What is the Federal Reserve?

The Federal Reserve is the central bank of the United States of America. It manages the country’s currency, interest rates, and money supply.

The Fed influences the American economy in many ways. But the one most consumers pay close attention to is the Fed’s setting of interest rates.

When the Fed raises or lowers interest rates, things like business loans and credit cards are directly affected. And things like mortgage loans are indirectly affected.

That means tens of thousands of borrower dollars hang in the balance when the FOMC meets, as it does this week.

Find and lock a low mortgage rate todayIn this article (Skip to...)

- What does the Federal Reserve do?

- What is the FOMC

- The Fed and U.S. mortgage rates

- What are today’s mortgage rates?

What does the Federal Reserve do?

Per its charter, the Federal Reserve has two explicit (and related) goals.

The Federal Reserve and employment rates

The first goal of “the Fed” is to foster maximum employment within the U.S. economy.

In economic terms, “maximum employment” is when all labor resources within the economy are being used in the most efficient manner possible.

In plain English, it means that everyone who wants a job can find work with suitable pay. It does not mean that the unemployment rate is zero because, in any economy, there will be people who are or who are voluntary out-of-work.

The Federal Reserve and inflation

The Fed’s second goal is to seek price stability within the economy.

“Price stability” is measured with inflation, which is the rate at which things change cost.

To consumers, inflation is more often felt than measured. When inflation is present, prices go up.

Or, another way, when inflation is present, your dollars “don’t go as far” as they used to; more money is required to purchase the exact same goods and services.

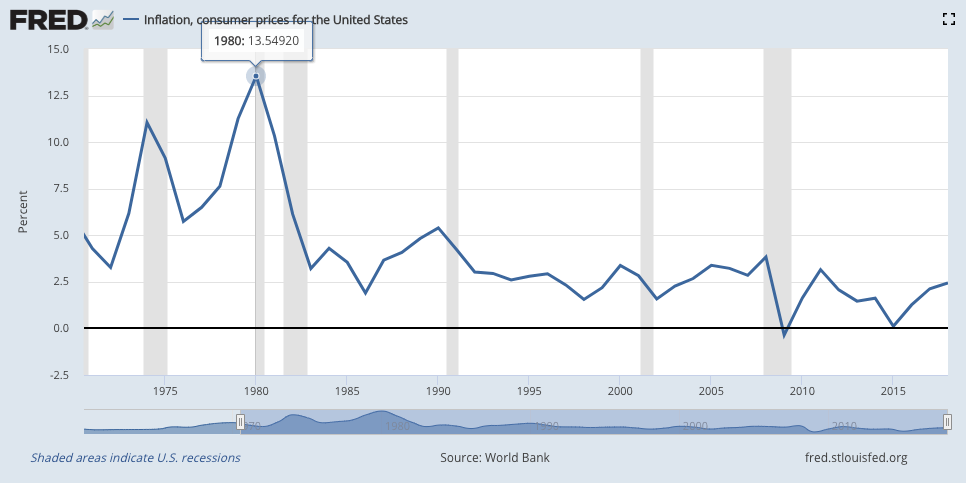

Inflation rates were their highest on record in the 1980s.

Consumer price inflation since 1970. Source: St. Louis Fed

The Federal Reserve aims to keep inflation near 2 percent annually.

When inflation rates exceed two percent by too much, it can be damaging to the U.S. economy. Consumers suddenly don’t have enough dollars to purchase basic goods and services, and many begin to struggle with debt.

During periods of inflation, workers often demand raises which leads to higher costs for business which, in a self-reinforcing cycle, results in even higher rates of inflation.

The Federal Reserve and deflation

However, inflation can run too low, too; falling well short of the Fed’s 2% target. Low or negative inflation in the economy is known as deflation, or disinflation.

During periods of deflation, consumer prices drop and then drop some more. Now, falling prices might seem like a good thing, but when prices are continually dropped, consumers “put off” making big purchases because prices will be lower in the future.

In putting off big purchases, consumers force businesses to lay off workers which creates additional downward pressure on wages and on prices.

Deflationary spirals are as damaging as inflationary ones.

For mortgage rate shoppers, though, deflation holds an advantage. Mortgage rates drop during periods of deflation. Inflation, however, drives mortgage rates up.

Find and lock a low mortgage rate today

What is the FOMC? (The Federal Open Market Committee)

Within the Federal Reserve is a 12-person, policy-setting committee called the Federal Open Market Committee (FOMC). Annually, there are eight scheduled meetings of the FOMC.

After each of its eight meetings, the Federal Reserve makes a press release known as the “FOMC Statement” which summarizes the central banker’s policy choices.

The FOMC and the Fed Funds Rate

The most widely-known FOMC monetary policy choice is its setting of the Federal Funds Rate. The Fed Funds Rate is the rate at which banks borrow money from each other overnight.

When the Fed votes to increase the Fed Funds Rate, costs rise for consumers and businesses which creates a drag on the U.S. economy. Conversely, when the FOMC votes to lower the Fed Funds Rate, the economy is pushed to expand.

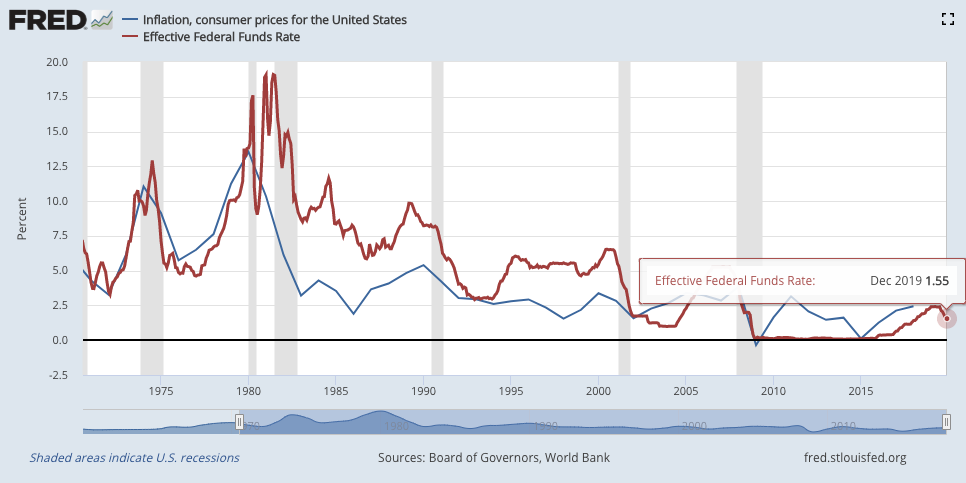

Consumer price inflation and the Fed Funds Rate. Source: St. Louis Fed

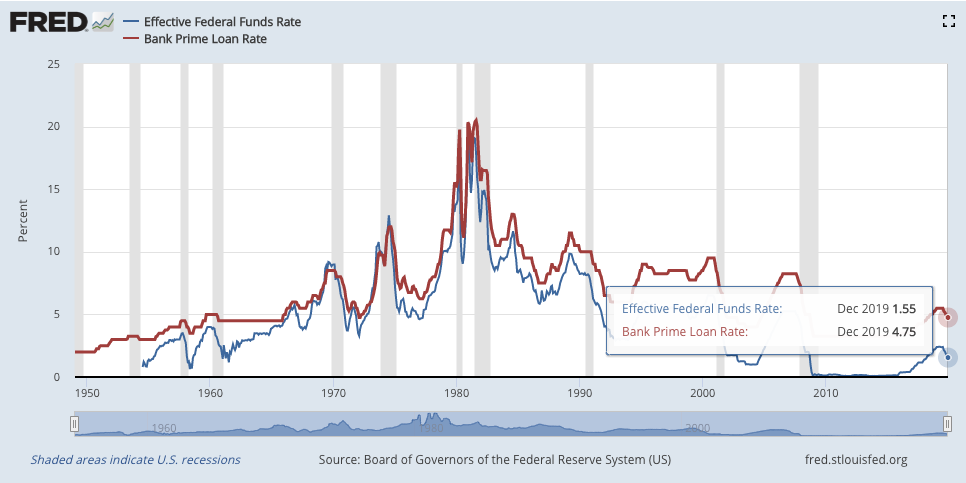

The Fed Fund Rate is also the basis for “Prime Rate.”

The FOMC and the Prime Lending Rate

Prime Rate is a key interest rate for consumers and U.S. businesses. Prime Rate is used to set credit card interest rates and the cost of business loans.

Prime Rate is generally equal to the Fed Funds Rate plus three percent.

The Fed Funds Rate and Bank Prime Lending Rate. Source: St. Louis Fed

The Federal Reserve uses other tools to influence U.S. economic growth, too, including Discount Rate, which is the overnight interest rate at which banks can borrow money from the Federal Reserve; and special programs such as quantitative easing.

Quantitative easing is a process via which the Fed purchases mortgage-backed securities (MBS) and other bonds in the open market in order to lower bonds yields and everyday mortgage rates.

The FOMC has used a quantitative easing program three times since 2009 and, each time, the result was lower mortgage rates.

The Fed’s second QE program coincided with the lowest recorded 30-year mortgage rates in history. The Fed’s third round of quantitative easing had a similar effect.

However, it’s important to recognize that .

The Fed does not set consumer mortgage rates, although it influences the direction in which they go. Mortgage rates are made on Wall Street.

Verify your new rate

The Fed and U.S. mortgage rates

The Federal Reserve does not control mortgage rates directly. It does, however, influence the direction in which mortgage rates move. This is because, as the nation’s central banker, the Fed’s actions and its rhetoric are closely watched by Wall Street.

“Actions” that the Fed can take include its setting of the Fed Funds Rate and the Discount Rate; and establishing programs such as quantitative easing.

It’s the setting of the Fed Funds Rate, though, which is the Fed’s most well-known tool. When the Fed votes to increase or decrease the Fed Funds Rate, the group is sending a very specific message to Wall Street.

When the Fed Fund Rate is raised, it’s a signal that inflationary pressures are growing within the U.S. economy and the maximum employment is nearing — both of which suggest an economic expansion.

Note that mortgage rates tend to rise around the same time that the Fed is raising rates.

This happens because the Fed generally raises rates only when inflation pressures are mounting within the economy, and because inflation devalues the mortgage-backed securities upon which mortgage rates are based.

Furthermore, the conditions that lead to a Fed Funds Rate hike are also likely to attract investment dollars into equity markets. When this happens, demand for MBS can drop, which causes mortgage rates to rise.

But even when the Fed doesn't raise the Fed Funds Rate, mortgage rates can move. This is because Wall Street is often as interested in what the Fed says as what the Fed does.

Comments from the Fed which suggest future rate hikes or economic expansion tend to have a negative effect on low mortgage rates; and dovish comments help to move rates down.

The Fed speaks to the public all year long.

In between FOMC meetings, members of the Federal Reserve speak to Wall Street, to business organizations, and to the press; offering opinions on the economy and future monetary policy. These comments help to shape current mortgage rates.

The Fed also publishes the “Fed Minutes”, which is a summary of the discussions and debates from its most-recent FOMC meeting. Fed Minutes are published three weeks after an FOMC meeting adjourns and often eclipse 8,000 words.

The Fed Minutes also provide fodder for Fed-watchers worldwide, and affect daily mortgage rates.

What are today’s mortgage rates?

The Federal Reserve doesn’t set U.S. mortgage rates, but its words and actions influence them.

Get today’s live mortgage rates now. Fed statements and actions are always at play and can influence markets unexpectedly.

Time to make a move? Let us find the right mortgage for you