Understanding the VA appraisal process

Sometimes, a VA appraisal comes in too low. An independent, professional appraiser visits the home and decides that the value of the home is lower than the price the buyer has agreed to pay.

That’s a problem because the lender isn’t allowed to lend more than the home’s fair market value. Still, this is no time to panic. Many homebuyers with VA loans end up overcoming appraisal obstacles and go on to purchase their chosen home. Read on for strategies that might help you.

Verify your VA loan eligibility. Start hereIn this article (Skip to...)

- How common are VA appraisal gaps?

- Reasons why VA appraisals come in too low

- What to do with a low VA appraisal

- The bottom line

- VA appraisal FAQ

How common are VA appraisal gaps?

Of course, the same issue can arise with any type of mortgage, not exclusively with a VA mortgage. Fannie Mae once examined data in 2011-12 and found, “Appraised values come in below contract about 8% of the time.” Of course, market conditions were very different back then from today so you should take that figure with a pinch of salt.

Verify your VA loan eligibility. Start hereAnd these “appraisal gaps” may be more common with VA loans because they tend to have higher standards concerning the condition and amenities of the property. These VA minimum property requirements (MPRs) are intended to ensure the home is “safe, structurally sound and sanitary.”

You may find it frustrating if a VA appraisal comes in too low. But try to think of it positively. It’s against your interests to pay more for a new home than it’s worth. And you may be able to use the appraiser’s professional opinion as a stick with which to beat down the price you pay.

Common reasons why a VA appraisal comes in too low

The seller

You may suspect that the most common reason for a VA loan appraisal gap are sellers who do not assess their home’s worth in line with comparable sales. Homeowners can think their home is worth more than it is because they have an emotional interest in doing so.

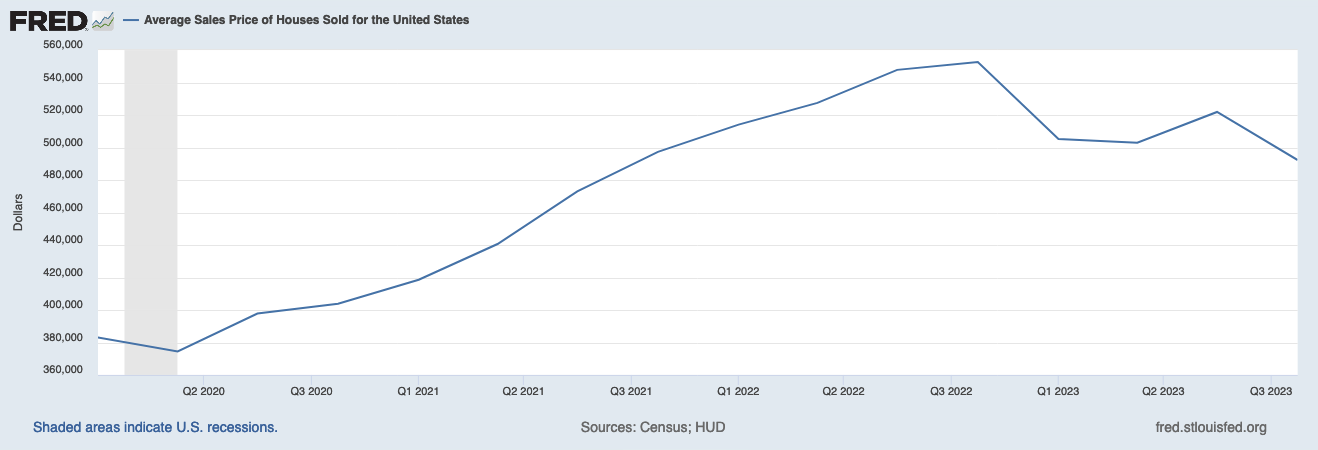

This can be a particular problem when conditions in the housing market change. Look at what happened to home prices between 2020 and 2023. When you’re used to your property’s value shooting upward, it can be hard to come to terms with the fact it’s suddenly declining.

Verify your VA loan eligibility. Start here

Professional appraisers aim to take a more scientific approach. And they’re most comfortable using “comps.” That’s short for comparables, meaning comparable homes that have recently sold in the street, neighborhood or area.

Of course, every home is unique. Even on cookie-cutter developments, some homes will have a bigger plot or a nicer view or be in better condition than others. That’s when the appraiser uses her skill to adjust the market value to reflect such differences. Only very occasionally are homes so remote or idiosyncratic that there are no comps. Then the appraiser must use her local knowledge and professional judgment to come up with a figure.

Property condition

The VA says: “The appraiser should not recommend repairs of cosmetic items, items involving minor deferred maintenance or normal wear and tear, or items that are inconsequential in relation to the overall condition of the property. While minor repairs should not be recommended, the appraiser should consider these items in the overall condition rating when estimating the market value of the property.”

So, your appraiser shouldn’t worry too much about the current owner’s bad taste in decor or the need to screw back on a kitchen unit’s door or fit a washer to a dripping faucet. You’ll fix those soon enough. But she will pay close attention to all the items on the VA’s list of minimum property requirements. What are they? Read VA minimum property requirements: 2024 VA loan MPRs.

A few of those could stymie a deal. For example, you must be able to safely and easily access the home year-round. And achieving that for a few remote homes could be ruinously expensive. You’ll also need utilities to be connected or alternative effective systems providing heat, light, power and drainage to be in place. And any iffy wiring or plumbing might need to be replaced before your loan is approved.

What to do when your VA appraisal comes in too low

Your first call should be to your mortgage company’s loan officer. This person is vital to your loan application and it’s good to build a cordial relationship with him or her right from the start. Just ask for advice whenever an issue such as an appraisal report gap arises.

Verify your VA loan eligibility. Start hereAfter that, you’ll likely want to call the seller. Of course, if you have a buyer’s agent, that’s his or her job.

Detail what’s happened and explain the size and reasons for the appraisal gap. Try to get them to close or at least shrink the gap by lowering the purchase price. If they’ll only shrink the gap, you’ll have to somehow find the money to allow the purchase to proceed. You also have the option to:

Appeal your VA appraisal

Suppose the seller won’t budge far enough or at all. Unless you can find the funds to bridge the VA appraisal gap yourself, you may have to walk away. You have the right to do that without penalty.

However, you still have one alternative: to appeal your VA appraisal. To do that, you simply ask your mortgage lender to submit a Reconsideration of Value (ROV) request to the VA. Of course, there’s no guarantee that will make the difference you need. It could even make things worse by shrinking the appraisal figure. But you’ll often have nothing to lose by trying.

What is the Tidewater Initiative?

Tidewater is a less formal process that sometimes occurs before your home appraisal is delivered. Your appraiser contacts your mortgage lender to say that an appraisal gap is looking very likely.

Your mortgage lender can then reach out to your buyer’s Realtor requesting additional home sales comps that could justify a higher valuation. These must be provided within 48 hours.

The appraiser may choose to change the market value in light of these or may not. But, if he or she doesn’t, a written explanation is required.

Verify your VA loan eligibility. Start hereSummary of ways to help close your VA appraisal gap

So, here are your main options when your VA appraisal comes in too low:

- Ask the seller to lower the sale price to the appraised value

- Cover the VA appraisal gap yourself in cash

- Split the gap between the buyer and seller

- Negotiate extras — Might you be able to use your savings to bridge the gap if the seller throws in some furniture or makes requested repairs?

- Appeal your VA appraisal

Don’t give up until that’s your only sensible choice. But, ultimately, there’s nothing wrong with making a strategic withdrawal.

The bottom line: Closing the VA appraisal gap

You wouldn’t have made an offer for the home if you didn’t really, really want it. So, by all means, explore every avenue to save the deal. Take advice from your loan officer and buyer’s agent, if you have one. They’ll have likely seen appraisal gaps many times before and may well have some clever ideas to get you through the loan process successfully.

However, always be willing to walk away. Why would you want to pay more for a home than it’s worth? You’ll probably find another soon at market value that will make you equally happy.

Verify your VA loan eligibility. Start here

VA appraisal FAQ

What causes a low VA appraisal?

An independent appraiser has decided that the asking price you’ve agreed to pay is higher than the home’s market value. That may be because the owner was asking too much or there may be issues with the condition. Compliance with the VA’s minimum property requirements can be another factor.

Can I challenge a low VA appraisal decision?

Certainly! You can appeal the appraisal by getting your mortgage lender to submit a Reconsideration of Value (ROV) request to the VA. Of course, that may or may not be successful.

Does a low VA appraisal affect my eligibility for a VA loan?

No. You may not be able to buy the home you want today but you can still get a VA loan for another you find tomorrow.

Can I request a re-appraisal for a low VA appraisal?

You can appeal your appraisal through the Reconsideration of Value process. But we can find no provision for your requesting a second appraisal from a different appraiser.

How can I avoid a low VA appraisal?

There’s no sure-fire way to avoid a VA appraisal that comes in too low. However, having a buyer’s agent who is experienced with VA loans might help you choose a home that’s likely to appraise well. And developing a good relationship with your lender’s loan officer can make sure someone influential is on your side.

Time to make a move? Let us find the right mortgage for you