Remodel spending tops $340 billion

Homeowners are expected to spend a jaw-dropping $340 billion on fixing up their homes in 2018.

There are many ways to finance a home construction projects but the two versions of the have emerged as a popular choice among today’s home buyers and homeowners wishing to make home improvements, especially when they don’t own the home yet.

The two FHA programs are known as the Standard 203k, and the Limited 203k.

Verify your 203k loan eligibilityThe FHA 203k: “Standard” and “Limited”

FHA guidelines include provisions for certain “programs”, which may provide additional assistance to homeowners.

One such FHA program is its construction loan program, known as the “203k loan.” The 203k comes in two varieties — the Standard and the Limited.

(The Limited 203k is formerly known as the FHA 203k Streamline.)

The FHA 203k can be used by owner-occupants of a home, local governments, and other eligible non-profits. It can be used to purchase and/or renovate a home with up to 4 units, and can be used in a multi-use building with certain exception.

Verify your 203k loan eligibilityWhat is the difference between Standard and Limited 203k?

The two versions of the FHA construction loan — the 203k Standard and the 203k Limited — work basically the same way.

However, there are a few differences.

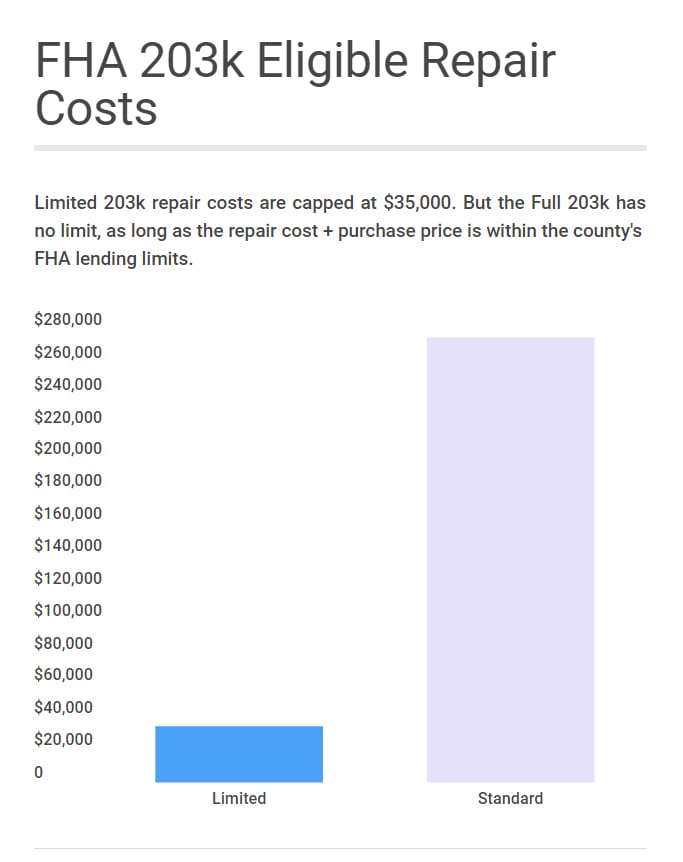

First, the Limited 203k is capped at $35,000 in repairs, and asks for less paperwork as part of the approval. The Standard 203k is not capped at $35,000 and paperwork requirements are a little more intense.

Another difference between the two 203k programs is that the Limited 203k requires that the home be “habitable” throughout the period of renovation. If the home will be uninhabitable for any reason at any time, use of the Standard 203k is required.

However, borrowers using the Standard 203k can add up to six months of mortgage payments to their construction loan for the period during which the home is uninhabitable.

A third difference is that, with the Limited 203k, payments to a contractor can be handled in two phases. The first payment can be made at the start of the project (i.e. 50% down to start the work); and, the second payment can be made at the project’s conclusion (i.e. remaining 50% on the work).

With the Standard 203k, payments are made differently. There is an assigned “consultant” who monitors construction, making payments as each phase of rehabilitation is completed.

Verify your 203k loan eligibilityWhich 203k Loan Should I Choose?

The two 203k programs also vary in what type of work can be performed. The FHA program guidelines include a comprehensive list.

This is the work which is allowed via the FHA 203k Limited:

- Repair/replacement of roofs, gutters and downspouts

- Repair/replacement/upgrade of existing HVAC systems

- Repair/replacement/upgrade of plumbing and electrical systems

- Repair/replacement of existing flooring

- Minor remodeling which does not involve structural repairs

- Exterior and interior painting

- Weatherization of windows and doors, insulation, weather stripping.

- Purchase and installation of appliances

- Improvements for accessibility for persons with disabilities

- Lead-based paint stabilization or abatement of lead-based paint hazards

- Repair, replacement or the addition of exterior decks, patios, and porches

- Basement remodeling which does not involve structural repairs

- Basement waterproofing

- Window and door replacement and exterior siding replacement

- Well or septic system repair or replacement

And, this is the work allowed via the FHA 203k Standard:

- Major rehabilitation, such as the relocation of a load-bearing wall

- New construction, including room additions

- Repair of structural damage

- Repairs requiring detailed drawings or architectural exhibits

- Landscaping or similar “site amenity” improvement

- Any repair requiring a work schedule longer than three (3) months; or rehabilitation activities that require more than two (2) payments per specialized contractor

- Improvements that require a plan reviewer

- Improvements that result in work not starting within 30 days after loan closing; or cause the owner to be displaced from the property for more than 30 days during the time the rehabilitation work is being conducted

In a capsule, the Limited lives up to its name — less paperwork for the borrower, easier for the lender to approve, and a simplicity in the draw schedule. The Standard 203k is meant for “bigger jobs.”

Both loans can be a boon for those looking to buy and rehabilitate before moving in the house.

What are today’s 203k mortgage rates?

The FHA 203k loan can help you purchase and/or rehab a home with less hassle and fewer costs than a traditional home construction loan. It also helps that FHA mortgage rates are low.

Take a look at today’s FHA mortgage rates now. Your social security number is not required to get started, and all quotes come with instant access to your live credit scores.

Time to make a move? Let us find the right mortgage for you