Is an FHA mortgage cheaper than a conventional one? For some people, yes. For some people, no. Whether an FHA mortgage is better than a conventional one depends on a number of factors including current interest rates, current mortgage insurance rates, and your expected downpayment/equity percentage.

Click here to get today's mortgage rates

.

FHA And Conforming Mortgages : Key Differences

At the core, all 30-year fixed rate mortgages are alike — there is a starting balance that, over 30 years, at a regular pace, pays down to zero. After 30 years, the loan is paid in full and the mortgage is retired.

However, the 30-year fixed rate mortgage comes in multiple flavors. There is the 30-year fixed rate mortgage from the VA; the 30-year fixed rate mortgage from the USDA; and jumbo lenders offer 30-year fixed rate mortgages, too. Each is slightly different in terms of qualification standards and payment schedules

The two most popular 30-year fixed rate mortgages are the conventional 30-year fixed rate mortgage as offered by Fannie Mae and Freddie Mac and the FHA 30-year fixed rate mortgage as offered by the Federal Housing Authority.

Between a Fannie Mae/Freddie Mac mortgage and an FHA one, which is best for you? It depends.

Click here to get today's mortgage rates

.

Each path has its pros and cons. As one example, the FHA mandates an upfront mortgage insurance payment on all of its loans. For FHA purchase mortgages and most FHA Streamline Refinances, that amount is 1.75% of the borrowed amount, or $1,750 per $100,000 borrowed.

Fannie Mae and Freddie Mac mortgages do not charge upfront mortgage insurance to anyone.

As another example, the FHA requires monthly mortgage insurance payments on all of its loans except for 15-year fixed rate mortgages with 78% loan-to-value or lower. Fannie Mae and Freddie only require mortgage insurance when your loan-to-value is 80% or higher.

These two points may suggest that conventional mortgages are cheaper than FHA ones, but that’s not always the case — especially because FHA mortgages are not subject to the same mortgage rate adjustments as are conventional loans.

For somebody with a 660 FICO score and a 10% downpayment, the typical conventional mortgage rate adjustment would be +0.375%. And, unlike mortgage insurance (which is temporary), a higher mortgage rate lasts for 30 years.

Click here to get today's mortgage rates

.

Comparing Mortgage Rates : FHA and Conventional

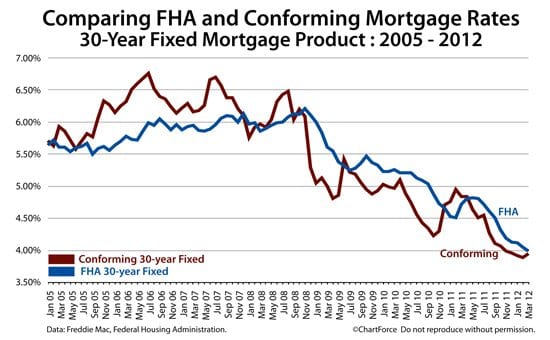

On any given day, 30-year fixed rate mortgage rates will vary for FHA mortgages and conventional ones. This is because FHA mortgage rates are based on mortgage-backed bonds from Ginnie Mae and conforming mortgage rates are based on mortgage-backed bonds from Fannie Mae and Freddie Mac.

Ginnie Mae bonds and Fannie Mae/Freddie Mac bonds are different so their respective mortgage rates are different. On some days, FHA mortgage rates are cheaper. On some days, conventional rates are cheaper.

Several years ago, FHA mortgage rates were much lower than conforming mortgages. This year, it’s the reverse.

For loans with accompanying discount points and closing costs, conforming mortgage rates are cheaper by about 0.125 percent. For loans structured with no closing costs, however, the FHA comes out ahead.

Click here to get today's mortgage rates

.

FHA Vs Conforming Cheat Sheet

There are no set rules for choosing between the FHA 30-year fixed rate mortgage and a comparable conventional one. The math depends on your individual situation and your long- and short-term goals for the home.

For example, if you plan to use for a refinance, you’ll have to use conventional because its a Fannie Mae and Freddie Mac product. Or, if you’re only making a 3.5% downpayment on the purchase of a new home, you have to use the FHA — Fannie Mae and Freddie Mac requires a 5 percent downpayment, at least; oftentimes, 10 percent.

But, as a good starting point for comparisons between FHA and conventional :

- Downpayment/equity of 4.99% or less : Apply for an FHA mortgage

- Downpayment/equity of 5.00-19.99% : Ask your loan officer for a recommendation

- Downpayment/equity of 20% or more : Apply for a conforming mortgage

There are exceptions to these guides, of course, so have a conversation with your loan officer about it. For example, because of loan-level pricing adjustments, credit scores must figure into your math.

Click here to get today's mortgage rates

.

Compare Your Own Loan : FHA or Conforming?

If you’re shopping for a mortgage and need to know whether an FHA mortgage product is better than a conforming one, consider the variables that make each product unique.

Consider the mortgage rate, consider your closing costs, consider add-on fees such as mortgage insurance, and think of your long-term goals for the home.

Time to make a move? Let us find the right mortgage for you

.