Navigating the landscape of assumable mortgages

Finding an assumable mortgage can feel like hitting the jackpot. Imagine that you could today get a home loan with a rate of 3% or 4% or even lower. How happy would that make you?

Well, maybe you can assume someone else’s mortgage and do precisely that. But the mortgage assumption process may be more challenging than it appears. So, read on to uncover the nuances of assumable mortgage loans and whether pursuing one makes sense for you.

Check your home buying options. Start hereIn this article (Skip to...)

- What is an assumable mortgage?

- Which loan types are assumable?

- Finding an assumable mortgage

- How to assume a mortgage

- Pros and cons

- FAQ

The quest

First, you have to find an assumable mortgage on a home you want. There’s no point in saving on your mortgage if you end up in a property that doesn’t meet your wants and needs.

You’ll then have to put together a bigger-than-usual down payment from either your savings or new borrowing. That will likely take the form of a second mortgage, such as a home equity loan. Your down payment will almost certainly be substantially higher than with a non-assumable mortgage but more on that later.

And remember, you’ll be paying down that second mortgage, assuming you need one, with monthly payments on top of those on your primary mortgage. Of course, that could eat into the savings your lower mortgage rate will buy you.

So, is finding an assumable mortgage worth it? Many who have one say it is. Because the overall savings can be significant. Just don’t expect an easy ride.

What is an assumable mortgage?

So, what is an assumable mortgage? It’s one that says it’s assumable in the homeowner’s mortgage agreement.

Find your lowest mortgage rate. Start hereLenders of conventional mortgages rarely permit one of their loans to be assumed except in cases of death or divorce. Their agreements contain “due-on-sale” clauses, which preclude loan assumption in all but those circumstances.

As a general rule, only government-backed loans are assumable on sale. Those made up 28.1% of all mortgages originated in 2022, down from 29.3% in 2021, according to a federal regulator.

So, most mortgages are not assumable. And some of those that are come with strings that lessen the appeal of assuming them. We’ll run through the different types in the next section.

Why bother finding an assumable mortgage?

Here’s why many are so keen on finding an assumable mortgage. Instead of searching for a whole new loan at today’s rates (around 7% when this was written), you take on (“assume”) the homeowner’s existing one. And you pay the same rate and the same monthly payments as the existing homeowner does.

Imagine your homeowners bought their property back during the week ending Jan. 6, 2021. That was when Freddie Mac says 30-year, fixed-rate mortgages hit their all-time average low of 2.65%. Think how much you’d save compared to a rate today of close to 7%.

And you might even save a little more. Because lenders tend not to need an appraisal when you’re assuming a loan. And government rules cap the amount that can be charged in closing costs.

The down payment downside

But nothing’s that relentlessly good. And you may struggle to find the money to fund the outsized down payment you’ll likely need.

Unless the home is located in a seriously depressed property market, you’re almost bound to face an “equity” problem.

You can calculate home equity by subtracting the existing mortgage balance when you assume the loan from the current market value of the home.

Remember, the mortgage you are assuming remains unchanged, maintaining its current balance. Therefore, you will likely need to cover that equity difference with your savings or draw out another loan.

Assuming your credit score and finances are in good shape, you can probably find a second mortgage. Don’t forget to include your monthly payments on that when you’re calculating how attractive your assumable mortgage will be.

Which types of mortgage loans are assumable?

Check your home buying options. Start hereFHA loans

FHA loans are government-backed mortgages regulated by the Federal Housing Administration. And they are assumable, providing you meet the FHA’s qualifying criteria.

However, there’s a downside. You’ll be on the hook for monthly mortgage insurance premiums for as long as you keep your mortgage. With FHA loans, these costs continue for the lifetime of the loan.

VA loans

VA loans are government-backed mortgages regulated by the Department of Veterans Affairs. And they are assumable providing you meet most of the VA’s qualifying criteria.

Why “most of?” Because you don’t need to have served or be serving in the military in order to assume one of these loans. Anyone meeting the credit, employment, residency, and financial criteria set by the VA can assume one.

However, these are even harder to find than most assumable loans. Why? Because the veteran or service member will lose some or all of their eligibility to apply for other VA loans for as long as the loan is assumed by someone who is not eligible for a VA loan. Their eligibility is protected if the person assuming is also eligible for a VA loan.

So, unless you get very lucky, most are unlikely to let an ineligible borrower assume their loan. If you find such a person, there’s no continuing mortgage insurance on a VA loan.

USDA loans

Well, sort of. The United States Department of Agriculture (USDA) retains the right to reset the rate and term of a mortgage when one of its loans is assumed. And that rather defeats the object of assuming.

By all means, call your loan officer to see what mortgage rate you’ll be offered if you assume a USDA loan. Maybe you’ll get a great deal. But don’t bank on it.

In any event, you’ll have to meet the USDA’s eligibility criteria, which include being on a low income.

ARMs

Some adjustable-rate mortgages (ARMs) are assumable. But not all. So, check (or have your buyers’ agent) check the seller’s mortgage agreement.

Have you already spotted the catch here? ARMs are adjustable-rate loans. So, their rates are likely to have risen since they were originated.

But hold on! Most ARMs have caps on the amount by which their rates can rise each year. So, you may still get a bargain.

Conventional loans

More than 70% of all mortgages originated in 2021 and 2022 were conventional. And it’s very rare for one of those to be assumable on a home’s sale. So, most mortgages are not assumable.

There’s an exception when a home isn’t being sold. This applies when an heir inherits a home on the owner’s death or when one party to a divorce chooses to remain in the marital home. However, even these must show that they can comfortably afford the monthly mortgage payments and other related costs, and fulfill the other eligibility criteria for the loan.

How do I go about finding an assumable mortgage?

Perhaps your first step should be to find a good buyer’s real estate agent. These can accelerate your search by reaching out to all the other real estate agents in their network of contacts, alerting them to your requirements.

Find your lowest mortgage rate. Start hereAs importantly, a buyer’s agent should be an excellent source of advice. He or she can help you run the figures for a candidate home to make sure the deal makes sense for you. And, of course, buyers agents take on those difficult negotiations. Better yet, sellers typically pay their commission.

Specialist websites

For decades, few home buyers were interested in assumable mortgage rates. Until the summer of 2021, mortgage rates had, during the 21st century, been either fairly steady or falling. But then they rose sharply through the fall of 2023. And, suddenly, everyone was talking about assuming loans.

Recently, free market capitalism kicked in. And several websites sprang up specializing in listings for homes with assumable mortgages. So, check out:

Get to work with your search engine to find similar sites.

Mainstream listings sites with keyword search

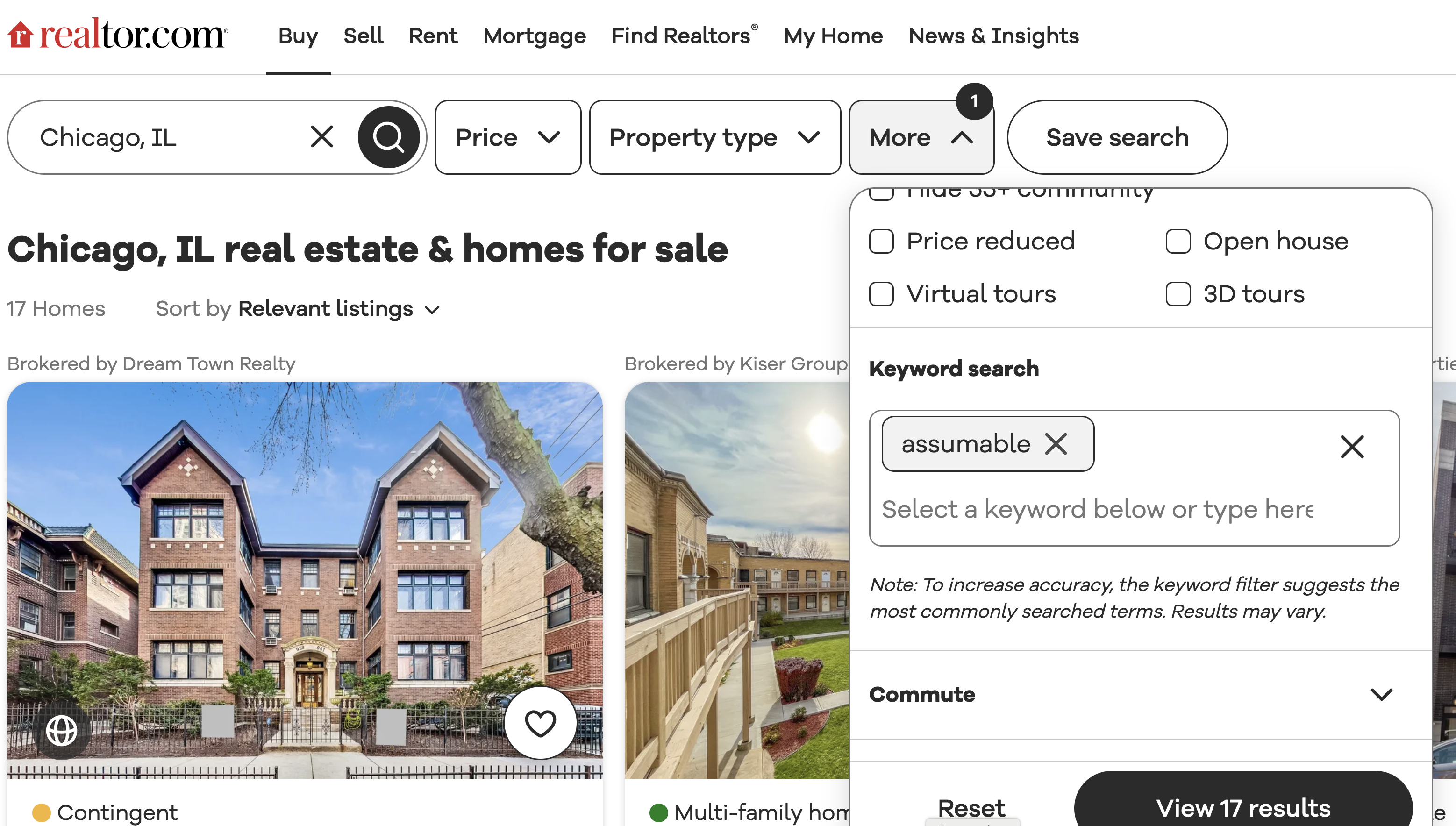

Nearly all of us are familiar with the big listings websites, such as Realtor.com and Zillow. But you may not know that you can use those to search for homes being listed with assumable mortgages.

With both those sites, you simply click on More on the search page, scroll down, and type “assumable” in the keyword field. It’s easy.

How to assume a mortgage

You or your buyer’s agent should ask to see the “assumable” clause in the seller’s mortgage agreement. Assuming that looks promising, get in touch with the mortgage servicer responsible for the loan (the company to which the current homeowner sends monthly payments).

Check your home buying options. Start hereTell the servicer’s agent that you wish to assume the loan and ask for the next steps. Although you won’t be applying for a new loan, expect still to be asked for the personal documentation that you’d normally supply to a lender. That includes:

- Government-issued photo ID

- Proof of residence and list of past addresses, if required

- Pay stubs

- IRS returns

- Bank, asset and debt statements

The servicer will also pull your credit report and score.

Importantly, you’ll need the servicer’s permission to use a second mortgage to bridge the gap between your savings and the sum you’ll need on closing.

Early on, the servicer will likely appoint a case officer to handle your mortgage assumption, so you and your buyer’s agent will have someone to discuss any issues with.

Pros and cons of assumable mortgages

Here are the main pros and cons of your new loan when you’re done finding an assumable mortgage:

Time to make a move? Let us find the right mortgage for youPros

You should benefit from:

- A significantly lower mortgage rate than those available today

- Much smaller monthly payments

- Lower closing costs than with a new mortgage. You probably won’t need an appraisal and the government department that backs the loan will cap your costs

Cons

Here are some drawbacks to consider before you commit:

- Your down payment is likely to be much higher than for a new mortgage of the same type. And you may need a second mortgage to cover it

- You’ll have to pay mortgage insurance on an FHA or USDA loan

- Finding an assumable mortgage isn’t easy. Finding one on a home you love is even harder

The bottom line

Assumable mortgages aren’t always the pure gold some think they’ll be. But, in the right circumstances, they can still deliver a much better overall deal than you could get with an all-new loan.

Just be sure to run all the figures — including mortgage insurance and second-mortgage payments. You need to be sure you know what you’re getting into.

If you use a buyer’s agent, he or she can help with this and all the tricky bits of the transaction: from starting your home search, through finding an assumable mortgage, all the way to closing.

You’ve nothing to lose by exploring your assumable mortgage options. And you might have a whole lot to gain.

Finding an assumable mortgage FAQ

An assumable mortgage is a type of home loan that allows a buyer to take over the existing mortgage terms and payments from the seller. It can be a desirable option, especially if the original mortgage has favorable terms.

Assumable mortgages are not as common today as they were in the past. However, some lenders still offer assumable mortgages, and they can be found by working with a knowledgeable loan officer or mortgage broker.

To determine if a mortgage is assumable, you can review the loan documents or contact the lender directly. The presence of an “assumption clause” in the mortgage agreement indicates that the loan may be assumable.

Assuming a mortgage can have advantages such as lower closing costs, a potentially lower interest rate than current market rates, and the avoidance of certain loan qualification requirements, making it easier to purchase a home.

Not all mortgages are assumable by just anyone. The lender typically needs to approve the assumption and may require the new borrower to meet certain creditworthiness standards before allowing them to assume the loan.

Generally, assumable mortgages cannot be modified by the new borrower. The terms and conditions of the original loan, including the interest rate and repayment schedule, are transferred to the new owner.

When a mortgage is assumed, the seller is typically released from liability for the loan. The new borrower assumes responsibility for the mortgage, including making timely payments.

Assuming a mortgage with bad credit can be challenging. Lenders often require the new borrower to have a good credit history and financial stability to ensure they can meet the loan obligations.

While assumable mortgages can be beneficial, they may have downsides as well. For example, assuming a mortgage with a higher interest rate than current market rates may not be financially advantageous.

Before assuming a mortgage, it’s important to review the loan terms, interest rate, remaining balance, and any associated fees. You should also consider your long-term financial goals and consult with a mortgage professional to ensure this option aligns with your needs.