What percentage of mortgages are adjustable-rate in 2022?

In mid-2022, adjustable-rate mortgages made up nearly 10% of all new home loan applications, according to the Mortgage Bankers Association (MBA).

Find your lowest ARM rate. Start hereThat may not sound like a lot, but it’s a far greater share of ARM loans than we’ve seen since 2008. And it’s easy to see why. With ARM rates hovering more than 100 basis points (1%) below fixed mortgage rates, home buyers in 2022 are leveraging adjustable rate loans to lower their payments and afford more expensive homes.

ARMs are much cheaper in the short term

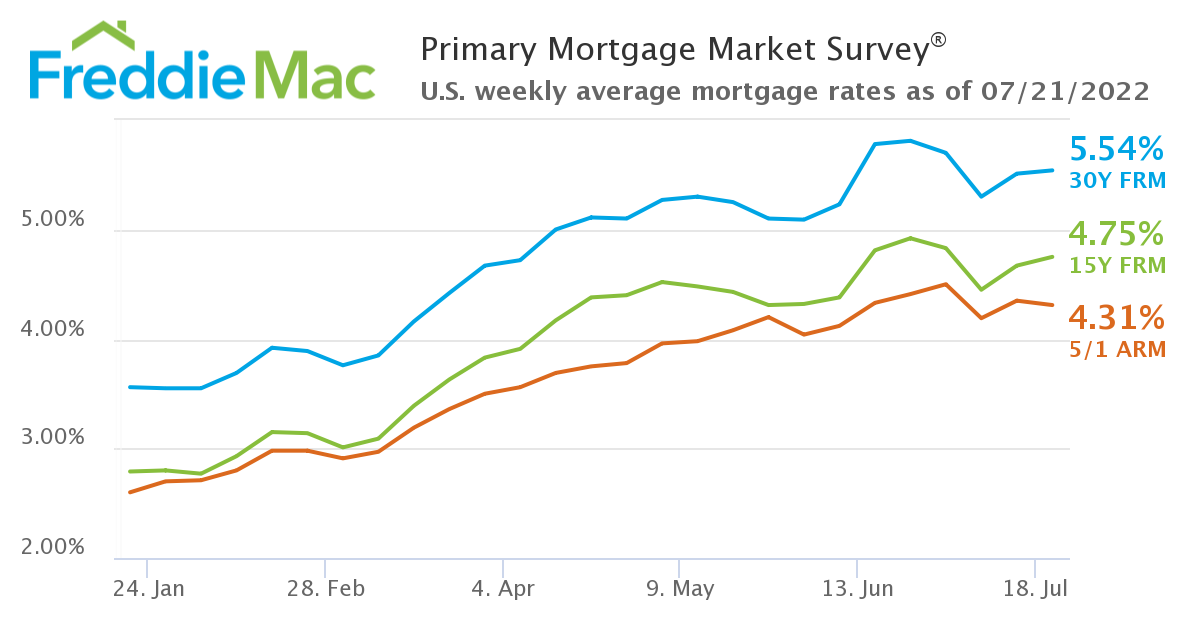

According to Freddie Mac, the average rate for a 30-year, fixed-rate mortgage (FRM) was 5.54% during the week ending Jul. 21, 2022. That same week, the average rate for a 5/1 ARM was just 4.31 percent.

The low-rate ARM trend is nothing new. Throughout 2022, even as interest rates have risen sharply, average adjustable rates have stayed around a percentage point or more below fixed mortgage rates.

Source: Freddie Mac Primary Mortgage Market Survey

A 5/1 ARM means the mortgage has its initial fixed rate for the first five years and then the rate can adjust once per year for the remaining 25 years. Other common options include a 7/1 or 10/1 ARM, meaning your initial rate is fixed for 7 or 10 years before it can adjust.

So you could save a small fortune in monthly payments by opting for an ARM, at least over the first five to 10 years of your loan. Alternatively, you could afford a much nicer, more costly home with the same payments you’d make on a smaller, fixed-rate mortgage.

Of course, an ARM isn’t for everyone. If you plan to stay in your home longer than 10 years, an ARM might not be the best choice. But if an adjustable-rate loan works for your financial situation, you could have a much better shot at affording a home in today’s market.

>Related: Perks and pitfalls of adjustable-rate mortgages in 2022

Adjustable-rate mortgage trends over time

Adjustable-rate mortgages were hugely popular prior to 2008, at one point making up over a third of the total mortgage market. However, they were also riskier for borrowers.

Find your lowest ARM rate. Start hereBefore the housing crash, ARM loans did not have the same protections they do now. As a result, homeowners largely avoided them over the last decade. Between 2008 and 2022, adjustable-rate loans never made up more than 10% of the mortgage market.

| Year | ARM Market Share (Approx.)1 | Average 30-Year Fixed Rate2 | Average 5/1 Adjustable-Rate3 |

| 2000 | 30% | 8.05% | Not Listed |

| 2005 | 35% | 5.87% | 5.32% |

| 2010 | 7% | 4.69% | 3.82% |

| 2015 | 5% | 3.85% | 2.94% |

| 2020 | 3% | 3.11% | 3.08% |

| 2022 | 10% | 4.52% | 3.45% |

1Mortgage Bankers Association "Chart of the Week: Adjustable-Rate Mortgage (ARM) Loan Trends.” 2,3Freddie Mac weekly Primary Mortgage Market Survey. 2022 Annual average interest rates as of July 25, 2022

It’s no coincidence that the share of adjustable-rate mortgages tends to move in line with average mortgage rates. As you can see above, ARM rates are consistently lower than fixed rates on average. And as fixed mortgage rates rise, adjustable-rate loans tend to grow in popularity. That’s exactly what we’ve seen in 2022 so far.

Find your lowest ARM rate. Start hereAdjustable-rate mortgages are less risky now

Adjustable-rate mortgages used to be far riskier than they are today. Prior to 2008, the initial fixed-rate period on an ARM (assuming you had one) was probably brief and was the only time you were shielded from the full effects of rising interest rates. But that has changed.

Today, the initial, fixed-rate period on an ARM can last as long as 10 years. And when that period expires, there are caps that limit how much your rate can increase over time to help ensure you can still afford the loan even if rates in general are rising.

Of course, the reason ARMs have lower rates is that you’re taking on some of the risk when rates spike. But borrowers are much better protected from that risk than they once were.

ARM rate caps offer protection

Each lender sets its own terms and conditions for adjustable-rate mortgages, so you’ll have to check your loan agreement for specifics. But ARMs today commonly offer three types of rate caps that protect borrowers from unreasonable rate hikes. Most ARMs have:

- A cap on how much your rate can increase at the end of the fixed-rate period. It can’t exceed the cap, no matter how high interest rates have risen

- Another cap on subsequent annual adjustments, meaning your rate can only increase by a certain amount each year

- A third cap on how high your rate can go over the entire life of your mortgage. This protects homeowners from seeing their rates rise astronomically if the market takes a dramatic upswing

Of course, you still have some exposure to higher interest rates. But these protections help ensure borrowers will still be able to afford their home loans even if rates rise.

In fact, borrowers using ARM loans often have to qualify based on their “fully indexed rate.” That means the lender will verify you’d be able to make payments even if your ARM rate were to meet its maximum cap. This rule helps ensure homeowners won’t default on their loans if rates rise sharply.

Is an adjustable-rate mortgage a good idea in 2022?

If you’re buying your “forever home,” there’s still real value in a fixed-rate mortgage loan. You’ll have a guaranteed rate and payment for the long haul, offering more security in your budget. And if rates fall later on, there’s always the option to refinance.

On the other hand, if you’re sure you’ll move within five to 10 years — that is, within an ARM’s fixed-rate period — you should seriously explore adjustable-rate mortgages.

After all, why pay more to lock a rate for 30 years when you can pay less to lock it for the number of years you’ll live in the home? For many, that’s a no-brainer.

Explore your options with a mortgage lender to learn what rates you qualify for and decide whether an ARM is the right home loan for you.

Time to make a move? Let us find the right mortgage for you