Takeaways

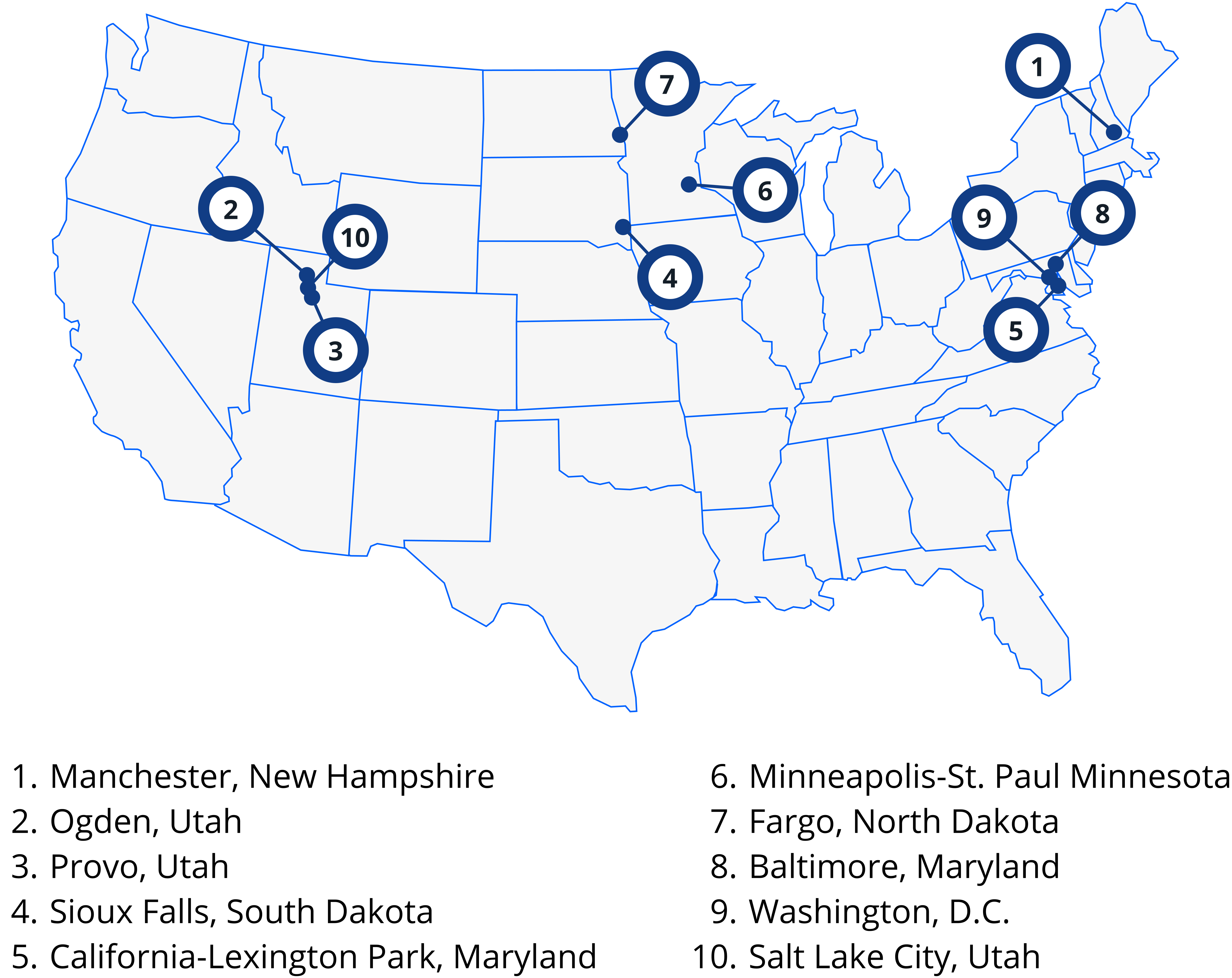

- Manchester, New Hampshire is the top city in the country in which to pay off $100,000 in debt

- Three of the top 10 cities are in Utah

- No cities in Washington State, California, New York, or Florida ranked in the top 100

- The smallest city to make the list was California, Maryland, with a population of 112,290. The largest city was Washington, D.C. with over six million

- The average home price among the top 10 cities is $404,000 and the average rent was $1,562 per month

- The average annual income among top cities was $93,809

In this article (Skip to...)

- Best cities to pay off $100K debt

- Top 25 cities to pay off debt

- Worst cities to pay off $100K debt

- Other notable cities

- The bottom line

Top 10 cities to pay off $100,000 in debt

- Manchester, New Hampshire

- Ogden, Utah

- Provo, Utah

- Sioux Falls, South Dakota

- California-Lexington Park, Maryland

- Minneapolis-St. Paul Minnesota

- Fargo, North Dakota

- Baltimore, Maryland

- Washington, D.C.

- Salt Lake City, Utah

Top cities where you can pay off $100,000 in debt

More than 70% of millennials have over $100,000 in non-mortgage debt; $117,000 to be exact, according to a recent survey.

Check your home buying eligibility. Start hereAbout half of millennials have student loans. The average balance among these individuals is nearly $127,000.

Debt levels among younger generations are hindering homebuying aspirations and other financial goals. It’s no wonder many are on a mission to zero-out debt as quickly as possible.

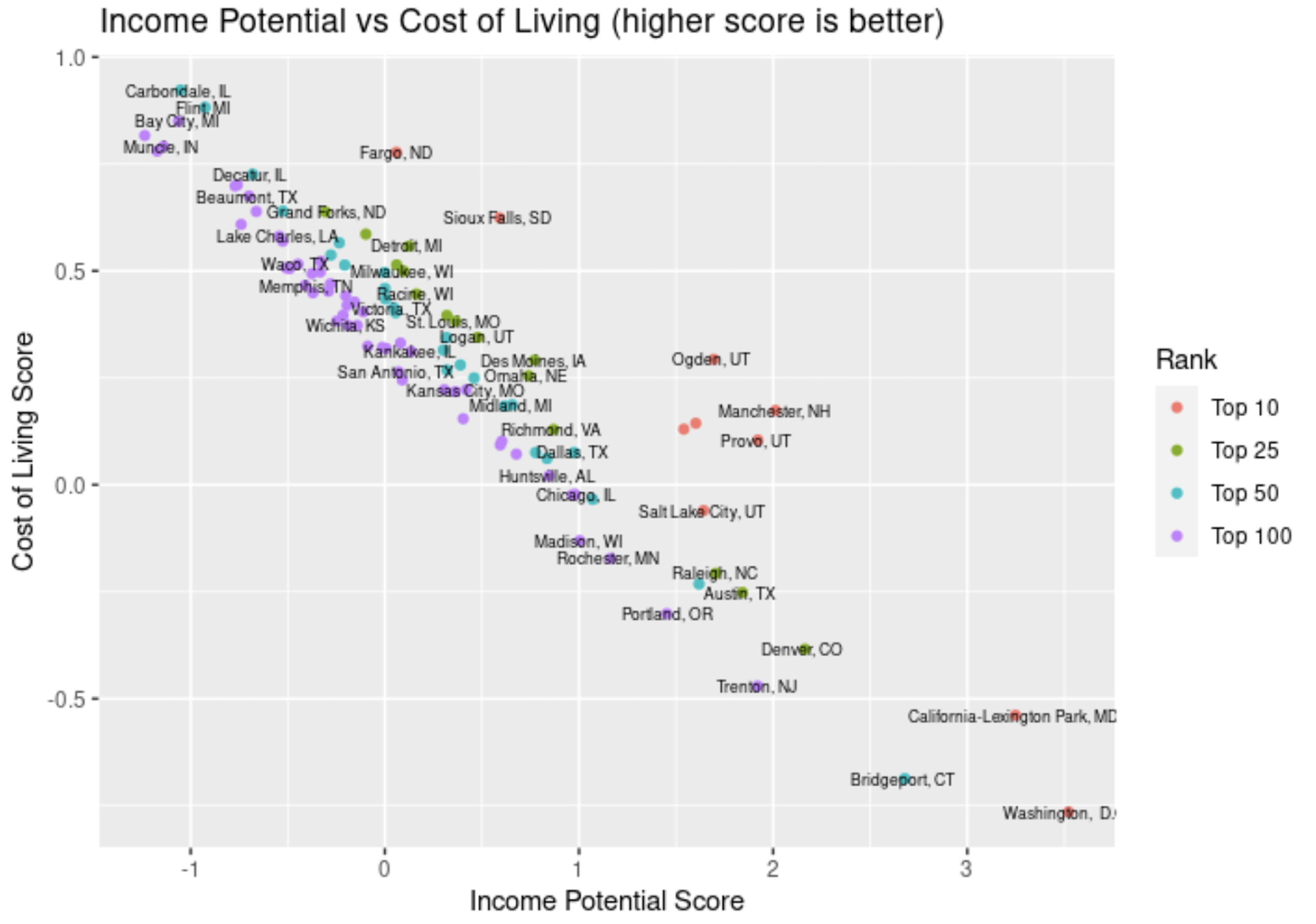

Some cities are more conducive to this goal than others. The top 10 cities to pay off $100,000 in debt are not necessarily the cheapest in the country.

Rather, they are areas with the best balance between earning potential and cost of living.

Some cities with relatively high cost of living made the list, but only because earning potential more than offsets these costs.

Likewise, many low-cost areas achieved top-10 status with relatively high median income.

Following are The Mortgage Reports’ picks for top areas of the country to pay off $100,000 in debt quickly.

#1 Manchester, New Hampshire

| Median income | $96,921 |

| Income rank | 13/384 |

| Cost of living rank | 176/384 |

| Typical home price | $407,634 |

| Typical monthly rent | $1,915 |

| Population | 413,035 |

Manchester, New Hampshire is The Mortgage Reports’ top city in which to pay off $100,000 in debt.

Among 384 cities, it ranked #13 for median household income, likely due in part to its proximity to Boston, about 50 miles south. Yet, it falls within the best 50% for cost of living.

Offering big-city incomes without the high price tag, Manchester may be your destination to finally retire your debt.

#2 Ogden, Utah

| Median income | $92,600 |

| Income rank | 26/384 |

| Cost of living rank | 130/384 |

| Typical home price | $370,400 |

| Typical monthly rent | $1,276 |

| Population | 662,875 |

Though Ogden’s median income is 26th highest among cities analyzed, it scored near the best one-third for cost of living.

The best part: you won’t lack things to do while paying off debt. Snow sports are minutes from downtown and the city offers plenty of summer activities, too, like fishing, boating, and hiking.

#3 Provo, Utah

| Median income | $95,687 |

| Income rank | 18/384 |

| Cost of living rank | 202/384 |

| Typical home price | $488,643 |

| Typical monthly rent | $1,493 |

| Population | 616,791 |

Another Utah town boasts a high income potential while keeping the cost of living in check: Provo.

With easy access to the Salt Lake International Airport, recreation, and job opportunities, Provo is worth considering on your debt payoff journey.

Check your home buying eligibility. Start here#4 Sioux Falls, South Dakota

| Median income | $77,605 |

| Income rank | 90/384 |

| Cost of living rank | 21/384 |

| Typical home price | $317,250 |

| Typical monthly rent | $1,169 |

| Population | 259,348 |

While Sioux Falls, South Dakota is one of the most affordable places to live on our list, its median income lands in the top 100 among cities analyzed.

With no income tax, home prices in the low $300,000, typical rent of $1,169, and incomes near $80,000, it could be a great location in which to chip away debt.

#5 California-Lexington Park, Maryland

| Median income | $113,717 |

| Income rank | 4/384 |

| Cost of living rank | 333/384 |

| Typical home price | $404,426 |

| Typical monthly rent | $1,603 |

| Population | 112,290 |

Located about 90 minutes from Washington, D.C., California and Lexington Park, Maryland ranked #4 out of nearly 400 cities in median income. While its cost of living is relatively high, housing and other costs have not yet outpaced local income levels, as has happened in many other areas of the country.

#6 Minneapolis-St. Paul, Minnesota

| Median income | $91,341 |

| Income rank | 31/384 |

| Cost of living rank | 187/384 |

| Typical home price | $338,394 |

| Typical monthly rent | $1,579 |

| Population | 3,573,609 |

The Minneapolis-St. Paul area offers low home and rent prices compared to its median income, landing it at #6 on our list.

Boasting 16 Fortune 500 company headquarters including Target, General Mills, and United Health Group, employment opportunities abound in this Midwest metro.

#7 Fargo, North Dakota

| Median income | $70,391 |

| Income rank | 150/384 |

| Cost of living rank | 9/384 |

| Typical home price | $300,302 |

| Typical monthly rent | $821 |

| Population | 240,421 |

While middle-of-the-road in income potential, Fargo is the 9th cheapest place to live in the U.S., according to our study.

Typical home prices and rents are well below the national average and the state income tax is just over 2%, yet median incomes are over $70,000 per year.

If you’re the frugal type and want to pay off debt, you might want to move to Fargo.

#8 Baltimore, Maryland

| Median income | $90,505 |

| Income rank | 33/384 |

| Cost of living rank | 193/384 |

| Typical home price | $178,038 |

| Typical monthly rent | $1,688 |

| Population | 2,796,733 |

Baltimore’s combination of high income potential and low housing costs land it in the top 10.

The typical home price of around $178,000 is easily affordable to someone making the median income, leaving plenty of money each month to apply to debt.

#9 Washington, D.C.

| Median income | $117,432 |

| Income rank | 3/384 |

| Cost of living rank | 350/384 |

| Typical home price | $722,786 |

| Typical monthly rent | $2,517 |

| Population | 6,196,585 |

While Washington, D.C. is lower on the list for affordability, high-paying jobs and career advancement opportunities more than compensate for this fault. The nation’s capital offers the highest median income level on our list of top cities.

Check your home buying eligibility. Start here#10 Salt Lake City, Utah

| Median income | $91,891 |

| Income rank | 27/384 |

| Cost of living rank | 256/384 |

| Typical home price | $576,162 |

| Typical monthly rent | $1,638 |

| Population | 1,201,043 |

The third Utah city to make the top 10, Salt Lake City offers everything you might expect: outdoor recreation, nightlife, family activities, and more. The 27th highest median income among studied cities more than offsets the reasonable but higher cost of living in this sought-after metro.

Top 25 cities to pay off $100K in debt

If you’re looking to clear a $100K debt, here’s a list of the top 25 cities in the U.S. ideally positioned to assist in you achieving that financial goal.

Check your home buying eligibility. Start here- Manchester, New Hampshire

- Ogden, Utah

- Provo, Utah

- Sioux Falls, South Dakota

- California-Lexington Park, Maryland

- Minneapolis-St. Paul Minnesota

- Fargo, North Dakota

- Baltimore, Maryland

- Washington, D.C.

- Salt Lake City, Utah

- Des Moines, Iowa

- Detroit, Michigan

- Omaha, Nebraska

- Logan, Utah

- Peoria, Illinois

- Denver, Colorado

- Milwaukee, Wisconsin

- La Crosse, Wisconsin

- St. Louis, Missouri

- Austin, Texas

- Springfield, Illinois

- Raleigh, North Carolina

- Racine, Wisconsin

- Grand Forks, North Dakota

- Richmond, Virginia

5 best small cities to pay off debt: population under 100,000

- Midland, Michigan (#31 overall)

- Dubuque, Iowa (#39 overall)

- Casper, Wyoming (#40 overall)

- Victoria, Texas (#42 overall)

- Lewiston, Idaho (#67 overall)

5 best large cities to pay off debt: population over 5 million

- Washington, D.C. (#9 overall)

- Dallas / Fort Worth, Texas (#27 overall)

- Houston, Texas (#37 overall)

- Philadelphia, Pennsylvania (#45 overall)

- Chicago, Illinois (#52 overall)

3 worst cities to pay off $100K in debt

While the bottom three cities offer high income potential, they are among the worst when it comes to the cost of living.

#3 San Luis Obispo, California

| Median income | $90,216 |

| Income rank | 34/384 |

| Cost of living rank | 379/384 |

| Typical home price | $1,080,625 |

| Typical monthly rent | $2,671 |

| Population | 282,165 |

#2 Kahului, Hawaii

| Median income | $94,760 |

| Income rank | 21/384 |

| Cost of living rank | 381/384 |

| Typical home price | $945,174 |

| Typical monthly rent | $2,500 |

| Population | 165,979 |

#3 Honolulu, Hawaii

| Median income | $96,580 |

| Income rank | 15/384 |

| Cost of living rank | 382/384 |

| Typical home price | $1,304,489 |

| Typical monthly rent | $2,346 |

| Population | 984,821 |

Worst states to pay off $100K in debt (no cities in top 100)

- Washington State

- California

- New York

- Florida

- Massachusetts

- Vermont

- Arizona

- Mississippi

- Georgia

- South Carolina

Other notable cities

Check your home buying eligibility. Start here5 cities with the lowest monthly rent

- Pine Bluff, Arkansas ($625)

- Carbondale, Illinois ($654)

- Morristown, Tennessee ($680)

- Danville, Illinois ($681)

- Lima, Ohio ($742)

5 cities with the lowest home prices

- Flint, Michigan ($48,493)

- Youngstown, Pennsylvania ($51,741)

- Detroit, Michigan ($62,621)

- Danville, Illinois ($66,461)

- Jackson, Mississippi ($70,115)

5 cities with the lowest cost of childcare*

- Gadsden, Alabama ($64/week)

- Gulfport, Mississippi ($65/week)

- Lawrence, Kansas ($70/week)

- Columbia, Missouri ($74/week)

- Lake Havasu City, Arizona ($75/week)

5 cities with the lowest overall cost of living

- Pine Bluff, Arkansas

- Carbondale, Illinois

- Flint, Michigan

- Bay City, Michigan

- Shreveport, Louisiana

Beyond debt payoff

Whether you have mountains of debt or none at all, living in a high-income, low-cost area is a good idea.

Once you’ve zeroed out debt, you can make strides toward your savings, retirement, investment, and real estate goals more easily.

Cutting expenses or raising your income by $10,000 per year amounts to $100,000 over 10 years. In the above-mentioned cities, this is entirely possible without reducing your standard of living. With the right move now, you could be on your way to a debt-free life.

Time to make a move? Let us find the right mortgage for youMethodology

The Mortgage Reports analyzed 384 U.S. cities of all sizes to discover which 10 offered the best opportunity to pay off $100,000 in debt.

We developed a proprietary cost of living index geared toward those most likely to have large amounts of debt: millennials.

For example, most cost-of-living indices under-weight housing costs, giving them about 30% weight. Yet millennials spend upwards of 50% of their income on housing. Our total home price, property tax, insurance, and rent cost weight was 47.5%.

We also included high-ticket necessities that are particularly draining for young professionals, such as childcare costs, state taxes, groceries, and utilities.

- Home prices - 22.5%

- Property Taxes - 3%

- Homeowner’s insurance - 2%

- Monthly rent - 20%

- Commuting Cost - 12.5%

- Childcare Cost - 2.5%

- State income tax - 5%

- Groceries - 10%

- Utilities - 10%

- Free recreation - 2.5%

- Healthcare - 10%

Cost of living isn’t the only factor we considered. Many higher-cost areas offer opportunities to pay off debt thanks to great earning potential. That’s why we factored in median household income as a gauge of earning potential and career advancement. After all, it does no good to spend only $40,000 per year on living expenses if you make $35,000.

To complete our analysis, we used data from Zillow ZHVI and ZORI, the Census Bureau, Policygenius, H+T Index, U.S. Department of Labor, Tax Foundation, Zippia grocery data, Forbes, and the Trust for Public Land.