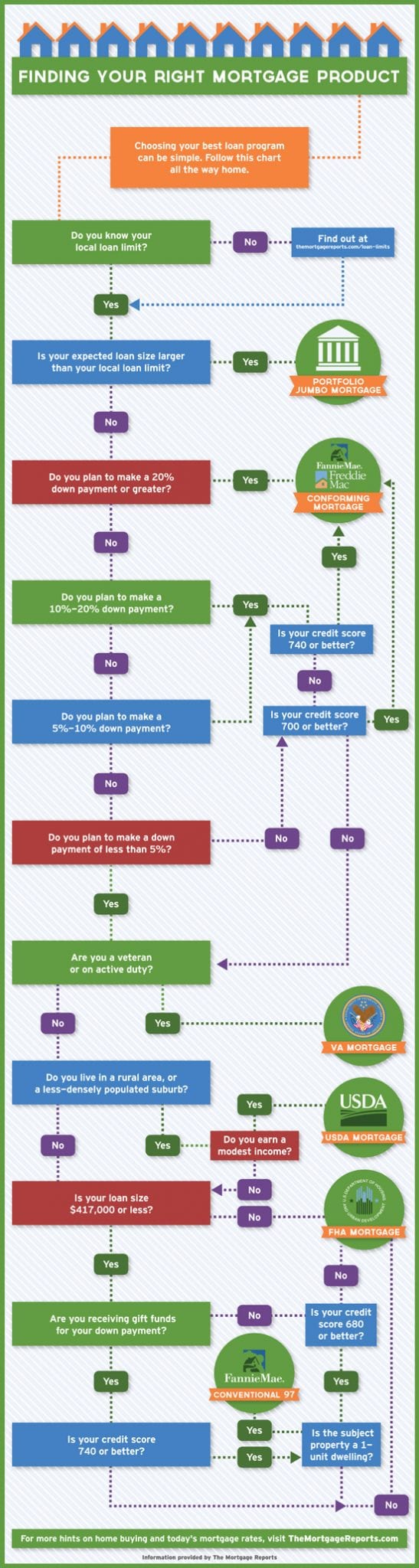

Not sure which mortgage loan is best for you? This chart should be a help.

Verify your new rateWhat are your mortgage options?

The mortgage market is expanding. Mortgage lenders are offering new products for the first time in a decade; and, it’s getting easier to find low and no down payment home loans.

However, it’s not always clear which loan is best for your needs. For example, just because you qualify for an FHA loan, should you use one?

Or, if you’re eligible for a but you plan to make a downpayment of 10 percent, should you still use the USDA loan for your purchase?

How to choose a mortgage: It’s not rocket surgery

When you break it down, choosing a mortgage isn’t that hard. Simply follow the steps in the flowchart below.

The graphic uses three specific loan traits as a starting point — (1) Down payment Amount, (2) Loan Size and (3) Credit Score — then follows-up with specific questions to help you find your “optimal” mortgage loan program.

In addition to identifying conventional loan opportunities via Fannie Mae and Freddie Mac, the flowchart identifies loan possibilities via the Federal Housing Administration (FHA), via jumbo mortgage lenders, and via niche mortgage programs including the USDA Rural Housing loan, the Department of Veterans Affairs VA loan, and the Fannie Mae Conventional 97 program.

Some of the questions asked include :

- What is your local loan limit?

- Are you borrowing more than your local loan limit?

- Do you plan to make a downpayment of 20% or more?

- Do you plan to make a downpayment of 5% of less?

Depending on your answers to the above questions, the flowchart might recommend a conforming loan with private mortgage insurance (PMI); or a jumbo mortgage that allows for loan sizes in excess of your local loan limits; or some different program which may be more suitable.

Other factors

Your loan choice may also be affected by where you live.

Buyers in less-densely populated areas may find the USDA Rural Housing program to be their best fit. Note that 97% of the United States is “USDA-eligible” and the USDA mortgage allows for 100% financing.

Furthermore, buyers may be routed to specific loan program depending on whether their downpayment is a gift from family, or is sourced from their own funds.

Once you’ve found a suitable loan program, pump your numbers into a mortgage payment calculator to determine your expected mortgage payment (and make sure you’re using accurate mortgage rates).

When you know your expected monthly payment, you can better budget for a home — whether you’re buying today, next month, or next year.

Verify your new rateEmbed this infographic on your website

To help spread good information, we’ve made the above infographic “embeddable”.

Using the code below, you can paste the image into your websites, your blogs, and, your favorite social networks (e.g.; Facebook, Instagram, Pinterest); and, also, into your digital newsletters.

To embed the infographic, choose the image width which suits you best, copy the code using CTRL-C, then paste the code as-is to your site.

550 Pixels Wide

750 Pixels Wide

1000 Pixels Wide

What Are Today’s Mortgage Rates?

Mortgage guidelines are loosening and it’s getting easier to get approved for a mortgage. Furthermore, with mortgage rates low, purchasing power is extended. It’s an excellent time to consider homeownership and the purchase of a new home.

Take a look at today’s real mortgage rates now. Your social security number is not required to get started, and all quotes come with instant access to your live credit scores.

Time to make a move? Let us find the right mortgage for you