Mortgage rate forecast for next week (April 22-26)

Mortgage interest rates grew for the third week in a row and broke the 7% ceiling for the first time in 2024.

The average 30-year fixed rate mortgage (FRM) jumped from 6.88% on April 11 to 7.10% on April 18, according to Freddie Mac.

“As rates trend higher, potential homebuyers are deciding whether to buy before rates rise even more or hold off in hopes of decreases later in the year,” said Sam Khater, Freddie Mac’s chief economist. Last week, purchase applications rose modestly, but it remains unclear how many homebuyers can withstand increasing rates in the future.”

Find your lowest mortgage rate. Start hereIn this article (Skip to...)

- Will rates go down in May?

- 90-day forecast

- Expert rate predictions

- Mortgage rate trends

- Rates by loan type

- Mortgage strategies for May

- Mortgage rates FAQ

Will mortgage rates go down in May?

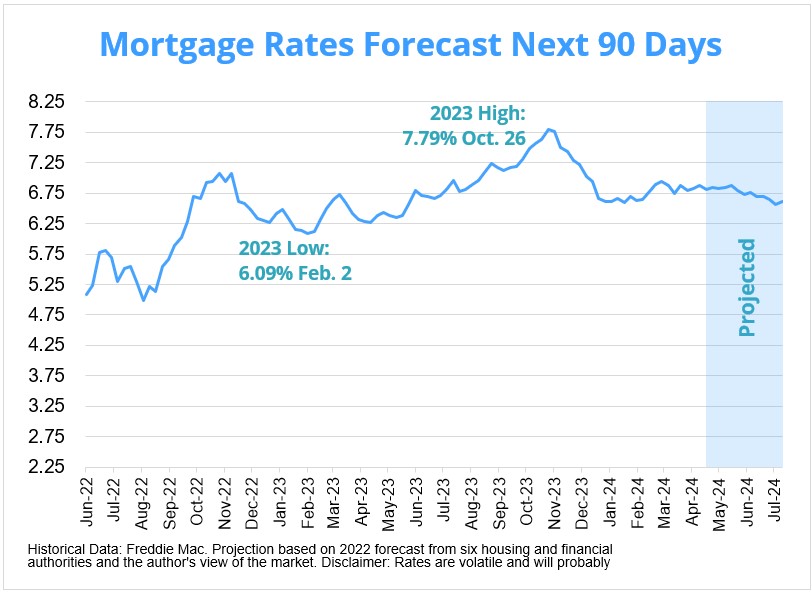

Mortgage rates fluctuated significantly in 2023, with the average 30-year fixed rate going as low as 6.09% on Feb. 2 and as high as 7.79% on Oct. 26, according to Freddie Mac.

Find your lowest mortgage rate. Start hereThe range can be largely attributed to the Federal Reserve’s ongoing fight against inflation, juxtaposed with uncertainty in the banking sector sparked by Silicon Valley Bank’s collapse. However, with duress permeating the financial market and the fallout from U.S. debt ceiling talks, the Fed may continue making hikes to bring interest rates down.

With the economy possibly heading into a recession, we may have already seen the peak of this rate cycle. Of course, interest rates are notoriously volatile and could tick back up on any given week.

Experts from CoreLogic, First American, CJ Patrick and others weigh in on whether 30-year mortgage rates will climb, fall, or level off in May.

Expert mortgage rate predictions for May

Craig Berry, branch manager at Acopia Home Loans

Prediction: Rates will moderate

“Inflation has decreased from a year ago, but it appears to have reached a standstill, and certain indicators suggest it may be on the rise once more. Recently, some Fed officials have hinted that instead of three to four rate cuts this year, one or two cuts may suffice. We may not see these cuts until later in the year. While minor fluctuations are to be expected — particularly on a week-to-week basis, unless there are significant shifts in the economy — we shouldn’t see any drastic spikes or declines in rates. Mortgage rates in May will likely remain stable, similar to April’s rates.”

Molly Boesel, principal economist at CoreLogic

Prediction: Rates will moderate

“The March inflation report was likely a disappointment to those hoping the Federal Reserve would start cutting rates sooner rather than later. It appears easing is still on the horizon, and with that should come a gradual decrease in the mortgage rates. For now, look for the 30-year mortgage rate to remain in the high-6% range in May.”

Ralph DiBugnara, president at Home Qualified

Prediction: Rates will rise

“Rates have been taking a little bit of a beating the last months because inflation is still not coming down fast enough. The last report said the Consumer Pricing Index, which measures the average cost of goods to consumers, rose 3.5% since last year — a higher than expected number and another sign inflation is still too high. This all says that there is no rate cut coming from the Fed in the next few months. Until inflation comes down the average interest rate we are seeing today will most likely be our reality. In May, I believe that will be about 7.4% on a 30-year fixed rate mortgage (FRM) and 6.75% on a 15-year FRM.”

Danielle Hale, chief economist at Realtor.com

Prediction: Rates will moderate

“March’s CPI report, which showed uncomfortably high price increases for a second month in the headline figures and third month in the core data, is creating a wrinkle for the Fed and investors as they contemplate the economy’s path forward. The improvement in inflation observed at the end of 2023 has evaporated, bolstering the Fed’s cautious approach to easing monetary policy back to a more neutral stance. I expect that we’ll see mortgage rates shoot higher in late April, on the heels of concerns that inflation will prove more difficult to tame than first estimated.

Whether mortgage rates continue to chart a higher course, or ease back — as they are expected to do before the year’s end — will depend on the economic data out in May. Although inflation has consistently surprised to the upside in recent months, that trend is not expected to last. The jobs report, out on May 3, will be an important tone setter for the month. A softer reading will likely mean steadiness in mortgage rates until the inflation data, while another month of decline in the unemployment rate could spark a further uptick. However, the number one mortgage rate mover is likely to be the April inflation data, which is released May 15. If inflation surprises on the high side again, I’d expect mortgage rates to move higher, while an on-target or lower inflation reading could translate into some rate relief.”

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will moderate

“Persistent inflation has dashed investor hopes for a Federal Reserve rate cut in June, which implies mortgage rates will remain ‘higher-for-longer.’ If inflation data between now and May continues to come in hotter than expected, and/or the Fed takes on a more hawkish tone at their upcoming meeting, we can anticipate upward pressure on mortgage rates.”

Rick Sharga, CEO at CJ Patrick Company

Prediction: Rates will moderate

“Momentum in the labor markets — lower unemployment and unexpectedly strong job creation — coupled with inflation that’s simply not moving in the direction the Federal Reserve wants, make it unlikely that we’ll see the Fed Funds Rate cut before June at the earliest. That probably means that mortgage rates will stay at or slightly above 7% through May as the market bides its time.

We’re not likely to see mortgage rates decline significantly until after the Fed makes its first cut; and the longer it takes for that to happen, the less likely it is that we’ll see rates much below 6.5% by the end of the year.”

Mortgage interest rates forecast next 90 days

As inflation ran rampant in 2022, the Federal Reserve took action to bring it down and that led to the average 30-year fixed-rate mortgage spiking in 2023.

With inflation gradually cooling, the Fed adjusted its policies with skipped hikes and cuts are expected this year. Additionally, the economy showing signs of slowing has many experts believing mortgage interest rates will gradually descend in 2024.

Find your lowest mortgage rate. Start hereOf course, rates could rise on any given week or if another global event causes widespread uncertainty in the economy.

Mortgage rate predictions for 2024

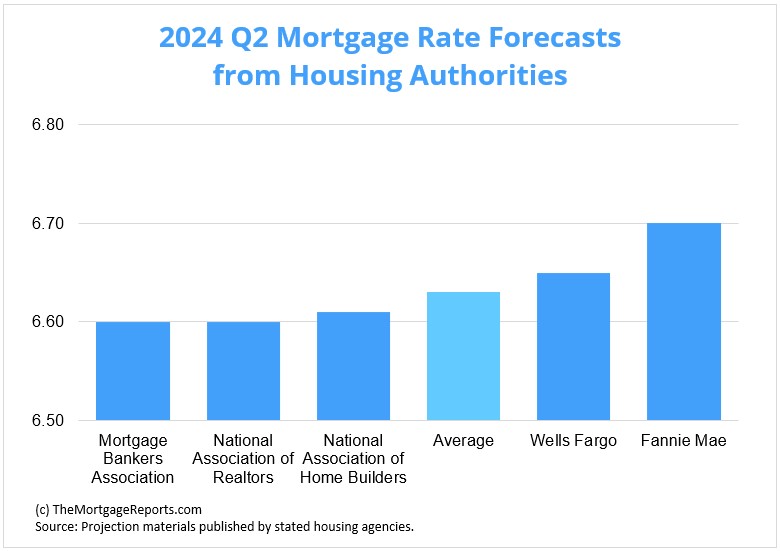

The 30-year fixed-rate mortgage averaged 7.1%% as of April 18, according to Freddie Mac. All five major housing authorities we looked at project 2024’s second quarter average to finish below that.

The Mortgage Bankers Association and National Association of Realtors sit at the low end of the group, predicting the average 30-year fixed interest rate to settle at 6.6% for Q2. Meanwhile, Fannie Mae had the highest forecast of 6.7%.

| Housing Authority | 30-Year Mortgage Rate Forecast (Q2 2024) |

| Mortgage Bankers Association | 6.60% |

| National Association of Realtors | 6.60% |

| National Association of Home Builders | 6.61% |

| Wells Fargo | 6.65% |

| Fannie Mae | 6.70% |

| Average Prediction | 6.63% |

Current mortgage interest rate trends

Mortgage rates increased for the second consecutive week.

The average 30-year fixed rate rose from 6.88% on April 11 to 7.10% on April 18. The average 15-year fixed mortgage rate similarly grew, going from 6.16% to 6.39%.

Get started shopping for mortgage rates| Month | Average 30-Year Fixed Rate |

| March 2023 | 6.54% |

| April 2023 | 6.34% |

| May 2023 | 6.43% |

| June 2023 | 6.71% |

| July 2023 | 6.84% |

| August 2023 | 7.07% |

| September 2023 | 7.20% |

| October 2023 | 7.62% |

| November 2023 | 7.44% |

| December 2023 | 6.82% |

| January 2024 | 6.64% |

| February 2024 | 6.78% |

| March 2024 | 6.82% |

Source: Freddie Mac

After hitting record-low territory in 2020 and 2021, mortgage rates climbed to a 23-year high in 2023. Many experts and industry authorities believe they will follow a downward trajectory into 2024. Whatever happens, interest rates are still below historical averages.

Dating back to April 1971, the fixed 30-year interest rate averaged around 7.8%, according to Freddie Mac. So if you haven’t locked a rate yet, don’t lose too much sleep over it. You can still get a good deal, historically speaking — especially if you’re a borrower with strong credit.

Just make sure you shop around to find the best lender and lowest rate for your unique situation.

Mortgage rate trends by loan type

Many mortgage shoppers don’t realize there are different types of rates in today’s mortgage market. But this knowledge can help home buyers and refinancing households find the best value for their situation.

Find your lowest mortgage rate. Start hereWhich mortgage loan is best?

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high-priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits, which max out at $ in most parts of the U.S.

On the other hand, if you’re a veteran or service member, a VA loan is almost always the right choice. VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance (PMI). But you need an eligible service history to qualify.

Conforming loans and FHA loans (those backed by the Federal Housing Administration) are great low-down-payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620. FHA loans are even more lenient about credit; home buyers can often qualify with a score of 580 or higher, and a less-than-perfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates — similar to VA — and reduced mortgage insurance costs. The catch? You need to live in a ‘rural’ area and have moderate or low income to be USDA-eligible.

Mortgage rate strategies for May 2024

Mortgage rates displayed their famous volatility in 2023. Uncertainty in the banking sector led to downtrends, but ongoing inflation battles, Fed hikes and a hot job market drove growth.

Find your lowest mortgage rate. Start hereThe central bank held off on a rate hike in its past five meetings, preferring to see if the economy would keep cooling organically. At the most recent meeting in March, the FOMC projected cuts starting as early as May or June. As always, the committee said it would adjust its policies as necessary — which could mean additional hikes or possibly none at all.

Here are just a few strategies to keep in mind if you’re mortgage shopping in the coming months.

Be ready to move quickly

Indecision can lead to failure or missed opportunities. That holds true in home buying as well.

Although the housing market is becoming more balanced than the recent past, it still favors sellers. Prospective borrowers should take the lessons learned from the last few years and apply them now even though conditions are less extreme.

“Taking too long to decide to make an offer can lead to paying more for the home at best and at worst to losing out on it entirely. Buyers should get pre-approved (not pre-qualified) for their mortgage, so that the seller has some certainty about the deal closing. And be ready to close quickly — a long escrow period will put you at a disadvantage.

And it’s definitely not a bad idea to work with a real estate agent who has access to “coming soon” properties, which can give a buyer a little bit of a head start competing for the limited number of homes available,” said Rick Sharga.

Buyer demand is lower than a typical year, but the market usually heats up in spring and summer. Being decisive (and prepared) should only play to your advantage.

Shopping around isn’t only for the holidays

Since interest rates can vary drastically from day to day and from lender to lender, failing to shop around likely leads to money lost.

Lenders charge different rates for different levels of credit scores. And while there are ways to negotiate a lower mortgage rate, the easiest is to get multiple quotes from multiple lenders and leverage them against each other.

“For potential home buyers, it’s important to get quotes from multiple lenders for a mortgage, as rates can vary dramatically, especially during such a volatile period,” said Odeta Kushi.

As the mortgage market slows due to lessened demand, lenders will be more eager for business. While missing out on the rock-bottom rates of 2020 and 2021 may sting, there’s always a way to use the market to your advantage.

How to shop for interest rates

Rate shopping doesn’t just mean looking at the lowest rates advertised online because those aren’t available to everyone. Typically, those are offered to borrowers with great credit who can put a down payment of 20% or more.

The rate lenders actually offer depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment (if buying a home)

- Your home equity (if refinancing)

- Your loan-to-value ratio (LTV)

- Your debt-to-income ratio (DTI)

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a ‘real’ rate quote based on your financial situation.

You should get three to five of these quotes at a minimum, then compare them to find the best offer. Look for the lowest rate, but also pay attention to your annual percentage rate (APR), estimated closing costs, and ‘discount points’ — extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Compare mortgage and refinance rates. Start here

Mortgage interest rate FAQ

Current mortgage rates are averaging 7.1% for a 30-year fixed-rate loan and 6.39% for a 15-year fixed-rate loan, according to Freddie Mac’s latest weekly rate survey. Your individual rate could be higher or lower than the average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Mortgage rates could decrease next week (April 22-26, 2024) if the mortgage market takes a cautious approach to a possible recession. However, rates could rise if lenders account for the Federal Reserve taking measures to counteract inflation or if a global event brings economic uncertainty.

If inflation continues to dissipate and the economy cools or goes into a recession, it’s likely mortgage rates will decrease in 2024. Although, it’s important to remember that interest rates are notoriously volatile and are driven by many factors, so they can rise during any given week.

Mortgage rates may continue to rise in 2024. High inflation, a strong housing market, and policy changes by the Federal Reserve have all pushed rates higher in 2022 and 2023. However, if the U.S. does indeed enter a recession, mortgage rates could come down.

Freddie Mac is now citing average 30-year rates in the 7% range. If you can find a rate in the 5s or 6s, you’re in a very good position. Remember that rates vary a lot by borrower. Those with perfect credit and large down payments may get below-average interest rates, while poor-credit borrowers and those with non-QM loans could see much higher rates. You’ll need to get pre-approved for a mortgage to know your exact rate.

For the most part, industry experts do not expect the housing market to crash in 2023. Yes, home prices are over-inflated. But many of the risk factors that led to the 2008 crash are not present in today’s market. Low inventory and massive buyer demand should keep the market propped up next year. Plus, mortgage lending practices are much safer than they used to be. That means there’s not a subprime mortgage crisis waiting in the wings.

At the time of this writing, the lowest 30-year mortgage rate ever was 2.65%. That’s according to Freddie Mac’s Primary Mortgage Market Survey, the most widely used benchmark for current mortgage interest rates.

Locking your rate is a personal decision. You should do what’s right for your situation rather than trying to time the market. If you’re buying a home, the right time to lock a rate is after you’ve secured a purchase agreement and shopped for your best mortgage deal. If you’re refinancing, you should make sure you compare offers from at least three to five lenders before locking a rate. That said, rates are rising. So the sooner you can lock in today’s market, the better.

That depends on your situation. It’s a good time to refinance if your current mortgage rate is above market rates and you could lower your monthly mortgage payment. It might also be good to refinance if you can switch from an adjustable-rate mortgage to a low fixed-rate mortgage; refinance to get rid of FHA mortgage insurance; or switch to a short-term 10- or 15-year mortgage to pay off your loan early.

It’s often worth refinancing for 1 percentage point, as this can yield significant savings on your mortgage payments and total interest payments. Just make sure your refinance savings justify your closing costs. You can use a mortgage calculator or speak with a loan officer to crunch the numbers.

Start by choosing a list of three to five mortgage lenders that you’re interested in. Look for lenders with low advertised rates, great customer service scores, and recommendations from friends, family, or a real estate agent. Then get pre-approved by those lenders to see what rates and fees they can offer you. Compare your offers (Loan Estimates) to find the best overall deal for the loan type you want.

What are today’s mortgage rates?

Mortgage rates are rising, but borrowers can almost always find a better deal by shopping around. Connect with a mortgage lender to find out exactly what rate you qualify for.

Time to make a move? Let us find the right mortgage for you1Today's mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

- https://www.blackknightinc.com/category/press-releases

- https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- http://www.freddiemac.com/research/datasets/refinance-stats/index.page