Introduction

Let’s be clear from the start. There’s no new government program that offers a $42,000 mortgage reduction for veteran homeowners.

Of course, many with VA loans could save $42,000 compared to people with other types of mortgages, depending on how much they borrow. But that’s not new. It’s built into the standard offering.

If you see ads on TV or online that claim there’s a new way to get a $42,000 mortgage reduction for veteran homeowners, don’t believe them. And definitely don’t engage with the advertiser.

Verify your VA loan eligibility. Start hereIn this article (Skip to...)

- Benefits of a VA loan

- $42,000 mortgage reduction

- VA mortgage eligibility requirements

- The bottom line

- FAQ

Benefits of a VA loan

If you already have a VA loan, you are probably already aware of its benefits. But there’s no harm in reminding yourself just how lucky you are:

Verify your VA loan eligibility. Start here- No down payment requirement — Zero. Zilch. Nada. Unless you want to make a down payment, in which case you can

- Ultra-low mortgage rates — Typically, VA rates are the lowest on the mortgage market. And that can slash your monthly payments and overall cost of borrowing

- No mortgage insurance — Other mortgages charge serious sums (often hundreds a month) in mortgage insurance unless you make at least a 20% down payment. VA loans don’t

- Low closing costs — The VA caps the amount a lender can charge you in closing costs

- Flexible funding fee — The one-time funding fee means you don’t have to worry about mortgage insurance. You can pay the fee on closing. Or you can simply add it to your mortgage and repay it over the lifetime of your loan

Read VA Loan Benefits and Requirements: 2024 VA Home Loan Guide for more benefits and fuller details, including eligibility requirements.

Can a VA loan really save you $42,000?

Yes. Consider a scenario where you’re buying a home for $350,000 with a 20% down payment. You are therefore seeking a $280,000, 30-year fixed-rate mortgage (FRM).

Assuming a mortgage rate of 7.285%, the total payment over 30 years would amount to $690,030. Conversely, opting for the same mortgage as a VA loan, now assuming a much more competitive mortgage rate of 6.67%, would result in a total payment of $648,435. This represents a saving of approximately $41,595.

Note that we made our calculations in March 2024, on the day this was written. Mortgage rates will almost certainly have moved up or down by the time you read this, and that will affect the figures.

However, you can do your own calculations at any time. Simply use our standard mortgage calculator for the conventional loan and our VA loan calculator for the other.

Exploring the $42,000 mortgage reduction for veteran homeowners

Back in 2021, USA Today spotted inaccurate claims about a new government program saving VA borrowers an extra $42,000. And the newspaper decided to fact-check them.

Verify your VA loan eligibility. Start hereSome implied that the extra savings flowed from President Joe Biden’s American Rescue Plan Act of 2021. Others said it was Congress that had just enacted a different program. Neither was true, and USA Today dubbed the promotion “misleading.”

When homeowners followed up on the ads, the advertisers tried to sell them the VA’s streamlined refinance program, the snappily named interest rate reduction refinance loan, which everyone calls the IRRRL.

That can be great if you now qualify for a lower mortgage rate than the one you’re currently paying. And we’re going to dig into more details in the following section.

But the IRRRL program ain’t new. Unless you regard something 40 years old as new.

How to take advantage of veteran mortgage reductions

The only time it’s worth refinancing (unless you need cash) is when doing so gets you a lower mortgage rate, and therefore, a lower monthly payment. If you’re in that position, a VA streamlined refinance is a quick, easy, and relatively inexpensive way to access those benefits.

Unfortunately, fairly few borrowers can currently get a lower mortgage rate than the one they’re paying on their VA loan. But keep reading. Because many experts predict mortgage rates to begin to fall in the second half of 2024.

And they may continue to do so after that, all the while adding to the pool of borrowers who can benefit from refinancing. So, continue reading because you may be interested in an IRRRL sooner than you think.

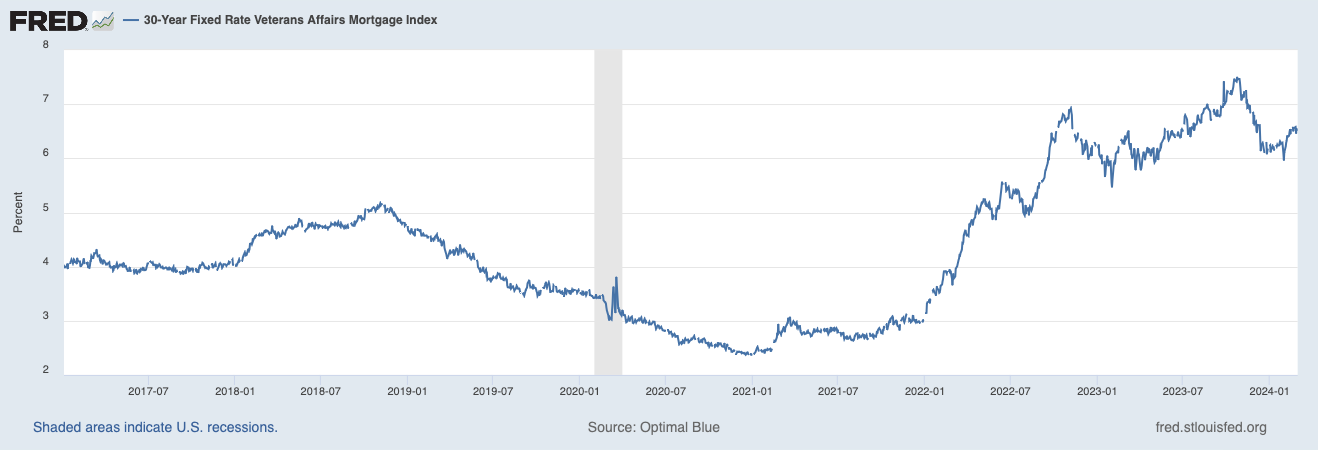

You can see in the following chart why few homeowners with VA loans would currently wish to refinance. For many years, there have only been a few months during which mortgage rates have been higher than they are now. So if you closed on a home in 2023, you could be one of the 46% of borrowers who could reduce their rate by at least 0.75% through a refinancing if rates fall to 6%.

What’s so great about IRRRL?

When you do want to refinance a VA loan, you’ll almost certainly want to use the IRRRL program. The only exception is if you want a VA cash-out refinance where you walk away from the closing table with a check. Right now, if you need to tap your home’s equity, you’ll probably be better off with a home equity loan or home equity line of credit (HELOC).

But let’s assume you want a lower mortgage rate and monthly payment. Then, an IRRRL delivers valuable benefits. Typically, you’ll need:

- No credit check

- Often, no appraisal

- No pay stubs

- Little or even no equity

- Very limited paperwork

- Low closing costs that you might be able to add to your mortgage balance

Be aware that there will be some closing costs, even if you add them to your new mortgage. So, don’t forget to include those when calculating whether an IRRRL is worth it.

Read VA IRRRL Rates and Guidelines: VA Streamline Refinance 2024 for more information.

Other programs

If you’re keen to revisit your existing VA loan because you’ve been struggling (and failing) to keep up with your monthly payments, you might still be able to qualify for an IRRRL. However, you can only have had one skipped payment in the last year, and none in the previous six months.

But don’t panic if you have more. The VA has several programs that can help get you back on track. Read VA help to avoid foreclosure on the VA’s website.

These programs can include getting more time to pay, agreeing a repayment plan, or adding your missed payments to your mortgage balance and paying them down over the remaining period on your main loan. Other programs can help those in even deeper trouble.

VA mortgage eligibility requirements

Those who are or have been in the military are likely to be eligible for VA loans if they:

- Are still serving or were not dishonorably discharged

- Have completed a minimum length of service (181 days of active duty during peacetime; 90 days of active duty during wartime; six years in the Reserves or National Guard)

Those whose spouses were killed in the line of duty may also be eligible, providing they haven’t remarried.

To be sure of your eligibility, you’ll need a certificate of eligibility (COE) from the VA. Check your likely eligibility on the VA’s website and then apply for a COE. Or your VA lender can check and apply for your behalf.

The bottom line: $42,000 mortgage reduction for veteran homeowners

Ads that claim a new government program provides a $42,000 mortgage reduction for veteran homeowners are misleading at best. There’s no such new program.

However, longstanding VA programs can save you $42,000+ over the lifetime of your loan compared to other types of mortgages just because they typically charge lower interest rates. And VA loans come with other important advantages such as a zero down payment requirement and no ongoing mortgage insurance premiums.

If and when it makes financial sense for you to refinance your existing VA loan to get a lower mortgage rate and monthly payment, check out IRRRLs. These streamlined VA loan refinancings are typically quick, inexpensive and easy.

Time to make a move? Let us find the right mortgage for you

FAQ about $42,000 mortgage reduction for veteran homeowners

Will the VA help pay my mortgage?

It won’t chip in its own money to help you out, no matter what ads say about a $42,000 mortgage reduction for veteran homeowners say. But, if you’re in trouble, the VA will go out of their way to help you through a bad patch. Call a VA loan technician on 877-827-3702 for practical help and advice.

Can you defer a mortgage payment on a VA loan?

Yes, provided you get the agreement of your VA loan servicer (the company to which you make your monthly payments), you can request a deferal. And, if you’ve already skipped payments, you may be able to get more time to catch up, agree a repayment plan, or even add your missed payments to your loan balance.

What benefits do veterans get when buying a house?

Those eligible for a VA loan can access many benefits not available to other borrowers. Maybe the biggest one are the uberlow mortgage rates that you’re typically offered. But first-time buyers will also appreciate the zero-down-payment option and the avoidance of ongoing mortgage insurance premiums.

Where can I find more information about the veteran mortgage reduction programs?

Click the following links for more details: