In this article:

When deciding between a condo and a house, there are a number of factors to consider:

- Condos are appealing because they are often less expensive than houses, and they generally require less upkeep and maintenance.

- However, you often cannot borrow as much when buying a condo. You may also need a larger down payment, and mortgage rates may be higher.

- When you buy a condo, you’re obliged to contribute your share of the costs of maintaining and improving common areas and services. That typically happens through a homeowners’ association (HOA). Dig deep into your HOA’s finances before making a purchase to ensure they are run efficiently and won’t cost you more money in the long run.

Should you buy a condo or house? What’s the difference? What is a condominium, anyway? Is one riskier than the other? Are there differences in ongoing homeownership costs? Are mortgages more expensive for one than the other?

Keep reading, and you’ll discover the answers to those and other questions.

Verify your new rateWhat’s the difference?

When you buy a single-family house, you own it all. The walls, the roof, the fixtures and fittings, the yard, the driveway ... from boundary to boundary, it’s all yours. And you’re the only one responsible for maintaining and perhaps improving it.

Condos aren’t like that.

What is a condominium?

When you buy a condo, you purchase your unit, which might be in anything from a duplex to a tower block, or a sprawling development of several blocks. In addition to your own unit, you also become part owner of (you have a joint legal interest in) the common areas and any common facilities and services.

Those might include landscaped areas, paths and driveways, parking areas or garages, and lobbies, elevators and hallways that provide access to units. If your building provides your unit with heating or HVAC, that could be regarded as a common facility. A doorman or janitor could provide a common service.

Your obligations

You’re obliged to contribute your share of the costs of maintaining and perhaps improving those common provisions. That typically happens through a homeowners’ association (HOA).

You must also comply with the covenants, conditions and restrictions (CC&Rs) that apply to your property.

What do you actually own?

You need to check your CC&Rs before you buy a condo to see what’s going to be yours and what’s defined as common. They will also tell you about any restrictions on the use of your property. Those might include rules about pets, using your home as a workplace or causing a noise or other nuisance.

For example, the building’s exterior walls and roof are usually common. But your ownership of interior walls that divide your unit from another could be only drywall-deep. Read your CC&Rs carefully so you know what you’re buying.

Condo or house — when condos are better

There are three main reasons some prefer condos:

1. Carefree living

You don’t have to mow the yard. You don’t have to clean the gutters. You don’t have to fix the roof. You don’t have to clear the snow. You don’t usually have to paint your home’s exterior.

True, you have to pay people to do that work. But you’re sharing the expense with others in your development. And that can work out cheaper than employing various contractors to do the same things for your own house.

Those who hate such chores —or who are no longer up to doing them — often love the condo lifestyle.

2. Lower purchase prices

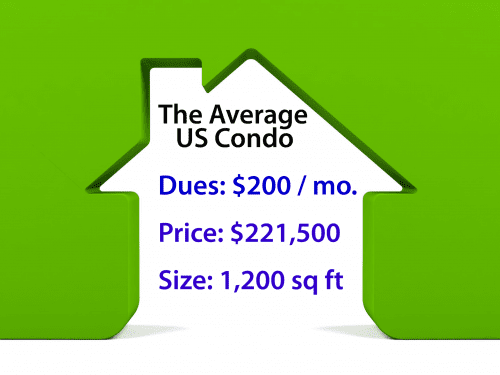

This clearly depends on the unit, the development and the area. But condos typically have lower purchase prices than comparable houses, especially in areas where home prices are high.

Check online to see if that applies where you live.

3. Ready-made friends

Many condos have a real community feel. Of course, many neighborhoods do, too.

But you tend to live in closer proximity with your neighbors in a condo development. And you’re more likely to bump into folks in common areas and elevators. So it can be easier to make friends.

Downsides to condos

But there can be downsides to condos. And some of them are serious.

1. Broke homeowners’ association

If your HOA has insufficient funds to carry out urgent — perhaps major — repairs, you could suddenly be required to pay a large lump sum to cover your share of the costs. This is called a “special assessment.”

Well-run HOAs build reserves over time, so that such expenses can be paid painlessly. But some are in better financial shape than others.

You need to dig deep into the HOA’s finances before you commit to buying a condo. if you purchase with a mortgage, your lender will do the digging for you, to protect its own interest.

2. When the living ain’t easy

Living in close proximity with your neighbors can foster a community spirit and help build friendships. But it could also drive you mad.

A combination of noisy neighbors and poor sound insulation can be especially trying. And if you end up next door to someone difficult or unpleasant, you’re stuck.

3. Paying for things you don’t want

Some developments come with clubhouses, swimming pools and fitness centers. That’s great. If you use them.

However, they’re less appealing if you don’t — but are still contributing to the running of them.

Condos and mortgages

It’s usually not hard to get a mortgage for a condo, providing you meet the usual lending criteria. But you may not get quite as good a loan deal as if you were buying a house.

This is important to you in two ways: First, you might end up paying more for your loan. And, secondly, so might potential buyers when you come to sell. Condo prices may be typically lower partly because fewer buyers are willing to live with less good mortgage deals.

Here are some ways in which mortgages can be less good for condo buyers:

1. You can’t borrow as much

Monthly HOA fees count as a continuing debt when lenders calculate your debt-to-income (DTI) ratio. And a poor one of those can see getting offered a smaller mortgage or a higher mortgage rate.

However, some programs are more flexible than others.

2. You may need a bigger down payment

If you need your down payment to be as small as possible, you may find a condo a bad bet.

For example, Freddie Mac excludes condos from its 3-percent-down Home Possible Advantage mortgage. And it imposes restrictions on them for its 5-percent-down Home Possible mortgage.

The Federal Housing Administration has loans for condos that it has approved. And you can apply to get one you want to buy approved.

3. You may pay a higher mortgage rate

Some mortgages come with “loan-level pricing adjustments” or LLPAs. These are hikes on the standard mortgage rate that you might otherwise have been offered. And they are added to compensate for extra risk.

Some lenders add an LLPA for condo purchases — though not on FHA, VA or USDA loans. Fannie Mae, for example, adds 0.750 percent for condos purchased with down payments below 25 percent.

If the condo you choose is not approved with Fannie Mae, Freddie Mac or any government-backed mortgage programs, you will likely pay higher interest rates and fees to finance it.

Condo or house?

You should choose your next home based on a broad range of criteria. If you think you’ll enjoy the lifestyle, and you’ve checked out your mortgage options, the development and the unit (and the HOA’s finances!), go for a condo unit.

After all, you can end up with bad neighbors or unexpected repairs and maintenance costs if you buy a house.

Different people want different things from life. Choose the one you think will make you happier.

What are today’s mortgage rates?

Mortgage rates today are favorable for both condos and houses. As of this writing, Freddie Mac’s weekly average rates dropped, stopping a trend of upward movement. To get the best deal on financing for a single-family home or condo, compare quotes from several mortgage lenders for the type of property you plan to purchase.

Time to make a move? Let us find the right mortgage for you