5/1 ARM rates are a bargain, but not without risk

Rates for an adjustable-rate mortgage (ARM) are almost always lower than those for a fixed-rate mortgage (FRM).

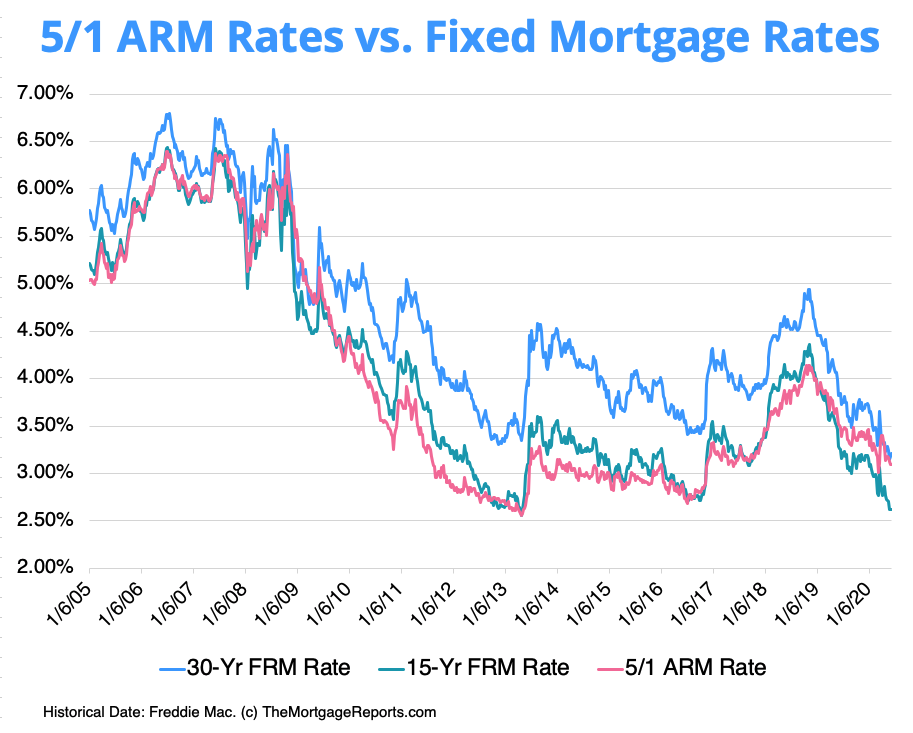

Since 2005, 5/1 ARM rates have been about 0.6% below 30-year FRM rates on average.

To put that in perspective, a 0.6% lower rate could save you almost $1,000 per year on a $250,000 loan.

But ARMs come with more risk than fixed-rate loans. After a short, fixed-rate period, your ARM rate could rise every year (or fall, if you're lucky).

So, how do you figure out if that potential $1,000+ savings margin is worth the risk?

Find and lock a low mortgage rateIn this article (Skip to...)

- 5/1 ARM rates vs. fixed mortgage rates

- How the 5/1 ARM works

- How 5/1 ARM rates are set

- Caps minimize potential ARM risk

- Why rates for the 5/1 ARM are so low

- Why are 15-year mortgage rates lower than ARMs?

- Rates for 5/1 ARMs vs. 7/1 or 10/1 ARMs

- Pros and cons of adjustable-rate mortgages

- 5/1 ARM FAQ

- How to find a low 5/1 ARM rate

5/1 ARM rates vs. fixed mortgage rates

Typically, interest rates for ARMs (adjustable-rate mortgages) are lower than their fixed-rate counterparts.

Looking at Freddie Mac's historical data, we can see that 5/1 ARM rates have stayed below rates for 30-year fixed-rate mortgages for the majority of recent history.

But 5/1 ARM rates aren't always the lowest.

It all depends on your timing — and how willing you are to take on more risk to see bigger savings.

Verify your new rate

How the 5/1 ARM works

ARMs are adjustable-rate mortgages. That makes them different from fixed-rate mortgages (FRMs), which are by far the most popular home loans in America.

The difference is in the names. An FRM has the same rate throughout its lifetime (or "term"). But an ARM mortgage rate can go up and down in line with market interest rates.

The 5/1 ARM is a "hybrid" ARM. In fact, most ARMs are technically "hybrids." That means they're part-fixed and part-adjustable.

Hybrid loans are fixed for an initial agreed period, and then will float for the rest of their term.

A 5/1 ARM has a fixed rate for the first five years... after the 5-year fixed-rate period, the lender can change your rate every year.

A 5/1 ARM has a fixed rate for the first five years, a 7/1 for the first seven, and a 10/1 for the first 10 years. There are other ones, too, even a 1/1 ARM. But those three — 5, 7, and 10 — are the most common.

What does the "1" in "5/1" stand for? It means that after the 5-year fixed-rate period, the lender can change your rate every one year.

Your interest rate might move up or down annually during the rest of your loan term, depending on how markets move. The same goes for 7/1 and 10/1 ARM rates.

How 5/1 ARM rates are set

Mortgage lenders set 5/1 ARM rates — and rates for other ARMs — based on two factors:

- The financial rate index to which your ARM mortgage rate will be tied — These rate indexes go up and down all the time and most are published daily in The Wall Street Journal

- Your "margin" — That's the amount that will be added to your index rate to reflect the extra risk your particular loan carries. All ARMs have a margin. But yours will be bigger if your credit score's low, if you're borrowing a large proportion of your home price, or if you have a lot of existing debts

Once the lender has decided on your rate index, it can't be changed. And your margin should remain the same throughout the term of your loan.

After you close, you and your loan are in the hands of financial markets, which are heavily influenced by the rates set by central banks such as the Federal Reserve.

To be clear, once you have your ARM, your rate will be entirely divorced from other mortgage rates.

After the initial fixed-rate period, it will be wholly determined by general interest rates as reflected in your particular financial rate index.

Verify your ARM rate

Caps minimize potential ARM risk

Nearly all ARMs include caps on the amount their rates can rise. You should check your loan estimate to make sure yours does — and that it provides the protection you need.

If you're shopping for an ARM loan, ask each lender for its policies on caps.

These caps typically take two forms:

- An annual cap — This stops you experiencing sharp pain if general interest rates suddenly rocket

- An overall cap — This limits the amount your rate can rise in total over the whole term of your loan

Caps provide important protections. But you still face some risk of rates rising. And you should never forget that.

Why ARM rates are so low

You'll see in the chart above that ARM rates are almost always lower than FRMs, even for the same borrower wanting the same loan. That's pretty much inevitable.

And you can see why. Suppose, during the next five years, rates suddenly zoom up to 18% for a 30-year FRM (which is where they were in October 1981).

With a fixed-rate loan, the lender carries all the burden of lending to you at today's uber-low rates. But, with a 5/1 ARM, it gets to share some risk burden with you — subject to those rate caps.

And lower risk always means lower interest rates.

Verify your new rate

Why are 15-year mortgage rates similar to 5/1 ARM rates?

On the chart above, ARM rates are usually much lower than 30-year fixed mortgage rates.

But you might notice that 5/1 ARM rates and 15-year FRM rates are much closer together. In fact, starting in early 2019, 15-year fixed rates have been consistently lower than 5/1 ARM rates.

Why is that? Simply because the 15-year FRM is a shorter-term loan.

When you choose a 5/1 ARM, you assume some of the lender's risk by agreeing to take on a higher rate if markets change later on. That's why ARM rates are low.

With a 15-year fixed-rate mortgage, you're shouldering even more of the lender's risk by promising to pay the loan off in half the time.

But with a 15-year fixed-rate mortgage, you're shouldering even more of that risk by promising to pay the loan off in half the time. (Remember, a 5/1 ARM is still a 30-year loan.)

But a 15-year loan, like the 5/1 ARM, has a big drawback for borrowers.

The catch? Since you're paying off a 15-year FRM in half the time, you'll have much bigger payments.

So while a 15-year loan might look appealing for its ultra-low rates, buyers have to weigh their interest rate savings against their ability to make a larger monthly payment.

Rates for 5/1 ARMs vs. 7/1 or 10/1 ARMs

To a lender, a 5/1 ARM is clearly more attractive than a 7/1 or 10/1 ARM That's because you're shouldering some of its risk for a longer period.

Assuming you want a 30-year mortgage, a 5/1 ARM will see you sharing that risk for 25 years. But a 10/1 will mean you're only doing so for 20 years.

Naturally, lenders are happy to incentivize you to take on more risk. And they do that by offering lower rates for a shorter your initial fixed-rate period. It follows that 1/1 ARMs are typically the cheapest of all.

Pros and cons of adjustable-rate mortgages

To understand the drawback of a 5/1 ARM, you have to understand why most people love fixed-rate mortgages best.

There's something hugely comforting about a 30-year fixed rate loan. Knowing that all your monthly payments — from the first through to the last — will be the same provides real security.

And it's a one-way bet. If rates go up, you're unaffected. But if they go down, you can refinance into a new, lower rate.

That's a lot to give up. So in what circumstances can it be smart to get an ARM? Here are five:

- When you know you'll be moving in a few years — If you plan to stay in the house as long as the fixed period lasts, it's a no-brainer. Most people move roughly once every seven to 10 years, so 7/1 and 10/1 ARMs should be more popular than they are

- If you plan to pay off the loan within the fixed-rate period — If you know you're going to get the funds to pay off your loan within x years, there's little point in paying extra for the security of a 30-year loan

- When you think rates will only go down from here on — It makes sense to agree to an adjustable-rate loan if you think rates will just keep falling. But since economists are frequently wrong about mortgage rate predictions, we caution against making that kind of bet

- If there’s a big spread between ARM and FRM rates — In other words, if the rate you get on an ARM is at the time so much lower than you could get on an FRM that it's an offer you can't refuse

- When you're getting a jumbo loan — Jumbo loans (when you're borrowing more than the current loan limits) tend to have much higher FRM rates than ARM ones. Picking the latter may be your only affordable way forward

So there are plenty of circumstances in which an ARM can be a smart choice.

ARMs still carry risk

You may think the risk presented by ARMs is tiny. And, judging by the last decade or so, you'd be right. For years, everyone expected mortgage rates to return to their pre-Great Recession "normal." And they really haven't (so far). People who have ARMs have done better than anyone.

But that's a warning as much as a comfort. Since the financial crash of 2007-08, the global financial system has been anything but normal. Meanwhile, COVID-19 made it even less so.

And that means there are no certainties. Few now expect mortgage rates to rise anytime soon. But few expected any of the major financial upheavals in history. These things just turn up without warning.

You could currently do a personal risk-benefit analysis that in many circumstances could make an ARM the smart choice. But don't assume the risk is zero.

5/1 ARM FAQ

A 5/1 ARM certainly can be a good idea. For instance, if you're planning to sell and move on within five years (or seven years, if you pick a 7/1 ARM), the risk is really limited to those plans going awry. A 5/1 ARM might also be a good solution if you want to increase your home buying budget with a lower rate.

And it can be a similarly good idea if you're in any of those circumstances we listed above.

That's simply the mortgage rate you'll pay on a 5/1 ARM. For the first five years, that rate will be fixed. But, after that, it can float in line with other interest rates.

However, most ARMs come with caps that limit the amount your rate can rise, both overall and each year. Make sure yours does and that those caps provide the protections you need.

Sometimes. But that depends entirely on the lender. Some lenders impose prepayment penalties that can run into thousands. Those most commonly apply within the first three or five years of a loan's life.

Check you loan estimate (mortgage quote) when you're shopping for your mortgage. There's a section on page 1 (under "Loan Terms") that discloses prepayment penalties. And, if this is important to you, go with a lender that has zero or easily affordable penalties.

Federal regulator the Consumer Financial Protection Bureau explains in its Consumer Handbook on Adjustable-rate mortgages (PDF):

"Some loans have hard prepayment penalties, meaning that you will pay an extra fee or penalty if you pay off the loan during the penalty period for any reason (because you refinance or sell your home, for example). Other loans have soft prepayment penalties, meaning that you will pay an extra fee or penalty only if you refinance the loan, but you will not pay a penalty if you sell your home."

You bet. Indeed, many mortgage programs make it easy for you to switch your loan from an ARM into an FRM. You may even be eligible for a streamline refinance, with minimal costs and hassle.

However, you may be penalized if you refinance quickly and your lender imposes prepayment penalties (see the previous question).

When you can refinance an ARM wholly depends on your lender's policies. Some have no prepayment penalties. Some penalize you if you refinance within three years and others within five years.

You need to check your loan estimate and loan agreement and discuss this with your lender before you commit to a mortgage.

Yes, in fact, many people refinance one ARM to another. If your ARM has a rate "floor" (a mortgage rate below which your loan can't go), you may well benefit from a lower rate by refinancing.

You may also benefit from a lower rate if your financial circumstances have changed so you now qualify for a better deal. Maybe your credit score's higher, or you've fewer non-mortgage debts or you're in a position to make a bigger down payment.

If you speak to people who've had ARMs over the last 12 years, they'll likely tell you it's the best choice they've made. Because rates have just kept falling. And what started out as a great deal has gotten sweeter and sweeter over the years.

But, one day, it's likely that rates will rise, though that may still be several years off. If that day comes, ARMs may then pose a real threat to those outside their initial fixed-rate period.

So keep an eye on rates. And, if necessary, refinance to an FRM — or to an ARM with the initial fixed-rate period you need.

How to find a low 5/1 ARM rate

Always shop around for your loan. ARM rates vary between lenders as much as rates for other loans do.

And you need to check that your final lender's prepayment policies suit your needs.

As long as you treat ARMs cautiously and are in one of those groups that stands to benefit, you can minimize your exposure to risk. For some, a 5/1 ARM will be the best possible deal available.

Time to make a move? Let us find the right mortgage for you